Public Sector Pension Investment Board boosted its stake in shares of ICU Medical, Inc. (NASDAQ:ICUI - Free Report) by 27.3% during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 77,627 shares of the medical instruments supplier's stock after buying an additional 16,627 shares during the quarter. Public Sector Pension Investment Board owned 0.32% of ICU Medical worth $10,779,000 as of its most recent filing with the Securities and Exchange Commission.

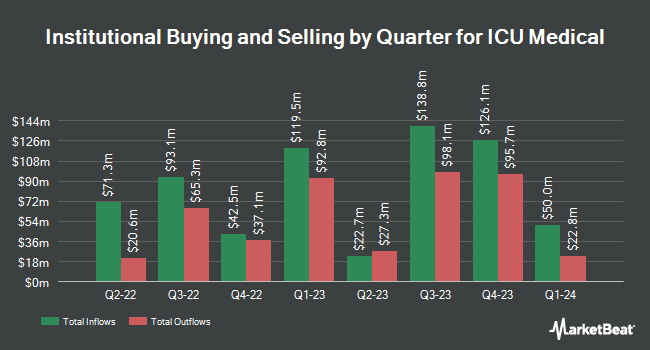

A number of other hedge funds also recently added to or reduced their stakes in the stock. GAMMA Investing LLC lifted its position in shares of ICU Medical by 17,559.7% in the first quarter. GAMMA Investing LLC now owns 99,424 shares of the medical instruments supplier's stock valued at $138,060,000 after acquiring an additional 98,861 shares in the last quarter. Point72 Asset Management L.P. boosted its position in ICU Medical by 63.2% during the fourth quarter. Point72 Asset Management L.P. now owns 245,340 shares of the medical instruments supplier's stock worth $38,069,000 after acquiring an additional 95,030 shares during the last quarter. Pacific Capital Partners Ltd purchased a new stake in ICU Medical in the 1st quarter worth approximately $12,845,000. Invesco Ltd. raised its holdings in ICU Medical by 80.1% in the 1st quarter. Invesco Ltd. now owns 203,827 shares of the medical instruments supplier's stock valued at $28,303,000 after acquiring an additional 90,674 shares during the last quarter. Finally, Dimensional Fund Advisors LP lifted its stake in shares of ICU Medical by 18.2% during the 4th quarter. Dimensional Fund Advisors LP now owns 539,981 shares of the medical instruments supplier's stock worth $83,788,000 after purchasing an additional 82,982 shares during the period. 96.10% of the stock is owned by hedge funds and other institutional investors.

ICU Medical Trading Up 2.0%

ICUI stock traded up $2.47 during midday trading on Monday, reaching $123.42. 158,521 shares of the company's stock traded hands, compared to its average volume of 265,758. The company has a debt-to-equity ratio of 0.63, a current ratio of 2.44 and a quick ratio of 1.17. ICU Medical, Inc. has a fifty-two week low of $107.00 and a fifty-two week high of $196.26. The business has a 50-day moving average price of $128.20 and a two-hundred day moving average price of $138.02. The company has a market capitalization of $3.05 billion, a P/E ratio of -81.30 and a beta of 0.88.

ICU Medical (NASDAQ:ICUI - Get Free Report) last announced its quarterly earnings results on Thursday, August 7th. The medical instruments supplier reported $2.10 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.44 by $0.66. The firm had revenue of $543.57 million during the quarter, compared to the consensus estimate of $543.33 million. ICU Medical had a positive return on equity of 7.24% and a negative net margin of 1.56%. The firm's quarterly revenue was down 8.0% compared to the same quarter last year. During the same period in the prior year, the firm earned $1.56 EPS. Equities research analysts forecast that ICU Medical, Inc. will post 4.11 EPS for the current fiscal year.

Analysts Set New Price Targets

A number of analysts have issued reports on the company. Piper Sandler initiated coverage on ICU Medical in a research note on Friday. They issued an "overweight" rating and a $145.00 price target on the stock. Raymond James Financial lowered their target price on shares of ICU Medical from $187.00 to $180.00 and set a "strong-buy" rating for the company in a report on Friday, August 8th. KeyCorp dropped their price target on shares of ICU Medical from $209.00 to $191.00 and set an "overweight" rating for the company in a research report on Monday, April 21st. Finally, Wall Street Zen lowered shares of ICU Medical from a "buy" rating to a "hold" rating in a report on Saturday, August 9th. Two research analysts have rated the stock with a hold rating, three have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $179.00.

Get Our Latest Research Report on ICU Medical

Insider Activity

In other ICU Medical news, COO Christian B. Voigtlander sold 4,985 shares of the company's stock in a transaction that occurred on Wednesday, May 28th. The stock was sold at an average price of $128.50, for a total value of $640,572.50. Following the completion of the transaction, the chief operating officer owned 6,088 shares in the company, valued at $782,308. This represents a 45.02% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CEO Vivek Jain acquired 21,929 shares of the company's stock in a transaction dated Thursday, August 14th. The shares were purchased at an average price of $112.84 per share, for a total transaction of $2,474,468.36. Following the purchase, the chief executive officer directly owned 130,149 shares of the company's stock, valued at approximately $14,686,013.16. This trade represents a 20.26% increase in their ownership of the stock. The disclosure for this purchase can be found here. Over the last quarter, insiders have sold 14,889 shares of company stock worth $1,933,186. Company insiders own 1.50% of the company's stock.

About ICU Medical

(

Free Report)

ICU Medical, Inc, together with its subsidiaries, develops, manufactures, and sells medical devices used in infusion therapy, vascular access, and vital care applications worldwide. Its infusion therapy products include needlefree products under the MicroClave, MicroClave Clear, and NanoClave brands; Neutron catheter patency devices; ChemoClave and ChemoLock closed system transfer devices, which are used to limit the escape of hazardous drugs or vapor concentrations, block the transfer of environmental contaminants into the system, and eliminates the risk of needlestick injury; Tego needle free connectors; Deltec GRIPPER non-coring needles for portal access; and ClearGuard, SwabCap, and SwabTip disinfection caps.

Further Reading

Before you consider ICU Medical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ICU Medical wasn't on the list.

While ICU Medical currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report