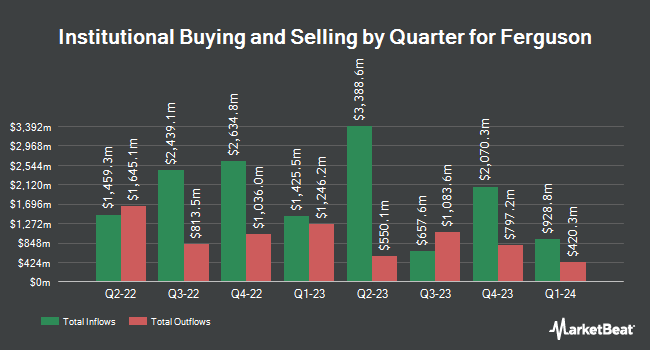

HighTower Advisors LLC trimmed its holdings in shares of Ferguson plc (NASDAQ:FERG - Free Report) by 30.2% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 16,020 shares of the company's stock after selling 6,919 shares during the quarter. HighTower Advisors LLC's holdings in Ferguson were worth $2,567,000 at the end of the most recent reporting period.

Several other hedge funds have also recently made changes to their positions in the business. Longfellow Investment Management Co. LLC purchased a new stake in shares of Ferguson during the 1st quarter valued at about $395,000. CCM Investment Group LLC purchased a new stake in Ferguson in the 1st quarter worth about $2,377,000. Nuveen LLC purchased a new stake in Ferguson in the 1st quarter worth about $128,642,000. Invesco Ltd. raised its position in Ferguson by 13.8% in the 1st quarter. Invesco Ltd. now owns 6,818,800 shares of the company's stock worth $1,092,576,000 after purchasing an additional 827,355 shares during the period. Finally, MUFG Securities EMEA plc raised its position in Ferguson by 34.1% in the 1st quarter. MUFG Securities EMEA plc now owns 58,999 shares of the company's stock worth $9,454,000 after purchasing an additional 15,000 shares during the period. 81.98% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of analysts recently weighed in on the stock. Barclays increased their price objective on shares of Ferguson from $190.00 to $247.00 and gave the stock an "overweight" rating in a research report on Wednesday, June 4th. Berenberg Bank reissued a "hold" rating and issued a $215.00 price objective on shares of Ferguson in a research report on Thursday, June 5th. Truist Financial reaffirmed a "buy" rating and set a $230.00 target price on shares of Ferguson in a research report on Wednesday, June 4th. Royal Bank Of Canada raised their target price on shares of Ferguson from $189.00 to $231.00 and gave the stock an "outperform" rating in a research report on Wednesday, June 4th. Finally, Oppenheimer raised their target price on shares of Ferguson from $189.00 to $235.00 and gave the stock an "outperform" rating in a research report on Wednesday, June 4th. Ten research analysts have rated the stock with a Buy rating and six have issued a Hold rating to the company's stock. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $220.64.

Check Out Our Latest Research Report on FERG

Ferguson Stock Up 0.7%

Shares of NASDAQ FERG traded up $1.59 during midday trading on Wednesday, reaching $235.51. 342,083 shares of the company's stock traded hands, compared to its average volume of 1,687,497. The company has a quick ratio of 0.91, a current ratio of 1.68 and a debt-to-equity ratio of 0.83. The stock's 50 day simple moving average is $223.54 and its 200-day simple moving average is $191.94. Ferguson plc has a one year low of $146.00 and a one year high of $238.16. The company has a market cap of $46.44 billion, a price-to-earnings ratio of 28.28, a P/E/G ratio of 1.69 and a beta of 1.16.

Ferguson (NASDAQ:FERG - Get Free Report) last announced its earnings results on Tuesday, June 3rd. The company reported $2.50 earnings per share for the quarter, beating the consensus estimate of $2.06 by $0.44. Ferguson had a net margin of 5.68% and a return on equity of 34.63%. The company's revenue was up 4.3% compared to the same quarter last year. During the same period in the prior year, the business earned $2.32 earnings per share. On average, analysts predict that Ferguson plc will post 9.4 EPS for the current fiscal year.

Ferguson Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Wednesday, August 6th. Shareholders of record on Friday, June 20th were paid a $0.83 dividend. This represents a $3.32 annualized dividend and a yield of 1.4%. The ex-dividend date was Friday, June 20th. Ferguson's dividend payout ratio (DPR) is 41.40%.

About Ferguson

(

Free Report)

Ferguson plc distributes plumbing and heating products in the United States and Canada. It offers plumbing and heating solutions to customers in the residential, commercial, civil/infrastructure, and industrial end markets. The company also provides expertise, solutions, and products, including infrastructure, plumbing, appliances, fire, fabrication, and others, as well as heating, ventilation, and air conditioning products under the Ferguson brand name.

See Also

Before you consider Ferguson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ferguson wasn't on the list.

While Ferguson currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.