HighTower Advisors LLC lessened its position in ING Group, N.V. (NYSE:ING - Free Report) by 16.0% during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 809,092 shares of the financial services provider's stock after selling 154,214 shares during the quarter. HighTower Advisors LLC's holdings in ING Group were worth $15,850,000 as of its most recent SEC filing.

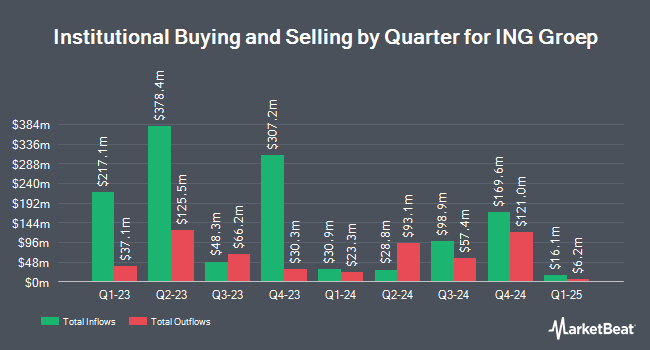

Several other hedge funds and other institutional investors have also made changes to their positions in ING. Legacy Advisors LLC purchased a new position in shares of ING Group in the first quarter valued at approximately $28,000. SBI Securities Co. Ltd. lifted its position in shares of ING Group by 135.3% in the first quarter. SBI Securities Co. Ltd. now owns 1,586 shares of the financial services provider's stock valued at $31,000 after acquiring an additional 912 shares in the last quarter. Redwood Investments LLC purchased a new position in shares of ING Group in the fourth quarter valued at approximately $41,000. Olde Wealth Management LLC purchased a new position in ING Group during the first quarter worth approximately $55,000. Finally, Hexagon Capital Partners LLC lifted its position in ING Group by 21.4% during the first quarter. Hexagon Capital Partners LLC now owns 5,085 shares of the financial services provider's stock worth $100,000 after buying an additional 897 shares in the last quarter. Hedge funds and other institutional investors own 4.49% of the company's stock.

Wall Street Analyst Weigh In

A number of brokerages recently commented on ING. Barclays upgraded ING Group from an "equal weight" rating to an "overweight" rating in a research report on Tuesday, July 15th. Cfra Research upgraded ING Group from a "moderate sell" rating to a "hold" rating in a research report on Tuesday, May 6th. One analyst has rated the stock with a Strong Buy rating, two have given a Buy rating and three have issued a Hold rating to the company. Based on data from MarketBeat.com, ING Group presently has an average rating of "Moderate Buy".

View Our Latest Research Report on ING Group

ING Group Trading Up 0.5%

ING stock traded up $0.1150 during midday trading on Friday, hitting $24.9650. 771,217 shares of the company's stock were exchanged, compared to its average volume of 2,755,735. ING Group, N.V. has a 1-year low of $15.09 and a 1-year high of $25.11. The company has a current ratio of 1.12, a quick ratio of 1.12 and a debt-to-equity ratio of 2.83. The business has a 50-day simple moving average of $22.87 and a two-hundred day simple moving average of $20.55. The stock has a market capitalization of $78.57 billion, a PE ratio of 11.51, a P/E/G ratio of 1.78 and a beta of 1.14.

ING Group (NYSE:ING - Get Free Report) last issued its quarterly earnings data on Thursday, July 31st. The financial services provider reported $0.64 earnings per share for the quarter, beating analysts' consensus estimates of $0.59 by $0.05. ING Group had a return on equity of 11.62% and a net margin of 27.28%.The business had revenue of $6.55 billion during the quarter, compared to analysts' expectations of $6.40 billion. On average, sell-side analysts predict that ING Group, N.V. will post 2.14 EPS for the current fiscal year.

ING Group Cuts Dividend

The business also recently announced a semi-annual dividend, which will be paid on Monday, August 25th. Investors of record on Monday, August 11th will be paid a dividend of $0.4002 per share. This represents a yield of 450.0%. The ex-dividend date of this dividend is Monday, August 11th. ING Group's payout ratio is presently 31.80%.

About ING Group

(

Free Report)

ING Groep N.V. provides various banking products and services in the Netherlands, Belgium, Germany, rest of Europe, and internationally. It operates through five segments: Retail Netherlands, Retail Belgium, Retail Germany, Retail Other, and Wholesale Banking. The company accepts current and savings accounts.

Recommended Stories

Before you consider ING Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ING Group wasn't on the list.

While ING Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.