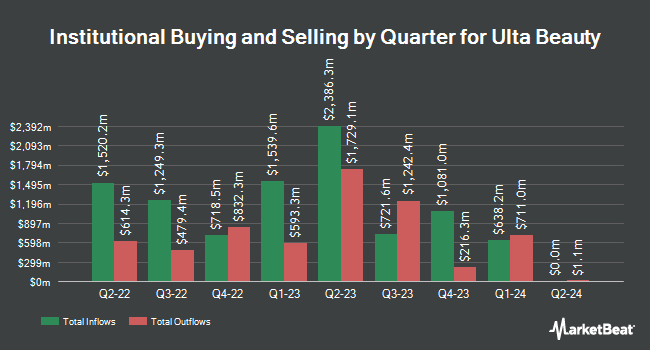

Ieq Capital LLC grew its position in shares of Ulta Beauty Inc. (NASDAQ:ULTA - Free Report) by 145.6% during the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 15,634 shares of the specialty retailer's stock after acquiring an additional 9,268 shares during the quarter. Ieq Capital LLC's holdings in Ulta Beauty were worth $5,730,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other hedge funds have also recently bought and sold shares of the company. Price T Rowe Associates Inc. MD boosted its holdings in Ulta Beauty by 128.2% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 1,225,023 shares of the specialty retailer's stock worth $449,021,000 after acquiring an additional 688,267 shares during the last quarter. T. Rowe Price Investment Management Inc. boosted its holdings in Ulta Beauty by 64.8% during the 1st quarter. T. Rowe Price Investment Management Inc. now owns 931,557 shares of the specialty retailer's stock worth $341,453,000 after acquiring an additional 366,147 shares during the last quarter. JPMorgan Chase & Co. boosted its holdings in Ulta Beauty by 81.7% during the 1st quarter. JPMorgan Chase & Co. now owns 913,600 shares of the specialty retailer's stock worth $334,871,000 after acquiring an additional 410,900 shares during the last quarter. Invesco Ltd. boosted its holdings in Ulta Beauty by 10.9% during the 1st quarter. Invesco Ltd. now owns 813,639 shares of the specialty retailer's stock worth $298,231,000 after acquiring an additional 79,666 shares during the last quarter. Finally, Deutsche Bank AG boosted its holdings in Ulta Beauty by 1.4% during the 4th quarter. Deutsche Bank AG now owns 655,561 shares of the specialty retailer's stock worth $285,123,000 after acquiring an additional 9,291 shares during the last quarter. 90.39% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

ULTA has been the topic of a number of recent analyst reports. Loop Capital reiterated a "hold" rating and set a $510.00 target price on shares of Ulta Beauty in a research note on Friday, July 25th. Robert W. Baird lifted their target price on Ulta Beauty from $575.00 to $600.00 and gave the stock an "outperform" rating in a research note on Friday, August 29th. UBS Group lifted their target price on Ulta Beauty from $640.00 to $680.00 and gave the stock a "buy" rating in a research note on Friday. Bank of America lifted their target price on Ulta Beauty from $500.00 to $575.00 and gave the stock a "neutral" rating in a research note on Friday, August 29th. Finally, Morgan Stanley lifted their target price on Ulta Beauty from $550.00 to $600.00 and gave the stock an "overweight" rating in a research note on Friday, August 29th. Thirteen research analysts have rated the stock with a Buy rating, thirteen have given a Hold rating and one has given a Sell rating to the stock. According to MarketBeat, the company has an average rating of "Hold" and a consensus target price of $536.75.

View Our Latest Research Report on Ulta Beauty

Ulta Beauty Stock Up 0.5%

Ulta Beauty stock traded up $2.89 during midday trading on Wednesday, reaching $535.41. The stock had a trading volume of 401,758 shares, compared to its average volume of 890,299. Ulta Beauty Inc. has a 12 month low of $309.01 and a 12 month high of $539.00. The firm's 50-day moving average price is $500.78 and its 200 day moving average price is $429.22. The firm has a market capitalization of $24.01 billion, a PE ratio of 20.54, a P/E/G ratio of 2.88 and a beta of 1.06.

Ulta Beauty (NASDAQ:ULTA - Get Free Report) last announced its quarterly earnings data on Thursday, August 28th. The specialty retailer reported $5.78 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $5.03 by $0.75. Ulta Beauty had a return on equity of 48.78% and a net margin of 10.31%.The business had revenue of $2.79 billion for the quarter, compared to analysts' expectations of $2.66 billion. During the same period in the previous year, the business posted $5.30 EPS. The firm's quarterly revenue was up 9.3% compared to the same quarter last year. Equities research analysts expect that Ulta Beauty Inc. will post 23.96 EPS for the current year.

Ulta Beauty Profile

(

Free Report)

Ulta Beauty, Inc operates as a specialty beauty retailer in the United States. The company offers branded and private label beauty products, including cosmetics, fragrance, haircare, skincare, bath and body products, professional hair products, and salon styling tools through its Ulta Beauty stores, shop-in-shops, Ulta.com website, and its mobile applications.

See Also

Before you consider Ulta Beauty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ulta Beauty wasn't on the list.

While Ulta Beauty currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.