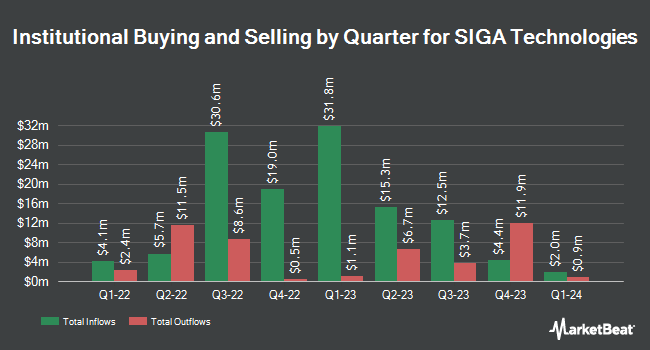

Hotchkis & Wiley Capital Management LLC boosted its stake in shares of Siga Technologies Inc. (NASDAQ:SIGA - Free Report) by 52.9% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 3,158,320 shares of the company's stock after acquiring an additional 1,093,080 shares during the quarter. Hotchkis & Wiley Capital Management LLC owned 4.42% of Siga Technologies worth $17,308,000 at the end of the most recent reporting period.

Other institutional investors also recently bought and sold shares of the company. Harbor Capital Advisors Inc. raised its position in Siga Technologies by 31.8% during the first quarter. Harbor Capital Advisors Inc. now owns 222,012 shares of the company's stock valued at $1,217,000 after acquiring an additional 53,534 shares in the last quarter. Dimensional Fund Advisors LP boosted its position in Siga Technologies by 11.4% during the fourth quarter. Dimensional Fund Advisors LP now owns 2,126,065 shares of the company's stock worth $12,777,000 after purchasing an additional 217,926 shares in the last quarter. Renaissance Technologies LLC boosted its position in Siga Technologies by 237.7% during the fourth quarter. Renaissance Technologies LLC now owns 417,436 shares of the company's stock worth $2,509,000 after purchasing an additional 293,836 shares in the last quarter. Legal & General Group Plc boosted its position in Siga Technologies by 12.6% during the fourth quarter. Legal & General Group Plc now owns 59,944 shares of the company's stock worth $360,000 after purchasing an additional 6,704 shares in the last quarter. Finally, Price T Rowe Associates Inc. MD boosted its position in Siga Technologies by 26.1% during the fourth quarter. Price T Rowe Associates Inc. MD now owns 40,005 shares of the company's stock worth $241,000 after purchasing an additional 8,290 shares in the last quarter. 55.40% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen upgraded Siga Technologies from a "hold" rating to a "strong-buy" rating in a research report on Saturday, August 9th.

Check Out Our Latest Stock Analysis on SIGA

Siga Technologies Stock Up 1.4%

Shares of Siga Technologies stock traded up $0.11 during mid-day trading on Friday, reaching $8.32. 130,502 shares of the stock traded hands, compared to its average volume of 475,376. The business has a 50-day moving average of $7.37 and a 200 day moving average of $6.39. Siga Technologies Inc. has a fifty-two week low of $4.95 and a fifty-two week high of $9.62. The stock has a market capitalization of $595.83 million, a PE ratio of 7.39 and a beta of 0.94.

Siga Technologies (NASDAQ:SIGA - Get Free Report) last issued its earnings results on Tuesday, August 5th. The company reported $0.49 earnings per share for the quarter. The business had revenue of $81.12 million for the quarter. Siga Technologies had a return on equity of 40.52% and a net margin of 45.73%. On average, equities research analysts expect that Siga Technologies Inc. will post 1.04 EPS for the current fiscal year.

Siga Technologies Profile

(

Free Report)

SIGA Technologies, Inc, a commercial-stage pharmaceutical company, focuses on the health security related markets in the United States. Its lead product is TPOXX, an oral formulation antiviral drug for the treatment of human smallpox disease caused by variola virus. The company was incorporated in 1995 and is headquartered in New York, New York.

Further Reading

Before you consider Siga Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Siga Technologies wasn't on the list.

While Siga Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.