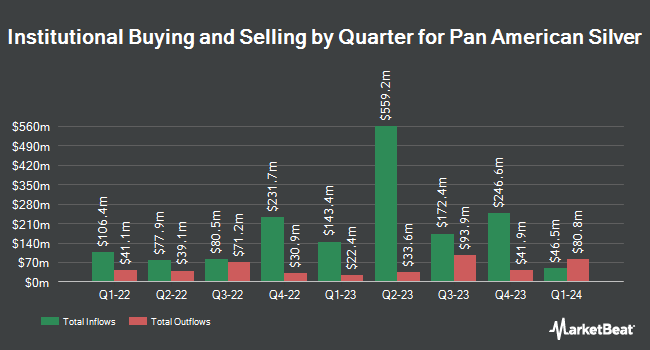

Hsbc Holdings PLC cut its holdings in shares of Pan American Silver Corp. (NYSE:PAAS - Free Report) TSE: PAAS by 90.2% in the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 127,985 shares of the basic materials company's stock after selling 1,179,632 shares during the quarter. Hsbc Holdings PLC's holdings in Pan American Silver were worth $3,313,000 as of its most recent SEC filing.

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Graybill Wealth Management LTD. bought a new position in Pan American Silver during the first quarter valued at about $33,000. Farther Finance Advisors LLC increased its stake in Pan American Silver by 39.8% during the first quarter. Farther Finance Advisors LLC now owns 2,720 shares of the basic materials company's stock valued at $70,000 after acquiring an additional 775 shares during the period. Whittier Trust Co. of Nevada Inc. increased its stake in Pan American Silver by 507.3% during the first quarter. Whittier Trust Co. of Nevada Inc. now owns 4,500 shares of the basic materials company's stock valued at $116,000 after acquiring an additional 3,759 shares during the period. Rossby Financial LCC bought a new position in Pan American Silver during the first quarter valued at about $151,000. Finally, Summit Securities Group LLC bought a new position in Pan American Silver during the first quarter valued at about $161,000. 55.43% of the stock is currently owned by institutional investors.

Pan American Silver Price Performance

PAAS traded up $1.05 during midday trading on Monday, reaching $33.98. 4,283,643 shares of the company's stock were exchanged, compared to its average volume of 4,561,166. The firm has a market capitalization of $12.30 billion, a price-to-earnings ratio of 23.44, a price-to-earnings-growth ratio of 0.46 and a beta of 0.64. The company has a quick ratio of 2.11, a current ratio of 3.05 and a debt-to-equity ratio of 0.15. Pan American Silver Corp. has a one year low of $18.50 and a one year high of $33.99. The business has a 50-day simple moving average of $30.02 and a two-hundred day simple moving average of $27.05.

Pan American Silver (NYSE:PAAS - Get Free Report) TSE: PAAS last issued its quarterly earnings data on Wednesday, August 6th. The basic materials company reported $0.43 earnings per share for the quarter, topping the consensus estimate of $0.40 by $0.03. The firm had revenue of $811.90 million for the quarter, compared to analysts' expectations of $782.12 million. Pan American Silver had a net margin of 16.80% and a return on equity of 11.49%. The company's quarterly revenue was up 18.3% compared to the same quarter last year. During the same period in the prior year, the firm earned $0.11 earnings per share. As a group, research analysts predict that Pan American Silver Corp. will post 1.26 EPS for the current year.

Pan American Silver Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, August 29th. Shareholders of record on Monday, August 18th were paid a dividend of $0.12 per share. This is a positive change from Pan American Silver's previous quarterly dividend of $0.10. This represents a $0.48 annualized dividend and a yield of 1.4%. The ex-dividend date of this dividend was Monday, August 18th. Pan American Silver's payout ratio is currently 33.10%.

Analyst Upgrades and Downgrades

Several equities analysts recently issued reports on PAAS shares. TD Securities lowered their price target on Pan American Silver from $30.00 to $26.00 and set a "hold" rating on the stock in a research note on Thursday, May 22nd. Zacks Research lowered Pan American Silver from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, August 19th. Wall Street Zen cut shares of Pan American Silver from a "strong-buy" rating to a "buy" rating in a research note on Saturday, August 16th. Finally, CIBC restated an "outperform" rating on shares of Pan American Silver in a research note on Tuesday, July 15th. Three equities research analysts have rated the stock with a Buy rating and five have issued a Hold rating to the company. Based on data from MarketBeat, Pan American Silver has a consensus rating of "Hold" and a consensus price target of $31.40.

Get Our Latest Research Report on Pan American Silver

Pan American Silver Profile

(

Free Report)

Pan American Silver Corp. engages in the exploration, mine development, extraction, processing, refining, and reclamation of silver, gold, zinc, lead, and copper mines in Canada, Mexico, Peru, Bolivia, Argentina, Chile, and Brazil. The company was formerly known as Pan American Minerals Corp. and changed its name to Pan American Silver Corp.

Featured Stories

Before you consider Pan American Silver, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pan American Silver wasn't on the list.

While Pan American Silver currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.