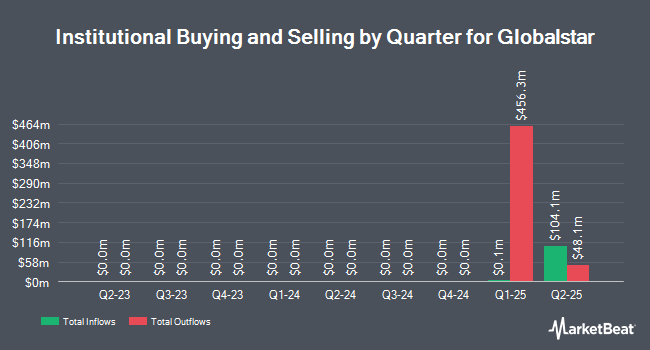

HighMark Wealth Management LLC trimmed its holdings in shares of Globalstar, Inc. (NASDAQ:GSAT - Free Report) by 69.7% in the second quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 2,900 shares of the company's stock after selling 6,666 shares during the period. HighMark Wealth Management LLC's holdings in Globalstar were worth $68,000 at the end of the most recent quarter.

Separately, Acadian Asset Management LLC bought a new stake in shares of Globalstar in the 1st quarter valued at about $99,000. 18.89% of the stock is currently owned by institutional investors.

Globalstar Trading Up 2.8%

Shares of GSAT opened at $40.27 on Friday. Globalstar, Inc. has a 12 month low of $15.00 and a 12 month high of $41.10. The stock's 50 day simple moving average is $29.89. The company has a market capitalization of $5.10 billion, a PE ratio of -89.49 and a beta of 0.99. The company has a debt-to-equity ratio of 1.30, a current ratio of 2.81 and a quick ratio of 2.72.

Globalstar (NASDAQ:GSAT - Get Free Report) last announced its earnings results on Thursday, August 7th. The company reported $0.13 EPS for the quarter, topping the consensus estimate of ($0.09) by $0.22. Globalstar had a negative net margin of 17.80% and a negative return on equity of 1.17%. Globalstar has set its FY 2025 guidance at EPS.

Analyst Upgrades and Downgrades

A number of brokerages have recently issued reports on GSAT. Zacks Research raised shares of Globalstar to a "strong-buy" rating in a report on Monday, August 11th. Wall Street Zen raised shares of Globalstar from a "sell" rating to a "hold" rating in a report on Monday, June 23rd. One equities research analyst has rated the stock with a Strong Buy rating, According to data from MarketBeat, the stock has an average rating of "Strong Buy".

Get Our Latest Stock Analysis on GSAT

Insider Transactions at Globalstar

In other news, CFO Rebecca Clary sold 5,359 shares of the firm's stock in a transaction that occurred on Monday, September 15th. The shares were sold at an average price of $29.75, for a total transaction of $159,430.25. Following the transaction, the chief financial officer directly owned 107,761 shares of the company's stock, valued at approximately $3,205,889.75. This trade represents a 4.74% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CEO Paul E. Jacobs sold 53,479 shares of the firm's stock in a transaction that occurred on Thursday, September 25th. The stock was sold at an average price of $34.95, for a total transaction of $1,869,091.05. Following the transaction, the chief executive officer directly owned 58,895 shares in the company, valued at $2,058,380.25. This represents a 47.59% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 113,605 shares of company stock valued at $3,758,155. 61.00% of the stock is currently owned by company insiders.

Globalstar Profile

(

Free Report)

Globalstar, Inc provides mobile satellite services worldwide. The company offers duplex two-way voice and data products, including mobile voice and data satellite communications services and equipment for remote business continuity, recreational usage, safety, emergency preparedness and response, and other applications; fixed voice and data satellite communications services and equipment at industrial, commercial, and residential sites, as well as rural villages and ships; and data modem services and equipment.

Further Reading

Want to see what other hedge funds are holding GSAT? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Globalstar, Inc. (NASDAQ:GSAT - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Globalstar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Globalstar wasn't on the list.

While Globalstar currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.