Evergreen Capital Management LLC lowered its holdings in shares of HP Inc. (NYSE:HPQ - Free Report) by 7.6% in the first quarter, according to its most recent disclosure with the SEC. The firm owned 223,221 shares of the computer maker's stock after selling 18,354 shares during the period. Evergreen Capital Management LLC's holdings in HP were worth $6,245,000 as of its most recent filing with the SEC.

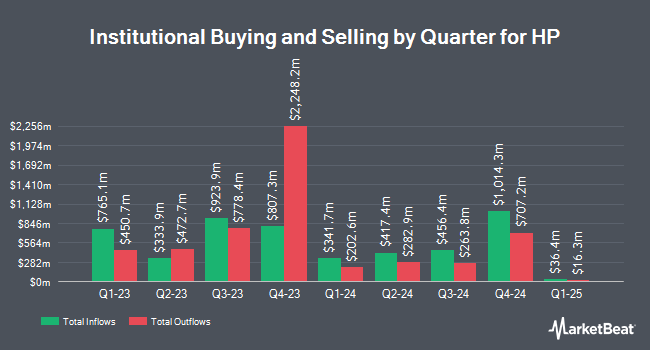

Several other hedge funds and other institutional investors also recently made changes to their positions in the business. Magnetar Financial LLC boosted its stake in shares of HP by 153.3% during the 1st quarter. Magnetar Financial LLC now owns 406,908 shares of the computer maker's stock worth $11,267,000 after acquiring an additional 246,278 shares during the period. Canada Pension Plan Investment Board boosted its position in HP by 5.8% during the first quarter. Canada Pension Plan Investment Board now owns 335,282 shares of the computer maker's stock worth $9,284,000 after purchasing an additional 18,400 shares during the period. Te Ahumairangi Investment Management Ltd boosted its position in HP by 7.7% during the first quarter. Te Ahumairangi Investment Management Ltd now owns 156,722 shares of the computer maker's stock worth $4,340,000 after purchasing an additional 11,233 shares during the period. WPG Advisers LLC bought a new stake in shares of HP during the 1st quarter worth about $25,000. Finally, State of Wyoming boosted its holdings in shares of HP by 112.5% during the 1st quarter. State of Wyoming now owns 12,075 shares of the computer maker's stock worth $334,000 after buying an additional 6,393 shares during the period. 77.53% of the stock is currently owned by institutional investors.

HP Stock Down 0.8%

HP stock traded down $0.25 during trading hours on Wednesday, hitting $28.70. The stock had a trading volume of 8,239,575 shares, compared to its average volume of 8,376,691. The stock has a market cap of $26.82 billion, a price-to-earnings ratio of 10.47, a P/E/G ratio of 2.30 and a beta of 1.29. HP Inc. has a one year low of $21.21 and a one year high of $39.79. The business's 50 day simple moving average is $25.94 and its 200-day simple moving average is $26.71.

HP (NYSE:HPQ - Get Free Report) last issued its quarterly earnings data on Wednesday, August 27th. The computer maker reported $0.75 earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of $0.75. The business had revenue of $13.93 billion during the quarter, compared to analyst estimates of $13.69 billion. HP had a net margin of 4.83% and a negative return on equity of 262.03%. The firm's quarterly revenue was up 3.1% on a year-over-year basis. During the same quarter last year, the business earned $0.83 EPS. HP has set its Q4 2025 guidance at 0.870-0.97 EPS. Research analysts anticipate that HP Inc. will post 3.56 EPS for the current fiscal year.

HP Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, October 1st. Stockholders of record on Wednesday, September 10th will be given a dividend of $0.2894 per share. This represents a $1.16 dividend on an annualized basis and a dividend yield of 4.0%. The ex-dividend date is Wednesday, September 10th. HP's dividend payout ratio (DPR) is 42.34%.

Analyst Upgrades and Downgrades

HPQ has been the subject of several recent research reports. Wall Street Zen upgraded HP from a "hold" rating to a "buy" rating in a research note on Monday, May 12th. JPMorgan Chase & Co. upped their target price on HP from $27.00 to $30.00 and gave the company an "overweight" rating in a research report on Thursday, August 28th. Wells Fargo & Company cut their target price on HP from $35.00 to $25.00 and set an "underweight" rating for the company in a research report on Thursday, May 29th. Bank of America cut their price objective on shares of HP from $35.00 to $33.00 and set a "neutral" rating for the company in a research report on Wednesday, May 28th. Finally, TD Cowen cut their price objective on shares of HP from $38.00 to $28.00 and set a "hold" rating for the company in a research report on Thursday, May 29th. Two investment analysts have rated the stock with a Buy rating, thirteen have assigned a Hold rating and one has given a Sell rating to the company's stock. According to data from MarketBeat, HP has an average rating of "Hold" and a consensus price target of $29.96.

Check Out Our Latest Analysis on HP

About HP

(

Free Report)

HP Inc provides products, technologies, software, solutions, and services to individual consumers, small- and medium-sized businesses, and large enterprises, including customers in the government, health, and education sectors worldwide. It operates through Personal Systems and Printing segments. The Personal Systems segment offers commercial personal computers (PCs), consumer PCs, workstations, thin clients, commercial tablets and mobility devices, retail point-of-sale systems, displays and other related accessories, software, support, and services for the commercial and consumer markets.

Read More

Before you consider HP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HP wasn't on the list.

While HP currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.