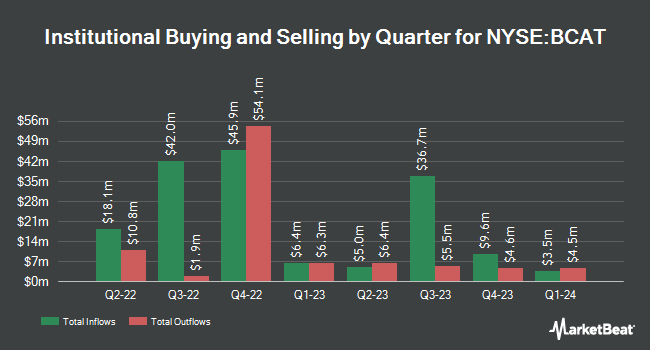

Ieq Capital LLC bought a new stake in BlackRock Capital Allocation Term Trust (NYSE:BCAT - Free Report) in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor bought 45,308 shares of the company's stock, valued at approximately $652,000.

Other hedge funds and other institutional investors have also modified their holdings of the company. Bank of America Corp DE boosted its holdings in BlackRock Capital Allocation Term Trust by 9.0% during the fourth quarter. Bank of America Corp DE now owns 1,183,518 shares of the company's stock valued at $17,930,000 after purchasing an additional 98,210 shares in the last quarter. Penserra Capital Management LLC raised its position in BlackRock Capital Allocation Term Trust by 9.7% in the 1st quarter. Penserra Capital Management LLC now owns 1,136,511 shares of the company's stock worth $16,365,000 after purchasing an additional 100,038 shares during the last quarter. Raymond James Financial Inc. raised its position in BlackRock Capital Allocation Term Trust by 35.4% in the 1st quarter. Raymond James Financial Inc. now owns 282,503 shares of the company's stock worth $4,068,000 after purchasing an additional 73,872 shares during the last quarter. LPL Financial LLC grew its holdings in BlackRock Capital Allocation Term Trust by 58.5% during the 1st quarter. LPL Financial LLC now owns 189,656 shares of the company's stock worth $2,731,000 after acquiring an additional 70,021 shares during the period. Finally, Cambridge Investment Research Advisors Inc. grew its holdings in BlackRock Capital Allocation Term Trust by 6.9% during the 1st quarter. Cambridge Investment Research Advisors Inc. now owns 164,392 shares of the company's stock worth $2,367,000 after acquiring an additional 10,594 shares during the period. 36.12% of the stock is currently owned by hedge funds and other institutional investors.

BlackRock Capital Allocation Term Trust Price Performance

Shares of BCAT stock traded down $0.05 on Tuesday, hitting $15.18. The stock had a trading volume of 119,965 shares, compared to its average volume of 528,407. BlackRock Capital Allocation Term Trust has a twelve month low of $12.91 and a twelve month high of $16.80. The company has a fifty day moving average price of $14.98 and a two-hundred day moving average price of $14.78.

BlackRock Capital Allocation Term Trust Cuts Dividend

The business also recently announced a monthly dividend, which will be paid on Tuesday, September 30th. Investors of record on Monday, September 15th will be paid a $0.2699 dividend. The ex-dividend date of this dividend is Monday, September 15th. This represents a c) dividend on an annualized basis and a yield of 21.3%.

BlackRock Capital Allocation Term Trust Profile

(

Free Report)

-

Featured Articles

Before you consider BlackRock Capital Allocation Term Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BlackRock Capital Allocation Term Trust wasn't on the list.

While BlackRock Capital Allocation Term Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.