Hilltop National Bank acquired a new position in Procter & Gamble Company (The) (NYSE:PG - Free Report) during the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund acquired 16,088 shares of the company's stock, valued at approximately $2,563,000.

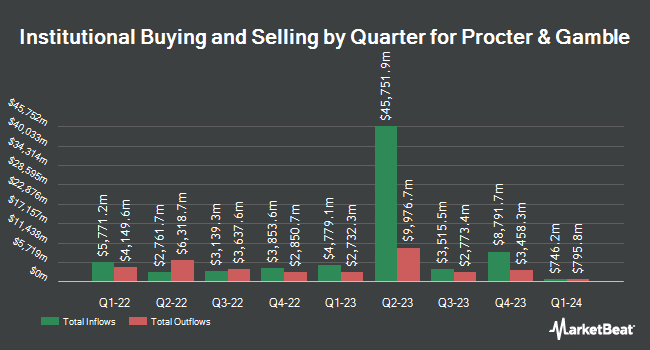

A number of other large investors have also added to or reduced their stakes in the company. Kingstone Capital Partners Texas LLC increased its stake in Procter & Gamble by 655,209.0% in the 2nd quarter. Kingstone Capital Partners Texas LLC now owns 76,028,952 shares of the company's stock worth $11,832,680,000 after acquiring an additional 76,017,350 shares during the last quarter. Northern Trust Corp increased its stake in Procter & Gamble by 0.8% in the 1st quarter. Northern Trust Corp now owns 29,644,000 shares of the company's stock worth $5,051,930,000 after acquiring an additional 248,792 shares during the last quarter. Price T Rowe Associates Inc. MD increased its stake in Procter & Gamble by 13.0% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 21,480,670 shares of the company's stock worth $3,660,737,000 after acquiring an additional 2,466,308 shares during the last quarter. Goldman Sachs Group Inc. increased its stake in Procter & Gamble by 3.5% in the 1st quarter. Goldman Sachs Group Inc. now owns 17,405,539 shares of the company's stock worth $2,966,252,000 after acquiring an additional 583,629 shares during the last quarter. Finally, UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC increased its position in shares of Procter & Gamble by 6.3% during the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 17,293,428 shares of the company's stock valued at $2,947,146,000 after purchasing an additional 1,018,865 shares during the last quarter. Institutional investors own 65.77% of the company's stock.

Insiders Place Their Bets

In other Procter & Gamble news, insider Susan Street Whaley sold 1,000 shares of the company's stock in a transaction on Friday, August 29th. The stock was sold at an average price of $156.84, for a total value of $156,840.00. Following the completion of the sale, the insider directly owned 28,436 shares in the company, valued at approximately $4,459,902.24. This represents a 3.40% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CEO Ma. Fatima Francisco sold 9,100 shares of the company's stock in a transaction on Tuesday, August 19th. The stock was sold at an average price of $157.27, for a total value of $1,431,157.00. Following the completion of the sale, the chief executive officer owned 27,295 shares of the company's stock, valued at $4,292,684.65. This represents a 25.00% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 120,181 shares of company stock worth $18,918,012. 0.20% of the stock is owned by company insiders.

Analyst Upgrades and Downgrades

Several equities analysts have recently weighed in on the company. Wells Fargo & Company cut their target price on Procter & Gamble from $173.00 to $170.00 and set an "overweight" rating on the stock in a research report on Thursday, September 25th. Berenberg Bank boosted their target price on Procter & Gamble from $152.00 to $154.00 and gave the company a "hold" rating in a research report on Wednesday, September 17th. BNP Paribas reissued an "outperform" rating and set a $177.00 target price on shares of Procter & Gamble in a research report on Friday, August 15th. JPMorgan Chase & Co. reissued a "neutral" rating and set a $170.00 target price (down previously from $178.00) on shares of Procter & Gamble in a research report on Friday, July 25th. Finally, BNP Paribas Exane cut their target price on Procter & Gamble from $177.00 to $172.00 and set an "outperform" rating on the stock in a research report on Tuesday, September 23rd. One equities research analyst has rated the stock with a Strong Buy rating, eleven have assigned a Buy rating and eight have issued a Hold rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $173.11.

Check Out Our Latest Stock Analysis on Procter & Gamble

Procter & Gamble Stock Performance

Shares of Procter & Gamble stock opened at $152.06 on Friday. The stock's fifty day moving average is $155.63 and its two-hundred day moving average is $160.17. The company has a market capitalization of $355.90 billion, a PE ratio of 23.36, a price-to-earnings-growth ratio of 4.04 and a beta of 0.36. The company has a quick ratio of 0.49, a current ratio of 0.70 and a debt-to-equity ratio of 0.49. Procter & Gamble Company has a 52 week low of $149.91 and a 52 week high of $180.43.

Procter & Gamble (NYSE:PG - Get Free Report) last announced its quarterly earnings data on Tuesday, July 29th. The company reported $1.48 EPS for the quarter, beating the consensus estimate of $1.42 by $0.06. The company had revenue of $20.89 billion for the quarter, compared to the consensus estimate of $20.79 billion. Procter & Gamble had a return on equity of 32.69% and a net margin of 18.95%.Procter & Gamble's quarterly revenue was up 1.7% on a year-over-year basis. During the same quarter in the prior year, the company posted $1.40 EPS. Procter & Gamble has set its FY 2026 guidance at 6.830-7.090 EPS. As a group, analysts expect that Procter & Gamble Company will post 6.91 earnings per share for the current year.

Procter & Gamble Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Friday, August 15th. Shareholders of record on Friday, July 18th were issued a $1.0568 dividend. This represents a $4.23 annualized dividend and a dividend yield of 2.8%. The ex-dividend date was Friday, July 18th. Procter & Gamble's dividend payout ratio is currently 64.82%.

About Procter & Gamble

(

Free Report)

Procter & Gamble Co engages in the provision of branded consumer packaged goods. It operates through the following segments: Beauty, Grooming, Health Care, Fabric and Home Care, and Baby, Feminine and Family Care. The Beauty segment offers hair, skin, and personal care. The Grooming segment consists of shave care like female and male blades and razors, pre and post shave products, and appliances.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Procter & Gamble, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Procter & Gamble wasn't on the list.

While Procter & Gamble currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report