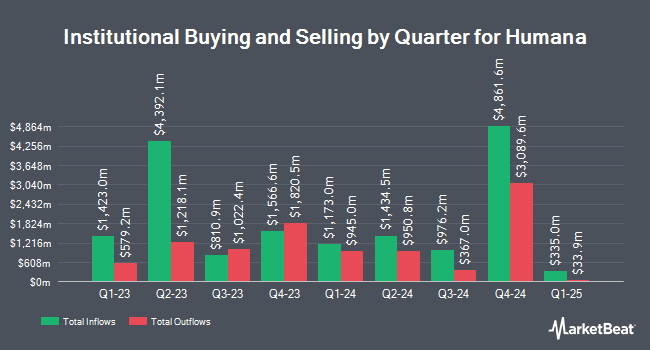

Bank of Nova Scotia trimmed its position in shares of Humana Inc. (NYSE:HUM - Free Report) by 29.5% during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 75,910 shares of the insurance provider's stock after selling 31,837 shares during the quarter. Bank of Nova Scotia owned 0.06% of Humana worth $20,086,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other institutional investors also recently bought and sold shares of the company. Banco Santander S.A. bought a new stake in Humana during the first quarter valued at about $245,000. OVERSEA CHINESE BANKING Corp Ltd bought a new stake in Humana during the first quarter valued at about $696,000. Shufro Rose & Co. LLC bought a new stake in Humana during the first quarter valued at about $210,000. Sound View Wealth Advisors Group LLC raised its holdings in Humana by 5.8% during the first quarter. Sound View Wealth Advisors Group LLC now owns 1,154 shares of the insurance provider's stock valued at $305,000 after acquiring an additional 63 shares during the period. Finally, Modera Wealth Management LLC bought a new stake in Humana during the first quarter valued at about $230,000. 92.38% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

Several equities research analysts have recently issued reports on HUM shares. Oppenheimer lifted their target price on Humana from $300.00 to $310.00 and gave the stock an "outperform" rating in a report on Thursday, May 1st. Mizuho lifted their target price on Humana from $305.00 to $316.00 and gave the stock an "outperform" rating in a report on Wednesday, April 9th. Wall Street Zen cut Humana from a "buy" rating to a "hold" rating in a report on Saturday. Bank of America reduced their target price on Humana from $320.00 to $260.00 and set a "neutral" rating on the stock in a report on Tuesday, June 17th. Finally, Guggenheim began coverage on Humana in a research report on Wednesday, April 9th. They issued a "buy" rating and a $326.00 price target for the company. Seventeen investment analysts have rated the stock with a hold rating and seven have given a buy rating to the company. According to MarketBeat.com, the company has a consensus rating of "Hold" and an average target price of $281.62.

Read Our Latest Report on HUM

Humana Trading Up 3.1%

Shares of Humana stock traded up $7.60 on Tuesday, hitting $254.95. 1,936,925 shares of the company traded hands, compared to its average volume of 1,940,093. The stock's 50 day moving average price is $235.53 and its 200-day moving average price is $254.67. The company has a current ratio of 1.95, a quick ratio of 1.95 and a debt-to-equity ratio of 0.69. Humana Inc. has a 52 week low of $206.87 and a 52 week high of $382.72. The company has a market cap of $30.66 billion, a PE ratio of 19.57, a PEG ratio of 1.45 and a beta of 0.44.

Humana (NYSE:HUM - Get Free Report) last posted its quarterly earnings results on Wednesday, July 30th. The insurance provider reported $6.27 earnings per share for the quarter, missing the consensus estimate of $6.32 by ($0.05). The company had revenue of $32.39 billion for the quarter, compared to the consensus estimate of $31.85 billion. Humana had a net margin of 1.28% and a return on equity of 13.67%. The business's revenue was up 9.6% on a year-over-year basis. During the same period in the prior year, the firm posted $6.96 EPS. Equities research analysts predict that Humana Inc. will post 16.47 EPS for the current year.

Humana Company Profile

(

Free Report)

Humana Inc, together with its subsidiaries, provides medical and specialty insurance products in the United States. It operates through two segments, Insurance and CenterWell. The company offers medical and supplemental benefit plans to individuals. It has a contract with Centers for Medicare and Medicaid Services to administer the Limited Income Newly Eligible Transition prescription drug plan program; and contracts with various states to provide Medicaid, dual eligible, and long-term support services benefits.

See Also

Before you consider Humana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Humana wasn't on the list.

While Humana currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.