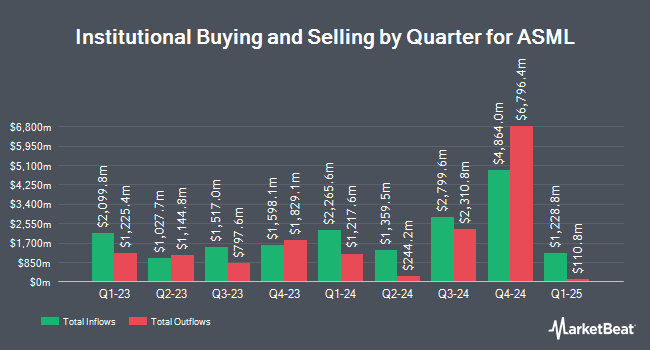

HighTower Advisors LLC grew its holdings in ASML Holding N.V. (NASDAQ:ASML - Free Report) by 4.3% in the 1st quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 113,881 shares of the semiconductor company's stock after purchasing an additional 4,674 shares during the quarter. HighTower Advisors LLC's holdings in ASML were worth $75,461,000 at the end of the most recent reporting period.

Other hedge funds have also recently added to or reduced their stakes in the company. Putney Financial Group LLC boosted its position in shares of ASML by 322.2% in the 1st quarter. Putney Financial Group LLC now owns 38 shares of the semiconductor company's stock worth $25,000 after buying an additional 29 shares in the last quarter. Banque Cantonale Vaudoise acquired a new position in shares of ASML during the 1st quarter valued at about $27,000. Wayfinding Financial LLC acquired a new stake in ASML during the 1st quarter worth approximately $35,000. Pinnacle Bancorp Inc. acquired a new stake in ASML during the 1st quarter worth approximately $42,000. Finally, Olde Wealth Management LLC acquired a new stake in ASML during the 1st quarter worth approximately $42,000. Institutional investors and hedge funds own 26.07% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities analysts have weighed in on ASML shares. Susquehanna decreased their price target on ASML from $1,100.00 to $965.00 and set a "positive" rating for the company in a report on Thursday, April 17th. Barclays reiterated an "equal weight" rating on shares of ASML in a research note on Tuesday, June 3rd. Jefferies Financial Group cut ASML from a "buy" rating to a "hold" rating in a research note on Thursday, June 26th. Erste Group Bank restated a "hold" rating on shares of ASML in a research note on Wednesday, July 23rd. Finally, DZ Bank cut ASML from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, July 16th. Seven investment analysts have rated the stock with a hold rating, six have issued a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus target price of $923.80.

Read Our Latest Stock Report on ASML

ASML Price Performance

ASML stock traded down $13.05 during trading on Friday, hitting $742.16. The company had a trading volume of 1,620,424 shares, compared to its average volume of 1,746,622. The company has a fifty day moving average price of $758.10 and a two-hundred day moving average price of $725.08. The company has a current ratio of 1.43, a quick ratio of 0.81 and a debt-to-equity ratio of 0.21. The company has a market cap of $291.98 billion, a P/E ratio of 30.97, a P/E/G ratio of 1.53 and a beta of 1.76. ASML Holding N.V. has a fifty-two week low of $578.51 and a fifty-two week high of $945.05.

ASML (NASDAQ:ASML - Get Free Report) last issued its quarterly earnings data on Wednesday, July 16th. The semiconductor company reported $4.55 earnings per share (EPS) for the quarter, missing the consensus estimate of $5.94 by ($1.39). The business had revenue of $8.94 billion during the quarter, compared to the consensus estimate of $8.72 billion. ASML had a net margin of 26.95% and a return on equity of 49.47%. The company's revenue for the quarter was up 23.2% compared to the same quarter last year. During the same quarter in the previous year, the firm posted $4.01 EPS. Equities research analysts expect that ASML Holding N.V. will post 25.17 earnings per share for the current fiscal year.

ASML Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Wednesday, August 6th. Stockholders of record on Tuesday, July 29th were given a dividend of $1.856 per share. The ex-dividend date was Tuesday, July 29th. This is an increase from ASML's previous quarterly dividend of $1.64. This represents a $7.42 dividend on an annualized basis and a dividend yield of 1.0%. ASML's dividend payout ratio is presently 26.21%.

About ASML

(

Free Report)

ASML Holding N.V. develops, produces, markets, sells, and services advanced semiconductor equipment systems for chipmakers. It offers advanced semiconductor equipment systems, including lithography, metrology, and inspection systems. The company also provides extreme ultraviolet lithography systems; and deep ultraviolet lithography systems comprising immersion and dry lithography solutions to manufacture various range of semiconductor nodes and technologies.

Featured Articles

Before you consider ASML, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ASML wasn't on the list.

While ASML currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.