HighPoint Advisor Group LLC grew its position in shares of Eli Lilly and Company (NYSE:LLY - Free Report) by 1.8% in the first quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 19,074 shares of the company's stock after buying an additional 333 shares during the quarter. Eli Lilly and Company accounts for 1.0% of HighPoint Advisor Group LLC's investment portfolio, making the stock its 20th largest holding. HighPoint Advisor Group LLC's holdings in Eli Lilly and Company were worth $16,885,000 at the end of the most recent reporting period.

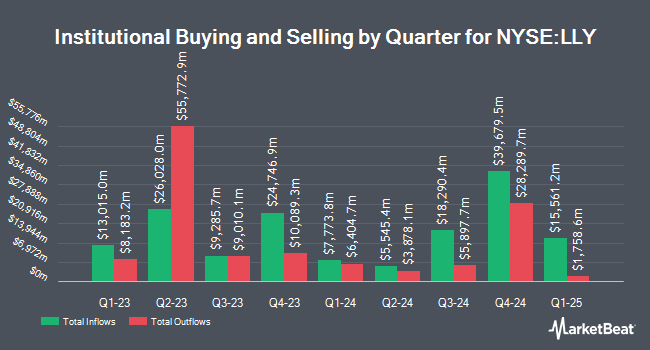

A number of other large investors also recently bought and sold shares of the company. GAMMA Investing LLC boosted its stake in shares of Eli Lilly and Company by 103,831.6% during the 1st quarter. GAMMA Investing LLC now owns 14,866,380 shares of the company's stock worth $12,278,292,000 after purchasing an additional 14,852,076 shares during the last quarter. Norges Bank acquired a new stake in shares of Eli Lilly and Company during the 4th quarter worth about $8,407,908,000. Wellington Management Group LLP boosted its stake in shares of Eli Lilly and Company by 19.0% during the 4th quarter. Wellington Management Group LLP now owns 12,625,925 shares of the company's stock worth $9,747,214,000 after purchasing an additional 2,012,129 shares during the last quarter. Capital International Investors boosted its stake in shares of Eli Lilly and Company by 23.2% during the 4th quarter. Capital International Investors now owns 8,730,758 shares of the company's stock worth $6,740,272,000 after purchasing an additional 1,645,222 shares during the last quarter. Finally, Capital Research Global Investors boosted its stake in shares of Eli Lilly and Company by 16.1% during the 4th quarter. Capital Research Global Investors now owns 10,757,511 shares of the company's stock worth $8,304,811,000 after purchasing an additional 1,493,673 shares during the last quarter. Hedge funds and other institutional investors own 82.53% of the company's stock.

Wall Street Analyst Weigh In

LLY has been the topic of several research analyst reports. UBS Group decreased their target price on shares of Eli Lilly and Company from $1,100.00 to $1,050.00 and set a "buy" rating on the stock in a research report on Friday, May 2nd. Wall Street Zen cut shares of Eli Lilly and Company from a "buy" rating to a "hold" rating in a research report on Saturday, June 28th. HSBC cut shares of Eli Lilly and Company from a "buy" rating to a "reduce" rating and decreased their target price for the stock from $1,150.00 to $700.00 in a research report on Monday, April 28th. The Goldman Sachs Group raised shares of Eli Lilly and Company from a "neutral" rating to a "buy" rating and decreased their target price for the stock from $892.00 to $888.00 in a research report on Tuesday, April 8th. Finally, Morgan Stanley reissued an "overweight" rating and issued a $1,135.00 target price (up from $1,133.00) on shares of Eli Lilly and Company in a research report on Thursday, July 10th. One equities research analyst has rated the stock with a sell rating, four have issued a hold rating and sixteen have assigned a buy rating to the company. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $1,012.56.

Read Our Latest Stock Analysis on LLY

Eli Lilly and Company Stock Up 1.9%

Shares of LLY traded up $14.29 during mid-day trading on Tuesday, reaching $776.47. 2,495,477 shares of the stock traded hands, compared to its average volume of 3,657,371. The firm has a market cap of $735.89 billion, a price-to-earnings ratio of 63.18, a P/E/G ratio of 1.12 and a beta of 0.40. The stock has a fifty day simple moving average of $767.03 and a 200 day simple moving average of $800.17. Eli Lilly and Company has a 12-month low of $677.09 and a 12-month high of $972.53. The company has a quick ratio of 1.06, a current ratio of 1.37 and a debt-to-equity ratio of 2.18.

Eli Lilly and Company (NYSE:LLY - Get Free Report) last posted its quarterly earnings data on Thursday, May 1st. The company reported $3.34 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $4.64 by ($1.30). The firm had revenue of $12.73 billion for the quarter, compared to analysts' expectations of $12.77 billion. Eli Lilly and Company had a net margin of 22.67% and a return on equity of 85.51%. The company's revenue for the quarter was up 45.2% on a year-over-year basis. During the same quarter in the prior year, the business earned $2.58 EPS. Sell-side analysts expect that Eli Lilly and Company will post 23.48 EPS for the current fiscal year.

Eli Lilly and Company Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Wednesday, September 10th. Investors of record on Friday, August 15th will be paid a $1.50 dividend. The ex-dividend date is Friday, August 15th. This represents a $6.00 dividend on an annualized basis and a dividend yield of 0.77%. Eli Lilly and Company's dividend payout ratio (DPR) is presently 48.82%.

Eli Lilly and Company Profile

(

Free Report)

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals worldwide. The company offers Basaglar, Humalog, Humalog Mix 75/25, Humalog U-100, Humalog U-200, Humalog Mix 50/50, insulin lispro, insulin lispro protamine, insulin lispro mix 75/25, Humulin, Humulin 70/30, Humulin N, Humulin R, and Humulin U-500 for diabetes; Jardiance, Mounjaro, and Trulicity for type 2 diabetes; and Zepbound for obesity.

Read More

Before you consider Eli Lilly and Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eli Lilly and Company wasn't on the list.

While Eli Lilly and Company currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report