iA Global Asset Management Inc. boosted its stake in Hilton Worldwide Holdings Inc. (NYSE:HLT - Free Report) by 1,210.6% in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 28,257 shares of the company's stock after purchasing an additional 26,101 shares during the quarter. iA Global Asset Management Inc.'s holdings in Hilton Worldwide were worth $6,430,000 as of its most recent SEC filing.

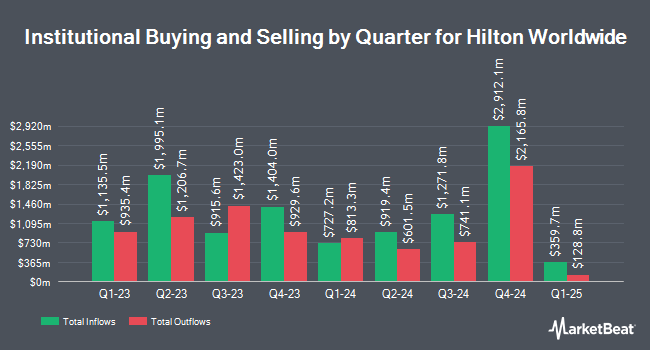

Other institutional investors also recently modified their holdings of the company. ORG Partners LLC grew its position in shares of Hilton Worldwide by 78.7% in the 1st quarter. ORG Partners LLC now owns 168 shares of the company's stock valued at $38,000 after purchasing an additional 74 shares during the period. Beacon Capital Management LLC boosted its holdings in Hilton Worldwide by 76.0% during the first quarter. Beacon Capital Management LLC now owns 176 shares of the company's stock worth $40,000 after purchasing an additional 76 shares during the last quarter. Valley National Advisers Inc. grew its holdings in shares of Hilton Worldwide by 244.8% in the 1st quarter. Valley National Advisers Inc. now owns 200 shares of the company's stock valued at $45,000 after acquiring an additional 142 shares in the last quarter. Optiver Holding B.V. grew its stake in Hilton Worldwide by 127.1% in the fourth quarter. Optiver Holding B.V. now owns 218 shares of the company's stock valued at $54,000 after purchasing an additional 122 shares in the last quarter. Finally, Wayfinding Financial LLC acquired a new position in shares of Hilton Worldwide during the 1st quarter worth approximately $54,000. 95.90% of the stock is currently owned by institutional investors and hedge funds.

Hilton Worldwide Trading Up 0.6%

NYSE:HLT traded up $1.55 during trading hours on Friday, hitting $262.47. 1,957,942 shares of the company were exchanged, compared to its average volume of 1,888,753. The company has a fifty day simple moving average of $262.31 and a 200 day simple moving average of $248.16. Hilton Worldwide Holdings Inc. has a one year low of $196.04 and a one year high of $279.46. The stock has a market capitalization of $61.73 billion, a price-to-earnings ratio of 40.32, a price-to-earnings-growth ratio of 2.57 and a beta of 1.26.

Hilton Worldwide (NYSE:HLT - Get Free Report) last posted its quarterly earnings data on Wednesday, July 23rd. The company reported $2.20 earnings per share for the quarter, topping the consensus estimate of $2.04 by $0.16. The company had revenue of $3.14 billion during the quarter, compared to analysts' expectations of $3.09 billion. Hilton Worldwide had a net margin of 13.84% and a negative return on equity of 46.13%. Hilton Worldwide's revenue for the quarter was up 6.3% compared to the same quarter last year. During the same period in the prior year, the company posted $1.91 earnings per share. Equities research analysts predict that Hilton Worldwide Holdings Inc. will post 7.89 earnings per share for the current fiscal year.

Hilton Worldwide Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Tuesday, September 30th. Shareholders of record on Friday, August 29th will be issued a $0.15 dividend. This represents a $0.60 dividend on an annualized basis and a yield of 0.2%. The ex-dividend date is Friday, August 29th. Hilton Worldwide's dividend payout ratio (DPR) is presently 9.22%.

Wall Street Analysts Forecast Growth

HLT has been the subject of several recent analyst reports. The Goldman Sachs Group reiterated a "neutral" rating and issued a $235.00 target price (down from $296.00) on shares of Hilton Worldwide in a research note on Monday, April 14th. Bank of America boosted their target price on shares of Hilton Worldwide from $275.00 to $285.00 and gave the company a "buy" rating in a research report on Monday, July 21st. Morgan Stanley lowered their target price on shares of Hilton Worldwide from $251.00 to $241.00 and set an "overweight" rating on the stock in a report on Tuesday, April 22nd. Truist Financial raised their price target on Hilton Worldwide from $223.00 to $246.00 and gave the stock a "hold" rating in a research report on Thursday, July 24th. Finally, Robert W. Baird boosted their price objective on shares of Hilton Worldwide from $276.00 to $278.00 and gave the company an "outperform" rating in a research report on Thursday, July 24th. Ten analysts have rated the stock with a hold rating, eight have issued a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus target price of $259.19.

Get Our Latest Analysis on Hilton Worldwide

Hilton Worldwide Company Profile

(

Free Report)

Hilton Worldwide Holdings Inc, a hospitality company, engages in managing, franchising, owning, and leasing hotels and resorts. It operates through two segments, Management and Franchise, and Ownership. The company engages in the hotel management and licensing of its brands. It operates luxury hotels under the Waldorf Astoria Hotels & Resorts, LXR Hotels & Resorts, and Conrad Hotels & Resorts brand; lifestyle hotels under the Canopy by Hilton, Curio Collection by Hilton, Tapestry Collection by Hilton, Tempo by Hilton, and Motto by Hilton brand; full service hotels under the Signia by Hilton, Hilton Hotels & Resorts, and DoubleTree by Hilton brand; service hotels under the Hilton Garden Inn, Hampton by Hilton, and Tru by Hilton brand; all-suite hotels under the Embassy Suites by Hilton, Homewood Suites by Hilton, and Home2 Suites by Hilton brand; and economy hotel under the Spark by Hilton brand, as well as Hilton Grand Vacations.

Recommended Stories

Before you consider Hilton Worldwide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hilton Worldwide wasn't on the list.

While Hilton Worldwide currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.