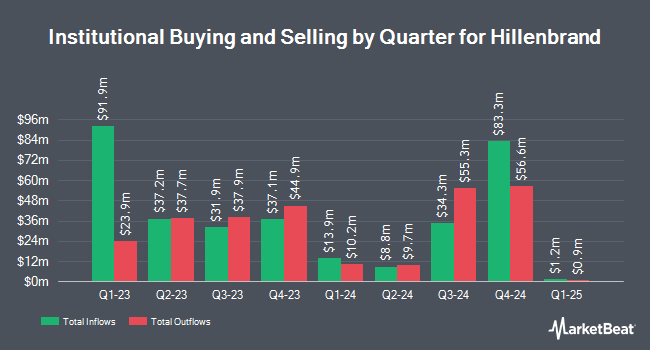

Clarkston Capital Partners LLC increased its holdings in shares of Hillenbrand Inc (NYSE:HI - Free Report) by 0.4% during the 1st quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 3,760,951 shares of the company's stock after acquiring an additional 14,200 shares during the period. Hillenbrand comprises about 1.8% of Clarkston Capital Partners LLC's investment portfolio, making the stock its 21st biggest position. Clarkston Capital Partners LLC owned 5.34% of Hillenbrand worth $90,789,000 at the end of the most recent quarter.

A number of other hedge funds have also recently added to or reduced their stakes in HI. Point72 Hong Kong Ltd bought a new stake in Hillenbrand during the 4th quarter worth about $42,000. Sterling Capital Management LLC lifted its stake in Hillenbrand by 712.8% in the fourth quarter. Sterling Capital Management LLC now owns 1,520 shares of the company's stock valued at $47,000 after acquiring an additional 1,333 shares during the last quarter. GAMMA Investing LLC lifted its holdings in Hillenbrand by 65.9% during the 1st quarter. GAMMA Investing LLC now owns 1,966 shares of the company's stock valued at $47,000 after purchasing an additional 781 shares during the last quarter. BI Asset Management Fondsmaeglerselskab A S acquired a new stake in Hillenbrand during the 1st quarter worth approximately $84,000. Finally, State of Wyoming grew its position in shares of Hillenbrand by 342.6% during the 4th quarter. State of Wyoming now owns 5,417 shares of the company's stock worth $167,000 after purchasing an additional 4,193 shares in the last quarter. Institutional investors own 89.09% of the company's stock.

Hillenbrand Stock Performance

NYSE HI traded down $0.13 on Tuesday, reaching $25.23. The stock had a trading volume of 99,404 shares, compared to its average volume of 533,767. The business's 50-day moving average price is $21.89 and its 200 day moving average price is $23.24. Hillenbrand Inc has a 12-month low of $18.36 and a 12-month high of $35.59. The stock has a market cap of $1.78 billion, a P/E ratio of -100.84 and a beta of 1.46. The company has a debt-to-equity ratio of 1.23, a quick ratio of 0.87 and a current ratio of 1.25.

Hillenbrand (NYSE:HI - Get Free Report) last posted its quarterly earnings data on Monday, August 11th. The company reported $0.51 EPS for the quarter, beating analysts' consensus estimates of $0.50 by $0.01. Hillenbrand had a negative net margin of 0.63% and a positive return on equity of 13.53%. The company had revenue of $598.90 million for the quarter, compared to analyst estimates of $572.48 million. During the same period in the previous year, the business posted $0.85 earnings per share. Hillenbrand's quarterly revenue was down 23.9% on a year-over-year basis. Hillenbrand has set its FY 2025 guidance at 2.200-2.350 EPS. As a group, equities analysts expect that Hillenbrand Inc will post 2.53 earnings per share for the current year.

Wall Street Analyst Weigh In

Several equities research analysts have weighed in on HI shares. DA Davidson cut their target price on Hillenbrand from $33.00 to $24.00 and set a "neutral" rating for the company in a research note on Thursday, May 1st. KeyCorp lowered Hillenbrand from an "overweight" rating to a "sector weight" rating in a report on Thursday, May 8th. Two analysts have rated the stock with a Hold rating, According to MarketBeat.com, Hillenbrand presently has an average rating of "Hold" and an average price target of $32.00.

View Our Latest Report on Hillenbrand

Hillenbrand Profile

(

Free Report)

Hillenbrand, Inc operates as an industrial company in the United States and internationally. The company operates through two segments, Advanced Process Solutions and Molding Technology Solutions. The Advanced Process Solutions segment designs, engineers, manufactures, markets, and services process and material handling equipment and systems comprising compounding, extrusion, and material handling equipment, equipment system design services, as well as offers mixing technology, ingredient automation, and portion process; and provides screening and separating equipment for various industries, including plastics, food and pharmaceuticals, chemicals, fertilizers, minerals, energy, wastewater treatment, forest products, and other general industrials.

See Also

Before you consider Hillenbrand, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hillenbrand wasn't on the list.

While Hillenbrand currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.