Herald Investment Management Ltd trimmed its holdings in Celestica, Inc. (NYSE:CLS - Free Report) TSE: CLS by 9.1% in the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 423,200 shares of the technology company's stock after selling 42,500 shares during the period. Celestica comprises about 6.3% of Herald Investment Management Ltd's investment portfolio, making the stock its 2nd largest holding. Herald Investment Management Ltd owned about 0.36% of Celestica worth $33,348,000 at the end of the most recent quarter.

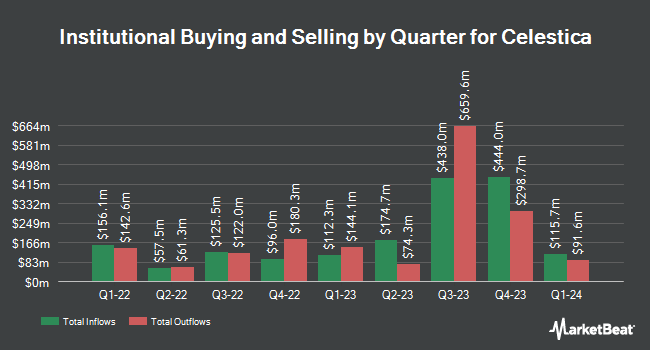

Several other institutional investors and hedge funds have also modified their holdings of CLS. Rothschild Investment LLC bought a new stake in Celestica during the first quarter valued at $26,000. ORG Partners LLC purchased a new position in Celestica in the 1st quarter worth approximately $29,000. Center for Financial Planning Inc. bought a new stake in shares of Celestica during the first quarter valued at approximately $30,000. Bessemer Group Inc. purchased a new position in Celestica during the fourth quarter valued at $42,000. Finally, Farther Finance Advisors LLC boosted its position in Celestica by 1,516.7% in the first quarter. Farther Finance Advisors LLC now owns 679 shares of the technology company's stock worth $54,000 after purchasing an additional 637 shares during the last quarter. 67.38% of the stock is currently owned by institutional investors and hedge funds.

Celestica Trading Up 3.8%

Shares of CLS traded up $7.78 during mid-day trading on Tuesday, reaching $212.38. The stock had a trading volume of 1,771,558 shares, compared to its average volume of 4,381,721. The company has a debt-to-equity ratio of 0.48, a current ratio of 1.44 and a quick ratio of 0.86. The firm has a market cap of $24.43 billion, a price-to-earnings ratio of 45.94 and a beta of 1.80. The business's fifty day moving average is $157.87 and its 200 day moving average is $120.23. Celestica, Inc. has a 52-week low of $40.65 and a 52-week high of $214.47.

Analysts Set New Price Targets

Several equities research analysts have recently weighed in on the stock. UBS Group reissued a "neutral" rating and issued a $208.00 target price (up previously from $101.00) on shares of Celestica in a research note on Wednesday, July 30th. Argus lowered their price target on shares of Celestica from $150.00 to $120.00 and set a "buy" rating on the stock in a research report on Tuesday, April 29th. Royal Bank Of Canada raised their price target on shares of Celestica from $185.00 to $225.00 and gave the company an "outperform" rating in a research report on Wednesday, July 30th. BMO Capital Markets reiterated an "outperform" rating and issued a $130.00 price objective (up previously from $118.00) on shares of Celestica in a research note on Thursday, May 22nd. Finally, Canaccord Genuity Group boosted their price objective on Celestica from $126.00 to $240.00 and gave the company a "buy" rating in a research note on Wednesday, July 30th. Two equities research analysts have rated the stock with a hold rating, ten have given a buy rating and two have issued a strong buy rating to the company's stock. According to MarketBeat, the company presently has an average rating of "Buy" and a consensus target price of $168.92.

View Our Latest Stock Analysis on CLS

Celestica Profile

(

Free Report)

Celestica Inc provides supply chain solutions in North America, Europe, and Asia. It operates through two segments: Advanced Technology Solutions, and Connectivity & Cloud Solutions. The company offers a range of product manufacturing and related supply chain services, including design and development, new product introduction, engineering services, component sourcing, electronics manufacturing and assembly, testing, complex mechanical assembly, systems integration, precision machining, order fulfillment, logistics, asset management, product licensing, and after-market repair and return services.

Featured Articles

Before you consider Celestica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Celestica wasn't on the list.

While Celestica currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.