Hedges Asset Management LLC cut its position in Merck & Co., Inc. (NYSE:MRK - Free Report) by 26.2% during the 2nd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 13,800 shares of the company's stock after selling 4,900 shares during the quarter. Hedges Asset Management LLC's holdings in Merck & Co., Inc. were worth $1,092,000 at the end of the most recent quarter.

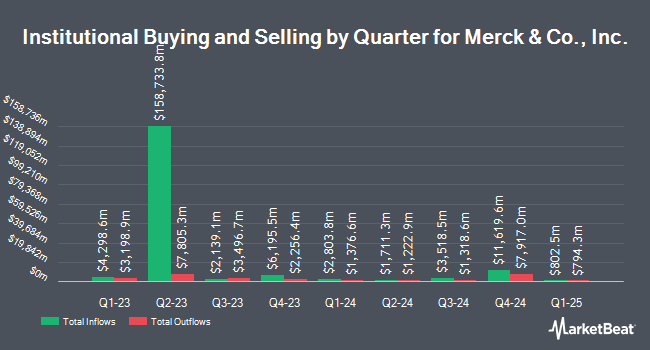

Several other large investors have also recently bought and sold shares of MRK. Barnes Dennig Private Wealth Management LLC acquired a new position in Merck & Co., Inc. during the 1st quarter valued at about $27,000. CBIZ Investment Advisory Services LLC increased its stake in Merck & Co., Inc. by 141.7% during the 1st quarter. CBIZ Investment Advisory Services LLC now owns 377 shares of the company's stock valued at $34,000 after buying an additional 221 shares during the period. MorganRosel Wealth Management LLC acquired a new position in Merck & Co., Inc. during the 1st quarter valued at about $36,000. Spurstone Advisory Services LLC acquired a new position in Merck & Co., Inc. during the 4th quarter valued at about $37,000. Finally, Mpwm Advisory Solutions LLC acquired a new position in Merck & Co., Inc. during the 4th quarter valued at about $45,000. Institutional investors and hedge funds own 76.07% of the company's stock.

Wall Street Analyst Weigh In

Several equities analysts have commented on the stock. Cantor Fitzgerald cut shares of Merck & Co., Inc. from an "overweight" rating to a "cautious" rating in a research note on Tuesday, May 20th. Morgan Stanley lowered their target price on shares of Merck & Co., Inc. from $99.00 to $98.00 and set an "equal weight" rating on the stock in a research note on Thursday, July 10th. Finally, Wells Fargo & Company lowered their target price on shares of Merck & Co., Inc. from $97.00 to $90.00 and set an "equal weight" rating on the stock in a research note on Wednesday, July 30th. One investment analyst has rated the stock with a Strong Buy rating, six have assigned a Buy rating, twelve have given a Hold rating and one has given a Sell rating to the company. According to data from MarketBeat.com, Merck & Co., Inc. currently has a consensus rating of "Hold" and a consensus target price of $107.44.

Check Out Our Latest Stock Analysis on MRK

Merck & Co., Inc. Price Performance

Shares of MRK traded down $2.28 during mid-day trading on Friday, hitting $82.87. The company's stock had a trading volume of 9,931,826 shares, compared to its average volume of 11,124,038. The firm has a 50-day moving average price of $82.93 and a 200 day moving average price of $82.75. The stock has a market capitalization of $206.99 billion, a price-to-earnings ratio of 12.77, a PEG ratio of 0.85 and a beta of 0.37. The company has a debt-to-equity ratio of 0.69, a current ratio of 1.42 and a quick ratio of 1.17. Merck & Co., Inc. has a fifty-two week low of $73.31 and a fifty-two week high of $119.38.

Merck & Co., Inc. (NYSE:MRK - Get Free Report) last announced its quarterly earnings data on Tuesday, July 29th. The company reported $2.13 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.03 by $0.10. The company had revenue of $15.81 billion for the quarter, compared to analysts' expectations of $15.92 billion. Merck & Co., Inc. had a net margin of 25.79% and a return on equity of 41.05%. Merck & Co., Inc. has set its FY 2025 guidance at 8.870-8.970 EPS. On average, research analysts predict that Merck & Co., Inc. will post 9.01 EPS for the current fiscal year.

Merck & Co., Inc. Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, October 7th. Stockholders of record on Monday, September 15th will be given a $0.81 dividend. This represents a $3.24 annualized dividend and a dividend yield of 3.9%. The ex-dividend date of this dividend is Monday, September 15th. Merck & Co., Inc.'s dividend payout ratio (DPR) is 49.92%.

About Merck & Co., Inc.

(

Free Report)

Merck & Co, Inc is a health care company, which engages in the provision of health solutions through its prescription medicines, vaccines, biologic therapies, animal health, and consumer care products. It operates through the following segments: Pharmaceutical, Animal Health, and Other. The Pharmaceutical segment includes human health pharmaceutical and vaccine products.

Further Reading

Before you consider Merck & Co., Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merck & Co., Inc. wasn't on the list.

While Merck & Co., Inc. currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

We are about to experience the greatest A.I. boom in stock market history...

Thanks to a pivotal economic catalyst, specific tech stocks will skyrocket just like they did during the "dot com" boom in the 1990s.

That’s why, we’ve hand-selected 7 tiny tech disruptor stocks positioned to surge.

- The first pick is a tiny under-the-radar A.I. stock that's trading for just $3.00. This company already has 98 registered patents for cutting-edge voice and sound recognition technology... And has lined up major partnerships with some of the biggest names in the auto, tech, and music industry... plus many more.

- The second pick presents an affordable avenue to bolster EVs and AI development…. Analysts are calling this stock a “buy” right now and predict a high price target of $19.20, substantially more than its current $6 trading price.

- Our final and favorite pick is generating a brand-new kind of AI. It's believed this tech will be bigger than the current well-known leader in this industry… Analysts predict this innovative tech is gearing up to create a tidal wave of new wealth, fueling a $15.7 TRILLION market boom.

Right now, we’re staring down the barrel of a true once-in-a-lifetime moment. As an investment opportunity, this kind of breakthrough doesn't come along every day.

And the window to get in on the ground-floor — maximizing profit potential from this expected market surge — is closing quickly...

Simply enter your email below to get the names and tickers of the 7 small stocks with potential to make investors very, very happy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.