Huber Capital Management LLC lessened its stake in shares of Tetra Technologies, Inc. (NYSE:TTI - Free Report) by 4.0% in the 1st quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 1,842,680 shares of the oil and gas company's stock after selling 76,116 shares during the quarter. Tetra Technologies comprises approximately 1.2% of Huber Capital Management LLC's holdings, making the stock its 26th largest position. Huber Capital Management LLC owned about 1.38% of Tetra Technologies worth $6,191,000 as of its most recent SEC filing.

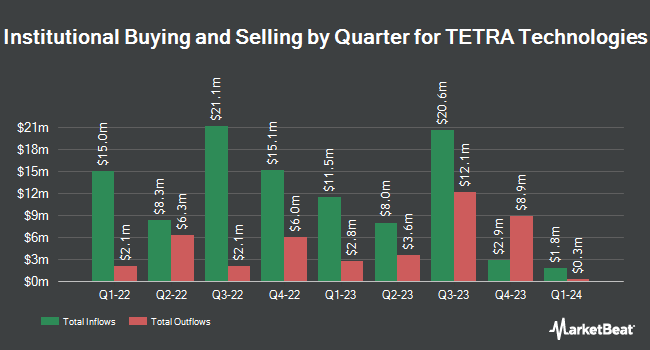

Several other large investors also recently made changes to their positions in the stock. Aquatic Capital Management LLC bought a new stake in Tetra Technologies during the 4th quarter valued at approximately $40,000. Byrne Asset Management LLC boosted its stake in Tetra Technologies by 67.9% during the 1st quarter. Byrne Asset Management LLC now owns 15,277 shares of the oil and gas company's stock valued at $51,000 after purchasing an additional 6,177 shares during the period. Teacher Retirement System of Texas bought a new stake in Tetra Technologies during the 1st quarter valued at approximately $61,000. Vestmark Advisory Solutions Inc. bought a new stake in Tetra Technologies during the 1st quarter valued at approximately $68,000. Finally, Caption Management LLC bought a new stake in Tetra Technologies during the 4th quarter valued at approximately $92,000. Institutional investors own 70.19% of the company's stock.

Analyst Ratings Changes

Several brokerages recently weighed in on TTI. Wall Street Zen upgraded Tetra Technologies from a "hold" rating to a "buy" rating in a research note on Saturday, August 9th. D. Boral Capital increased their target price on Tetra Technologies from $4.00 to $5.00 and gave the company a "buy" rating in a research note on Thursday, July 31st. Finally, Stifel Nicolaus increased their target price on Tetra Technologies from $6.00 to $6.50 and gave the company a "buy" rating in a research note on Thursday, July 31st. One investment analyst has rated the stock with a Strong Buy rating and two have given a Buy rating to the stock. Based on data from MarketBeat.com, the company currently has an average rating of "Buy" and an average target price of $5.75.

Check Out Our Latest Stock Analysis on TTI

Tetra Technologies Price Performance

Shares of TTI traded up $0.01 during mid-day trading on Tuesday, reaching $4.71. The company had a trading volume of 383,223 shares, compared to its average volume of 1,471,427. Tetra Technologies, Inc. has a twelve month low of $2.03 and a twelve month high of $5.12. The company has a debt-to-equity ratio of 0.62, a current ratio of 2.47 and a quick ratio of 1.61. The company's 50-day moving average is $3.81 and its 200-day moving average is $3.36. The company has a market capitalization of $627.08 million, a P/E ratio of 5.47 and a beta of 1.39.

Tetra Technologies (NYSE:TTI - Get Free Report) last released its quarterly earnings results on Tuesday, July 29th. The oil and gas company reported $0.09 EPS for the quarter, hitting analysts' consensus estimates of $0.09. The business had revenue of $173.87 million for the quarter, compared to analyst estimates of $172.46 million. Tetra Technologies had a return on equity of 14.10% and a net margin of 18.95%. Tetra Technologies has set its FY 2025 guidance at EPS. On average, equities analysts anticipate that Tetra Technologies, Inc. will post 0.15 EPS for the current year.

About Tetra Technologies

(

Free Report)

TETRA Technologies, Inc, together with its subsidiaries, operates as an energy services and solutions company. It operates through two segments, Completion Fluids & Products Division and Water & Flowback Services. The Completion Fluids & Products segment manufactures and markets clear brine fluids, additives, and associated products and services to the oil and gas industry for use in well drilling, completion, and workover operations in the United States, as well as in Latin America, Europe, Asia, the Middle East, and Africa.

Further Reading

Before you consider Tetra Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tetra Technologies wasn't on the list.

While Tetra Technologies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.