QRG Capital Management Inc. cut its holdings in shares of Host Hotels & Resorts, Inc. (NASDAQ:HST - Free Report) by 25.3% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 522,451 shares of the company's stock after selling 176,894 shares during the period. QRG Capital Management Inc. owned approximately 0.08% of Host Hotels & Resorts worth $7,424,000 at the end of the most recent quarter.

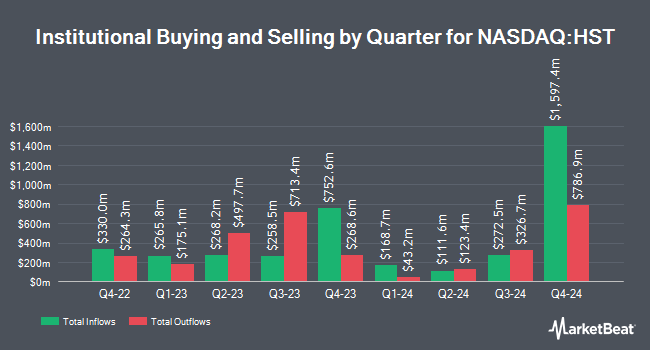

Several other institutional investors and hedge funds have also added to or reduced their stakes in HST. Exchange Traded Concepts LLC raised its holdings in shares of Host Hotels & Resorts by 17.1% during the first quarter. Exchange Traded Concepts LLC now owns 14,193 shares of the company's stock valued at $202,000 after acquiring an additional 2,074 shares during the period. Wealth Enhancement Advisory Services LLC raised its holdings in shares of Host Hotels & Resorts by 10.2% during the first quarter. Wealth Enhancement Advisory Services LLC now owns 57,318 shares of the company's stock valued at $814,000 after acquiring an additional 5,318 shares during the period. Fifth Third Bancorp raised its holdings in shares of Host Hotels & Resorts by 10.9% during the first quarter. Fifth Third Bancorp now owns 38,566 shares of the company's stock valued at $548,000 after acquiring an additional 3,804 shares during the period. SG Americas Securities LLC raised its holdings in shares of Host Hotels & Resorts by 250.8% during the first quarter. SG Americas Securities LLC now owns 62,599 shares of the company's stock valued at $890,000 after acquiring an additional 44,753 shares during the period. Finally, Farther Finance Advisors LLC raised its holdings in shares of Host Hotels & Resorts by 80.1% during the first quarter. Farther Finance Advisors LLC now owns 4,287 shares of the company's stock valued at $62,000 after acquiring an additional 1,906 shares during the period. 98.52% of the stock is owned by institutional investors and hedge funds.

Host Hotels & Resorts Stock Down 0.4%

HST stock traded down $0.06 during trading hours on Friday, hitting $15.67. The company's stock had a trading volume of 13,372,347 shares, compared to its average volume of 8,650,328. The company has a quick ratio of 2.08, a current ratio of 2.08 and a debt-to-equity ratio of 0.76. The company has a market capitalization of $10.87 billion, a PE ratio of 16.32 and a beta of 1.32. Host Hotels & Resorts, Inc. has a 12 month low of $12.22 and a 12 month high of $19.37. The stock has a 50 day moving average price of $14.93 and a two-hundred day moving average price of $15.87.

Host Hotels & Resorts (NASDAQ:HST - Get Free Report) last posted its earnings results on Wednesday, April 30th. The company reported $0.64 EPS for the quarter, topping the consensus estimate of $0.56 by $0.08. The company had revenue of $1.59 billion during the quarter, compared to the consensus estimate of $1.55 billion. Host Hotels & Resorts had a net margin of 11.66% and a return on equity of 10.11%. The company's revenue for the quarter was up 8.4% compared to the same quarter last year. During the same period in the previous year, the firm posted $0.60 earnings per share. On average, equities research analysts expect that Host Hotels & Resorts, Inc. will post 1.88 earnings per share for the current year.

Host Hotels & Resorts Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, July 15th. Investors of record on Monday, June 30th will be issued a dividend of $0.20 per share. This represents a $0.80 annualized dividend and a dividend yield of 5.11%. The ex-dividend date of this dividend is Monday, June 30th. Host Hotels & Resorts's dividend payout ratio is currently 83.33%.

Wall Street Analyst Weigh In

HST has been the topic of a number of recent analyst reports. Morgan Stanley cut their price target on shares of Host Hotels & Resorts from $15.00 to $14.00 and set an "equal weight" rating on the stock in a report on Tuesday, April 22nd. Evercore ISI restated an "outperform" rating on shares of Host Hotels & Resorts in a report on Friday, May 16th. Citigroup dropped their price objective on shares of Host Hotels & Resorts from $21.00 to $19.00 and set a "buy" rating on the stock in a research note on Monday, March 17th. Compass Point lowered shares of Host Hotels & Resorts from a "buy" rating to a "neutral" rating and dropped their price objective for the company from $20.00 to $18.00 in a research note on Monday, March 10th. Finally, Truist Financial dropped their price objective on shares of Host Hotels & Resorts from $20.00 to $17.00 and set a "hold" rating on the stock in a research note on Friday, March 21st. Two research analysts have rated the stock with a sell rating, six have given a hold rating and six have given a buy rating to the company. According to data from MarketBeat, the company has a consensus rating of "Hold" and a consensus target price of $18.27.

Read Our Latest Analysis on Host Hotels & Resorts

Host Hotels & Resorts Profile

(

Free Report)

Host Hotels & Resorts, Inc is a real estate investment trust, which engages in the management of luxury and upper-upscale hotels. It operates through the following geographical segments: United States, Brazil, and Canada. The company was founded in 1927 and is headquartered in Bethesda, MD.

See Also

Before you consider Host Hotels & Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Host Hotels & Resorts wasn't on the list.

While Host Hotels & Resorts currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.