Hsbc Holdings PLC grew its position in Liberty Broadband Corporation (NASDAQ:LBRDK - Free Report) by 6,649.1% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 878,124 shares of the company's stock after acquiring an additional 865,113 shares during the quarter. Hsbc Holdings PLC owned approximately 0.61% of Liberty Broadband worth $73,923,000 as of its most recent filing with the Securities and Exchange Commission.

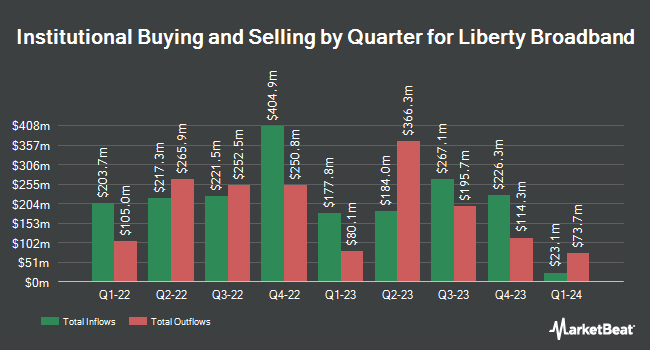

A number of other institutional investors have also made changes to their positions in LBRDK. LPL Financial LLC increased its holdings in shares of Liberty Broadband by 11.6% in the 4th quarter. LPL Financial LLC now owns 5,755 shares of the company's stock valued at $430,000 after acquiring an additional 599 shares during the last quarter. Raymond James Financial Inc. bought a new stake in shares of Liberty Broadband in the 4th quarter valued at approximately $949,000. Guggenheim Capital LLC increased its holdings in shares of Liberty Broadband by 111.0% in the 4th quarter. Guggenheim Capital LLC now owns 11,503 shares of the company's stock valued at $860,000 after acquiring an additional 6,052 shares during the last quarter. Stifel Financial Corp increased its holdings in shares of Liberty Broadband by 2.6% in the 4th quarter. Stifel Financial Corp now owns 96,914 shares of the company's stock valued at $7,245,000 after acquiring an additional 2,453 shares during the last quarter. Finally, Price T Rowe Associates Inc. MD increased its holdings in shares of Liberty Broadband by 23.2% in the 4th quarter. Price T Rowe Associates Inc. MD now owns 495,297 shares of the company's stock valued at $37,029,000 after acquiring an additional 93,405 shares during the last quarter. 80.22% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Separately, Wall Street Zen upgraded Liberty Broadband to a "hold" rating in a report on Saturday, July 12th.

Get Our Latest Stock Report on Liberty Broadband

Liberty Broadband Stock Performance

LBRDK traded down $1.59 during trading on Tuesday, reaching $61.06. 304,940 shares of the company were exchanged, compared to its average volume of 1,236,156. The stock has a market cap of $8.76 billion, a P/E ratio of 8.05 and a beta of 0.96. The firm has a 50 day moving average of $79.64 and a 200 day moving average of $83.93. The company has a current ratio of 0.60, a quick ratio of 0.60 and a debt-to-equity ratio of 0.26. Liberty Broadband Corporation has a 52 week low of $57.91 and a 52 week high of $104.00.

About Liberty Broadband

(

Free Report)

Liberty Broadband Corporation engages in the communications businesses. The company's GCI Holdings segment provides data, wireless, video, voice, and managed services to residential customers, businesses, governmental entities, educational, and medical institutions in Alaska under the GCI brand.

Recommended Stories

Before you consider Liberty Broadband, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Liberty Broadband wasn't on the list.

While Liberty Broadband currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.