HighTower Advisors LLC lowered its position in shares of Carrier Global Corporation (NYSE:CARR - Free Report) by 4.9% in the first quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 1,065,867 shares of the company's stock after selling 54,441 shares during the quarter. HighTower Advisors LLC owned approximately 0.12% of Carrier Global worth $67,576,000 at the end of the most recent quarter.

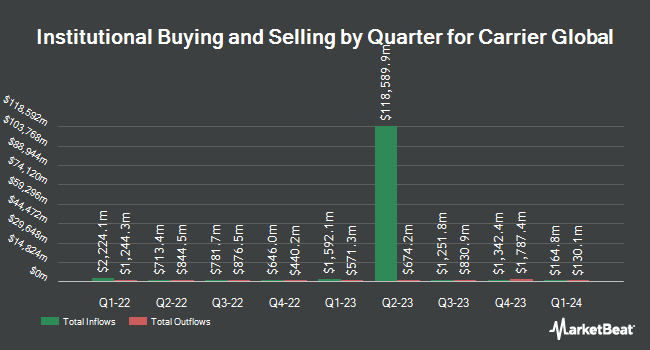

A number of other hedge funds have also made changes to their positions in CARR. JPMorgan Chase & Co. grew its holdings in Carrier Global by 17.6% during the 1st quarter. JPMorgan Chase & Co. now owns 31,126,869 shares of the company's stock worth $1,973,444,000 after acquiring an additional 4,668,929 shares during the last quarter. Nuveen LLC bought a new stake in Carrier Global during the 1st quarter worth about $649,512,000. Brown Advisory Inc. grew its holdings in Carrier Global by 82.6% during the 1st quarter. Brown Advisory Inc. now owns 9,673,979 shares of the company's stock worth $613,330,000 after acquiring an additional 4,377,402 shares during the last quarter. Northern Trust Corp boosted its stake in shares of Carrier Global by 16.7% in the 4th quarter. Northern Trust Corp now owns 8,847,377 shares of the company's stock valued at $603,922,000 after purchasing an additional 1,266,137 shares during the last quarter. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its stake in shares of Carrier Global by 15.6% in the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 6,930,061 shares of the company's stock valued at $473,046,000 after purchasing an additional 936,892 shares during the last quarter. Institutional investors and hedge funds own 91.00% of the company's stock.

Carrier Global Stock Down 0.5%

CARR stock traded down $0.32 during mid-day trading on Friday, hitting $65.44. 2,968,204 shares of the company were exchanged, compared to its average volume of 5,259,797. The company has a debt-to-equity ratio of 0.76, a quick ratio of 0.80 and a current ratio of 1.17. The firm has a market cap of $55.69 billion, a P/E ratio of 14.26, a P/E/G ratio of 1.80 and a beta of 1.25. The firm's 50 day simple moving average is $72.32 and its 200 day simple moving average is $68.13. Carrier Global Corporation has a 1-year low of $54.22 and a 1-year high of $83.32.

Carrier Global (NYSE:CARR - Get Free Report) last announced its earnings results on Tuesday, July 29th. The company reported $0.92 EPS for the quarter, topping the consensus estimate of $0.90 by $0.02. The firm had revenue of $6.11 billion for the quarter, compared to the consensus estimate of $6.08 billion. Carrier Global had a net margin of 18.33% and a return on equity of 17.83%. On average, sell-side analysts predict that Carrier Global Corporation will post 2.99 EPS for the current fiscal year.

Carrier Global Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, August 8th. Shareholders of record on Monday, July 21st were issued a dividend of $0.225 per share. This represents a $0.90 annualized dividend and a yield of 1.4%. The ex-dividend date was Monday, July 21st. Carrier Global's dividend payout ratio (DPR) is 19.61%.

Analysts Set New Price Targets

Several brokerages have recently issued reports on CARR. Robert W. Baird reduced their target price on shares of Carrier Global from $85.00 to $84.00 and set an "outperform" rating on the stock in a research note on Wednesday, July 30th. Mizuho set a $72.00 target price on shares of Carrier Global in a research note on Tuesday, April 22nd. JPMorgan Chase & Co. reaffirmed a "neutral" rating and issued a $79.00 target price on shares of Carrier Global in a research note on Tuesday, July 15th. Melius began coverage on shares of Carrier Global in a research note on Tuesday, July 1st. They issued a "hold" rating and a $90.00 target price on the stock. Finally, Melius Research raised shares of Carrier Global to a "hold" rating and set a $90.00 target price on the stock in a research note on Tuesday, July 1st. Seven equities research analysts have rated the stock with a hold rating and ten have assigned a buy rating to the stock. Based on data from MarketBeat, Carrier Global currently has a consensus rating of "Moderate Buy" and a consensus price target of $84.47.

Read Our Latest Stock Analysis on Carrier Global

Insider Buying and Selling

In other Carrier Global news, Director Maximilian Viessmann sold 4,267,425 shares of the firm's stock in a transaction that occurred on Thursday, June 5th. The shares were sold at an average price of $70.30, for a total transaction of $299,999,977.50. Following the sale, the director directly owned 54,341,534 shares in the company, valued at approximately $3,820,209,840.20. This trade represents a 7.28% decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through this link. Company insiders own 7.20% of the company's stock.

Carrier Global Company Profile

(

Free Report)

Carrier Global Corporation provides heating, ventilating, and air conditioning (HVAC), refrigeration, fire, security, and building automation technologies in the United States, Europe, the Asia Pacific, and internationally. It operates through three segments: HVAC, Refrigeration, and Fire & Security.

Further Reading

Before you consider Carrier Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carrier Global wasn't on the list.

While Carrier Global currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report