Heartland Advisors Inc. trimmed its holdings in shares of Fidelity National Information Services, Inc. (NYSE:FIS - Free Report) by 39.7% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 101,510 shares of the information technology services provider's stock after selling 66,961 shares during the quarter. Heartland Advisors Inc.'s holdings in Fidelity National Information Services were worth $7,581,000 as of its most recent SEC filing.

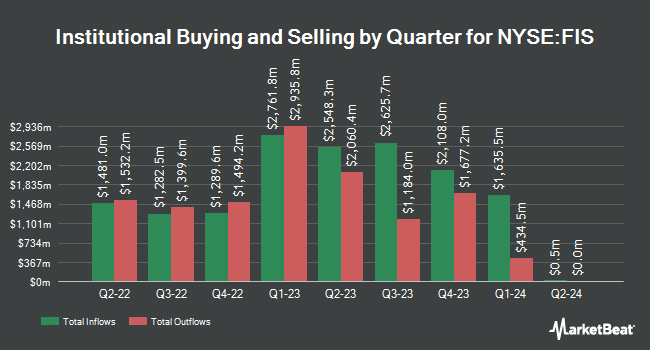

Other large investors have also made changes to their positions in the company. Sierra Ocean LLC raised its stake in Fidelity National Information Services by 356.0% in the 1st quarter. Sierra Ocean LLC now owns 342 shares of the information technology services provider's stock valued at $26,000 after purchasing an additional 267 shares during the last quarter. YANKCOM Partnership raised its stake in Fidelity National Information Services by 118.8% in the 1st quarter. YANKCOM Partnership now owns 350 shares of the information technology services provider's stock valued at $26,000 after purchasing an additional 190 shares during the last quarter. Hazlett Burt & Watson Inc. raised its stake in Fidelity National Information Services by 179.9% in the 1st quarter. Hazlett Burt & Watson Inc. now owns 389 shares of the information technology services provider's stock valued at $29,000 after purchasing an additional 250 shares during the last quarter. Kennebec Savings Bank raised its stake in Fidelity National Information Services by 71.3% in the 1st quarter. Kennebec Savings Bank now owns 447 shares of the information technology services provider's stock valued at $33,000 after purchasing an additional 186 shares during the last quarter. Finally, Wayfinding Financial LLC acquired a new position in Fidelity National Information Services in the 1st quarter valued at $43,000. 96.23% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several research firms recently commented on FIS. TD Cowen raised Fidelity National Information Services from a "hold" rating to a "buy" rating and set a $92.00 price objective for the company in a research note on Monday, April 21st. Robert W. Baird boosted their price objective on Fidelity National Information Services from $82.00 to $86.00 and gave the stock a "neutral" rating in a research note on Wednesday, July 16th. Oppenheimer raised Fidelity National Information Services from a "market perform" rating to an "outperform" rating and set a $94.00 price objective on the stock in a research note on Wednesday, April 23rd. Truist Financial boosted their price objective on Fidelity National Information Services from $84.00 to $85.00 and gave the stock a "hold" rating in a research note on Thursday, July 17th. Finally, Citigroup raised Fidelity National Information Services from a "neutral" rating to a "buy" rating and boosted their price objective for the stock from $79.00 to $86.00 in a research note on Monday, April 21st. One equities research analyst has rated the stock with a sell rating, eight have given a hold rating and thirteen have given a buy rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $91.00.

View Our Latest Report on FIS

Fidelity National Information Services Trading Up 1.9%

Shares of FIS stock traded up $1.51 on Friday, hitting $81.92. The stock had a trading volume of 2,694,227 shares, compared to its average volume of 2,200,373. The company has a debt-to-equity ratio of 0.57, a current ratio of 0.63 and a quick ratio of 0.63. The firm has a market capitalization of $43.04 billion, a P/E ratio of 54.25 and a beta of 1.06. Fidelity National Information Services, Inc. has a 1 year low of $66.51 and a 1 year high of $91.98. The company's 50 day moving average price is $80.36 and its 200-day moving average price is $76.86.

Fidelity National Information Services (NYSE:FIS - Get Free Report) last announced its quarterly earnings data on Tuesday, May 6th. The information technology services provider reported $1.21 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.20 by $0.01. The business had revenue of $2.53 billion during the quarter, compared to analysts' expectations of $2.50 billion. Fidelity National Information Services had a return on equity of 18.15% and a net margin of 8.10%. The business's quarterly revenue was up 2.6% compared to the same quarter last year. During the same quarter last year, the business posted $1.33 EPS. Analysts anticipate that Fidelity National Information Services, Inc. will post 5.74 earnings per share for the current year.

Fidelity National Information Services Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, June 24th. Stockholders of record on Tuesday, June 10th were issued a $0.40 dividend. The ex-dividend date was Tuesday, June 10th. This represents a $1.60 dividend on an annualized basis and a dividend yield of 1.95%. Fidelity National Information Services's payout ratio is currently 105.96%.

Fidelity National Information Services Company Profile

(

Free Report)

Fidelity National Information Services, Inc engages in the provision of financial services technology solutions for financial institutions, businesses, and developers worldwide. It operates through Banking Solutions, Capital Market Solutions, and Corporate and Other segments. The company provides core processing and ancillary applications; mobile and online banking; fraud, risk management, and compliance; card and retail payment; electronic funds transfer and network; wealth and retirement; and item processing and output solutions.

See Also

Before you consider Fidelity National Information Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fidelity National Information Services wasn't on the list.

While Fidelity National Information Services currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.