Hsbc Holdings PLC grew its stake in shares of Weis Markets, Inc. (NYSE:WMK - Free Report) by 19.6% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 28,076 shares of the company's stock after acquiring an additional 4,602 shares during the quarter. Hsbc Holdings PLC owned about 0.10% of Weis Markets worth $2,160,000 as of its most recent SEC filing.

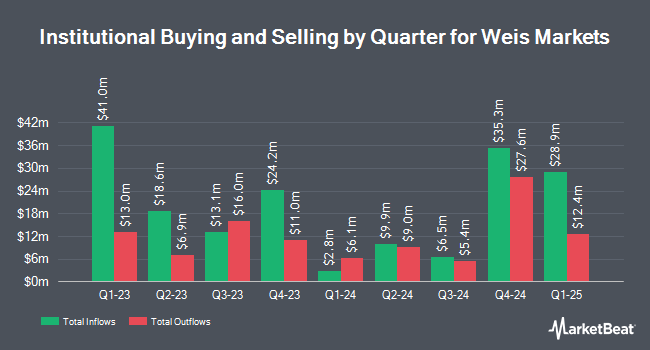

Several other hedge funds have also recently modified their holdings of the stock. Vanguard Group Inc. increased its holdings in shares of Weis Markets by 1.1% during the first quarter. Vanguard Group Inc. now owns 1,863,084 shares of the company's stock valued at $143,551,000 after acquiring an additional 20,202 shares in the last quarter. American Century Companies Inc. increased its holdings in shares of Weis Markets by 10.6% during the first quarter. American Century Companies Inc. now owns 536,851 shares of the company's stock valued at $41,364,000 after acquiring an additional 51,564 shares in the last quarter. Charles Schwab Investment Management Inc. increased its holdings in shares of Weis Markets by 1.0% during the first quarter. Charles Schwab Investment Management Inc. now owns 424,476 shares of the company's stock valued at $32,706,000 after acquiring an additional 4,200 shares in the last quarter. Northern Trust Corp increased its holdings in shares of Weis Markets by 9.1% during the fourth quarter. Northern Trust Corp now owns 166,968 shares of the company's stock valued at $11,307,000 after acquiring an additional 13,887 shares in the last quarter. Finally, Allianz Asset Management GmbH increased its holdings in Weis Markets by 7.8% in the 1st quarter. Allianz Asset Management GmbH now owns 152,837 shares of the company's stock worth $11,776,000 after buying an additional 11,017 shares during the period.

Wall Street Analyst Weigh In

Separately, Wall Street Zen downgraded shares of Weis Markets from a "strong-buy" rating to a "buy" rating in a report on Thursday, May 8th.

Check Out Our Latest Research Report on Weis Markets

Weis Markets Price Performance

NYSE:WMK traded up $0.54 during midday trading on Tuesday, hitting $72.19. The company's stock had a trading volume of 111,310 shares, compared to its average volume of 133,564. Weis Markets, Inc. has a fifty-two week low of $62.25 and a fifty-two week high of $90.23. The firm's 50 day moving average is $73.61 and its 200-day moving average is $76.28. The firm has a market cap of $1.79 billion, a P/E ratio of 17.96 and a beta of 0.49.

Weis Markets (NYSE:WMK - Get Free Report) last issued its quarterly earnings results on Wednesday, August 6th. The company reported $1.01 earnings per share for the quarter. Weis Markets had a net margin of 2.23% and a return on equity of 7.60%. The company had revenue of $1.21 billion for the quarter.

Weis Markets Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Monday, August 11th. Stockholders of record on Monday, July 28th were paid a dividend of $0.34 per share. The ex-dividend date of this dividend was Monday, July 28th. This represents a $1.36 dividend on an annualized basis and a dividend yield of 1.9%. Weis Markets's dividend payout ratio (DPR) is presently 33.83%.

About Weis Markets

(

Free Report)

Weis Markets, Inc engages in the retail sale of food through a chain of supermarkets in Pennsylvania and surrounding states. The company's retail food stores sell groceries, dairy products, frozen foods, meats, seafood, fresh produce, floral, pharmacy services, deli products, prepared foods, bakery products, beer and wine, and fuel; and general merchandise items, such as health and beauty care, and household products.

Further Reading

Before you consider Weis Markets, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Weis Markets wasn't on the list.

While Weis Markets currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.