Heritage Wealth Partners LLC lowered its position in UnitedHealth Group Incorporated (NYSE:UNH - Free Report) by 55.0% in the 1st quarter, according to the company in its most recent filing with the SEC. The fund owned 795 shares of the healthcare conglomerate's stock after selling 971 shares during the quarter. Heritage Wealth Partners LLC's holdings in UnitedHealth Group were worth $416,000 as of its most recent SEC filing.

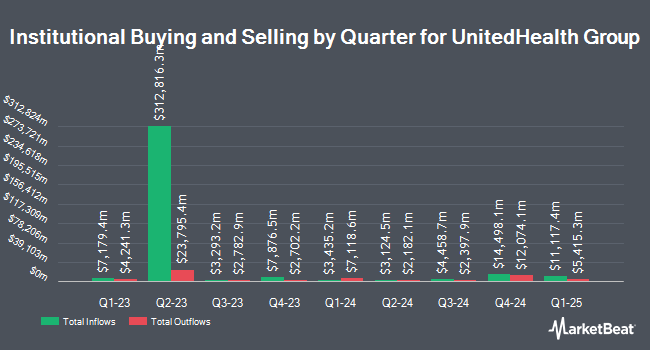

Several other large investors have also added to or reduced their stakes in UNH. Vanguard Group Inc. boosted its position in shares of UnitedHealth Group by 6.6% during the 1st quarter. Vanguard Group Inc. now owns 90,729,585 shares of the healthcare conglomerate's stock valued at $47,519,620,000 after acquiring an additional 5,583,343 shares during the last quarter. Wellington Management Group LLP boosted its position in shares of UnitedHealth Group by 10.6% during the 1st quarter. Wellington Management Group LLP now owns 25,847,940 shares of the healthcare conglomerate's stock valued at $13,537,859,000 after acquiring an additional 2,486,839 shares during the last quarter. Northern Trust Corp boosted its position in shares of UnitedHealth Group by 12.5% during the 4th quarter. Northern Trust Corp now owns 9,503,671 shares of the healthcare conglomerate's stock valued at $4,807,527,000 after acquiring an additional 1,058,488 shares during the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its position in shares of UnitedHealth Group by 36.6% during the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 8,592,718 shares of the healthcare conglomerate's stock valued at $4,346,712,000 after acquiring an additional 2,301,010 shares during the last quarter. Finally, GAMMA Investing LLC boosted its position in shares of UnitedHealth Group by 56,142.1% during the 1st quarter. GAMMA Investing LLC now owns 8,295,153 shares of the healthcare conglomerate's stock valued at $4,344,586,000 after acquiring an additional 8,280,404 shares during the last quarter. Institutional investors own 87.86% of the company's stock.

Insider Transactions at UnitedHealth Group

In related news, CEO Patrick Hugh Conway sold 589 shares of the business's stock in a transaction on Tuesday, June 10th. The stock was sold at an average price of $305.00, for a total transaction of $179,645.00. Following the completion of the transaction, the chief executive officer owned 10,398 shares in the company, valued at $3,171,390. The trade was a 5.36% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. 0.28% of the stock is currently owned by insiders.

UnitedHealth Group Stock Performance

UNH traded up $3.7480 during midday trading on Friday, reaching $307.0980. The company had a trading volume of 14,867,565 shares, compared to its average volume of 23,438,662. The company has a quick ratio of 0.85, a current ratio of 0.85 and a debt-to-equity ratio of 0.73. UnitedHealth Group Incorporated has a 1 year low of $234.60 and a 1 year high of $630.73. The business has a 50-day moving average of $288.39 and a two-hundred day moving average of $387.54. The company has a market cap of $278.13 billion, a P/E ratio of 13.31, a P/E/G ratio of 1.98 and a beta of 0.43.

UnitedHealth Group (NYSE:UNH - Get Free Report) last released its earnings results on Tuesday, July 29th. The healthcare conglomerate reported $4.08 earnings per share (EPS) for the quarter, missing the consensus estimate of $4.45 by ($0.37). The business had revenue of $111.62 billion for the quarter, compared to analysts' expectations of $111.75 billion. UnitedHealth Group had a return on equity of 23.32% and a net margin of 5.04%.The business's revenue for the quarter was up 12.9% compared to the same quarter last year. During the same quarter in the prior year, the business posted $6.80 EPS. UnitedHealth Group has set its FY 2025 guidance at 16.000- EPS. As a group, equities research analysts predict that UnitedHealth Group Incorporated will post 29.54 earnings per share for the current fiscal year.

UnitedHealth Group Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 23rd. Investors of record on Monday, September 15th will be issued a dividend of $2.21 per share. The ex-dividend date is Monday, September 15th. This represents a $8.84 dividend on an annualized basis and a yield of 2.9%. UnitedHealth Group's payout ratio is presently 38.30%.

Analyst Ratings Changes

UNH has been the subject of a number of recent research reports. Mizuho dropped their target price on UnitedHealth Group from $515.00 to $350.00 and set an "outperform" rating for the company in a research report on Friday, May 16th. Wolfe Research decreased their price target on UnitedHealth Group from $501.00 to $390.00 and set an "outperform" rating on the stock in a research note on Tuesday, May 20th. Raymond James Financial cut UnitedHealth Group from a "strong-buy" rating to a "market perform" rating in a research note on Wednesday, May 14th. Wells Fargo & Company decreased their price target on UnitedHealth Group from $306.00 to $267.00 and set an "overweight" rating on the stock in a research note on Monday, August 4th. Finally, Erste Group Bank cut UnitedHealth Group from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, April 30th. Fifteen analysts have rated the stock with a Buy rating, six have given a Hold rating and three have issued a Sell rating to the company's stock. Based on data from MarketBeat.com, UnitedHealth Group presently has a consensus rating of "Moderate Buy" and an average target price of $365.38.

Read Our Latest Research Report on UnitedHealth Group

UnitedHealth Group Profile

(

Free Report)

UnitedHealth Group Incorporated operates as a diversified health care company in the United States. The company operates through four segments: UnitedHealthcare, Optum Health, Optum Insight, and Optum Rx. The UnitedHealthcare segment offers consumer-oriented health benefit plans and services for national employers, public sector employers, mid-sized employers, small businesses, and individuals; health care coverage, and health and well-being services to individuals age 50 and older addressing their needs; Medicaid plans, children's health insurance and health care programs; and health and dental benefits, and hospital and clinical services, as well as health care benefits products and services to state programs caring for the economically disadvantaged, medically underserved, and those without the benefit of employer-funded health care coverage.

Read More

Before you consider UnitedHealth Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UnitedHealth Group wasn't on the list.

While UnitedHealth Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report