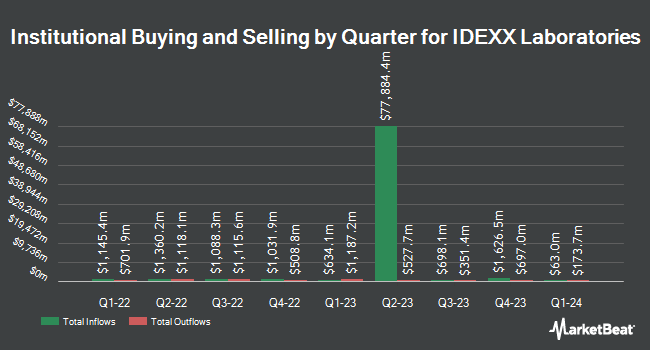

1832 Asset Management L.P. decreased its position in IDEXX Laboratories, Inc. (NASDAQ:IDXX - Free Report) by 94.3% in the first quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 5,059 shares of the company's stock after selling 83,823 shares during the period. 1832 Asset Management L.P.'s holdings in IDEXX Laboratories were worth $2,125,000 at the end of the most recent quarter.

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. MorganRosel Wealth Management LLC purchased a new position in IDEXX Laboratories in the first quarter valued at $26,000. Migdal Insurance & Financial Holdings Ltd. increased its holdings in IDEXX Laboratories by 55.6% in the first quarter. Migdal Insurance & Financial Holdings Ltd. now owns 84 shares of the company's stock valued at $35,000 after buying an additional 30 shares in the last quarter. Colonial Trust Co SC increased its holdings in IDEXX Laboratories by 84.8% in the fourth quarter. Colonial Trust Co SC now owns 85 shares of the company's stock valued at $35,000 after buying an additional 39 shares in the last quarter. Bank of Jackson Hole Trust increased its holdings in IDEXX Laboratories by 328.6% in the first quarter. Bank of Jackson Hole Trust now owns 90 shares of the company's stock valued at $39,000 after buying an additional 69 shares in the last quarter. Finally, Itau Unibanco Holding S.A. increased its holdings in IDEXX Laboratories by 540.0% in the fourth quarter. Itau Unibanco Holding S.A. now owns 96 shares of the company's stock valued at $40,000 after buying an additional 81 shares in the last quarter. Hedge funds and other institutional investors own 87.84% of the company's stock.

IDEXX Laboratories Stock Down 0.7%

Shares of NASDAQ IDXX opened at $641.35 on Tuesday. The company's 50-day simple moving average is $572.19 and its 200-day simple moving average is $495.65. The company has a quick ratio of 0.79, a current ratio of 1.11 and a debt-to-equity ratio of 0.31. The firm has a market cap of $51.31 billion, a price-to-earnings ratio of 53.40, a price-to-earnings-growth ratio of 4.18 and a beta of 1.49. IDEXX Laboratories, Inc. has a 52-week low of $356.14 and a 52-week high of $688.12.

IDEXX Laboratories (NASDAQ:IDXX - Get Free Report) last posted its quarterly earnings results on Monday, August 4th. The company reported $3.63 earnings per share for the quarter, topping the consensus estimate of $3.28 by $0.35. The firm had revenue of $1.11 billion for the quarter, compared to the consensus estimate of $1.06 billion. IDEXX Laboratories had a net margin of 24.41% and a return on equity of 64.42%. The company's revenue for the quarter was up 10.6% on a year-over-year basis. During the same period last year, the firm posted $2.44 earnings per share. IDEXX Laboratories has set its FY 2025 guidance at 12.400-12.760 EPS. Equities analysts predict that IDEXX Laboratories, Inc. will post 11.93 EPS for the current fiscal year.

Analysts Set New Price Targets

IDXX has been the subject of a number of recent analyst reports. Wall Street Zen raised shares of IDEXX Laboratories from a "hold" rating to a "buy" rating in a report on Saturday, July 12th. Leerink Partners lifted their target price on shares of IDEXX Laboratories from $580.00 to $600.00 and gave the company an "outperform" rating in a research report on Thursday, July 17th. Jefferies Financial Group initiated coverage on shares of IDEXX Laboratories in a research report on Tuesday, July 1st. They issued a "buy" rating and a $625.00 target price on the stock. Piper Sandler reiterated a "neutral" rating and issued a $700.00 target price (up previously from $510.00) on shares of IDEXX Laboratories in a research report on Monday, August 11th. Finally, BTIG Research lifted their target price on shares of IDEXX Laboratories from $545.00 to $785.00 and gave the company a "buy" rating in a research report on Tuesday, August 5th. One equities research analyst has rated the stock with a Strong Buy rating, six have issued a Buy rating and three have given a Hold rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $649.44.

Read Our Latest Stock Report on IDXX

Insider Transactions at IDEXX Laboratories

In other news, EVP Nimrata Hunt sold 7,143 shares of the firm's stock in a transaction dated Wednesday, August 6th. The shares were sold at an average price of $630.43, for a total value of $4,503,161.49. Following the transaction, the executive vice president directly owned 18,007 shares of the company's stock, valued at approximately $11,352,153.01. This trade represents a 28.40% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this link. Also, EVP Michael Lane sold 8,411 shares of the firm's stock in a transaction dated Wednesday, August 6th. The stock was sold at an average price of $627.74, for a total transaction of $5,279,921.14. Following the completion of the transaction, the executive vice president directly owned 7,132 shares in the company, valued at approximately $4,477,041.68. This represents a 54.11% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders sold 51,870 shares of company stock valued at $32,877,757. Company insiders own 0.98% of the company's stock.

IDEXX Laboratories Profile

(

Free Report)

IDEXX Laboratories, Inc develops, manufactures, and distributes products primarily for the companion animal veterinary, livestock and poultry, dairy, and water testing markets in Africa, the Asia Pacific, Canada, Europe, Latin America, and internationally. The company operates through three segments: Companion Animal Group; Water Quality Products; and Livestock, Poultry and Dairy.

Featured Articles

Want to see what other hedge funds are holding IDXX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for IDEXX Laboratories, Inc. (NASDAQ:IDXX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider IDEXX Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IDEXX Laboratories wasn't on the list.

While IDEXX Laboratories currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.