Hotchkis & Wiley Capital Management LLC decreased its holdings in MGIC Investment Corporation (NYSE:MTG - Free Report) by 33.6% in the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 374,090 shares of the insurance provider's stock after selling 189,290 shares during the quarter. Hotchkis & Wiley Capital Management LLC owned about 0.16% of MGIC Investment worth $9,270,000 as of its most recent SEC filing.

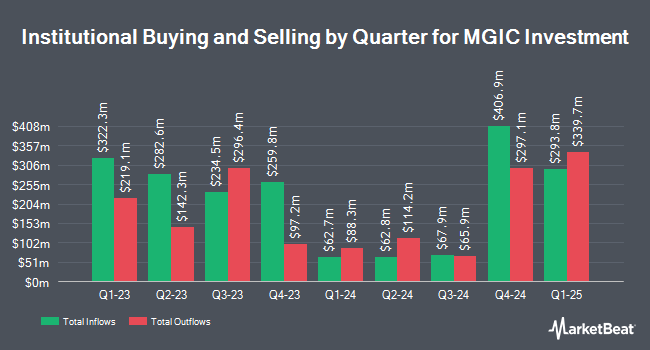

A number of other institutional investors have also recently made changes to their positions in MTG. Caisse DE Depot ET Placement DU Quebec boosted its position in shares of MGIC Investment by 292.0% in the 4th quarter. Caisse DE Depot ET Placement DU Quebec now owns 2,072,629 shares of the insurance provider's stock worth $49,142,000 after purchasing an additional 1,543,908 shares in the last quarter. BNP Paribas Financial Markets boosted its position in shares of MGIC Investment by 259.4% in the 4th quarter. BNP Paribas Financial Markets now owns 1,105,399 shares of the insurance provider's stock worth $26,209,000 after purchasing an additional 797,852 shares in the last quarter. JPMorgan Chase & Co. boosted its position in shares of MGIC Investment by 4.8% in the 1st quarter. JPMorgan Chase & Co. now owns 16,162,180 shares of the insurance provider's stock worth $400,499,000 after purchasing an additional 743,212 shares in the last quarter. Citigroup Inc. boosted its position in shares of MGIC Investment by 259.1% in the 1st quarter. Citigroup Inc. now owns 902,982 shares of the insurance provider's stock worth $22,376,000 after purchasing an additional 651,549 shares in the last quarter. Finally, Nuveen LLC acquired a new stake in MGIC Investment during the 1st quarter worth about $13,266,000. Institutional investors and hedge funds own 95.58% of the company's stock.

Insider Transactions at MGIC Investment

In other news, CEO Timothy J. Mattke sold 139,203 shares of the company's stock in a transaction dated Thursday, August 7th. The stock was sold at an average price of $26.54, for a total value of $3,694,447.62. Following the sale, the chief executive officer owned 1,100,994 shares in the company, valued at $29,220,380.76. This represents a 11.22% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, COO Salvatore A. Miosi sold 30,000 shares of the company's stock in a transaction dated Friday, August 1st. The stock was sold at an average price of $26.22, for a total value of $786,600.00. Following the completion of the sale, the chief operating officer owned 249,401 shares in the company, valued at $6,539,294.22. The trade was a 10.74% decrease in their position. The disclosure for this sale can be found here. 1.05% of the stock is owned by corporate insiders.

MGIC Investment Stock Performance

Shares of MTG stock traded up $0.13 on Friday, hitting $27.81. The company had a trading volume of 1,578,097 shares, compared to its average volume of 1,832,332. MGIC Investment Corporation has a twelve month low of $21.94 and a twelve month high of $28.67. The company has a quick ratio of 1.46, a current ratio of 1.46 and a debt-to-equity ratio of 0.13. The firm has a market cap of $6.41 billion, a P/E ratio of 9.12, a price-to-earnings-growth ratio of 2.01 and a beta of 0.90. The company has a 50-day moving average price of $26.89 and a 200-day moving average price of $25.60.

MGIC Investment (NYSE:MTG - Get Free Report) last issued its earnings results on Wednesday, July 30th. The insurance provider reported $0.82 EPS for the quarter, topping analysts' consensus estimates of $0.70 by $0.12. MGIC Investment had a return on equity of 14.73% and a net margin of 62.58%.The firm had revenue of $304.25 million for the quarter, compared to the consensus estimate of $306.25 million. During the same quarter in the prior year, the business earned $0.77 earnings per share. The company's revenue was down .3% compared to the same quarter last year. As a group, equities research analysts predict that MGIC Investment Corporation will post 2.71 earnings per share for the current fiscal year.

MGIC Investment Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Thursday, August 21st. Stockholders of record on Thursday, August 7th were paid a $0.15 dividend. The ex-dividend date was Thursday, August 7th. This is a positive change from MGIC Investment's previous quarterly dividend of $0.13. This represents a $0.60 dividend on an annualized basis and a dividend yield of 2.2%. MGIC Investment's dividend payout ratio (DPR) is currently 19.67%.

Analyst Ratings Changes

A number of analysts have commented on the company. Compass Point reaffirmed a "neutral" rating and set a $28.00 price target (up previously from $27.00) on shares of MGIC Investment in a research report on Friday, May 23rd. Keefe, Bruyette & Woods lifted their price target on MGIC Investment from $26.00 to $27.00 and gave the stock a "market perform" rating in a research report on Monday, July 7th. Finally, Barclays lifted their price target on MGIC Investment from $26.00 to $27.00 and gave the stock an "equal weight" rating in a research report on Tuesday, July 8th. Five equities research analysts have rated the stock with a Hold rating and one has assigned a Sell rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Reduce" and an average target price of $26.67.

Check Out Our Latest Report on MTG

About MGIC Investment

(

Free Report)

MGIC Investment Corporation, through its subsidiaries, provides private mortgage insurance, other mortgage credit risk management solutions, and ancillary services to lenders and government sponsored entities in the United States, the District of Columbia, Puerto Rico, and Guam. The company offers primary mortgage insurance that provides mortgage default protection on individual loans, as well as covers unpaid loan principal, delinquent interest, and various expenses associated with the default and subsequent foreclosure.

Further Reading

Before you consider MGIC Investment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MGIC Investment wasn't on the list.

While MGIC Investment currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report