Ieq Capital LLC acquired a new position in shares of Knight-Swift Transportation Holdings Inc. (NYSE:KNX - Free Report) in the first quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund acquired 116,132 shares of the transportation company's stock, valued at approximately $5,051,000. Ieq Capital LLC owned 0.07% of Knight-Swift Transportation as of its most recent SEC filing.

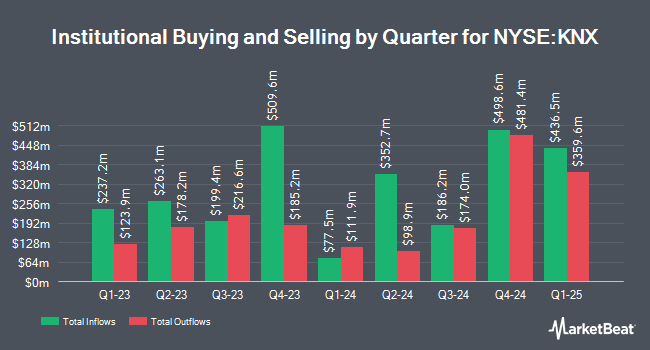

A number of other institutional investors also recently made changes to their positions in the company. Vanguard Group Inc. raised its position in shares of Knight-Swift Transportation by 3.6% in the first quarter. Vanguard Group Inc. now owns 14,935,845 shares of the transportation company's stock valued at $649,560,000 after buying an additional 515,212 shares in the last quarter. Victory Capital Management Inc. raised its position in shares of Knight-Swift Transportation by 4.6% in the first quarter. Victory Capital Management Inc. now owns 8,344,372 shares of the transportation company's stock valued at $362,897,000 after buying an additional 364,263 shares in the last quarter. Dimensional Fund Advisors LP raised its position in shares of Knight-Swift Transportation by 9.1% in the first quarter. Dimensional Fund Advisors LP now owns 7,629,706 shares of the transportation company's stock valued at $331,813,000 after buying an additional 638,352 shares in the last quarter. DZ BANK AG Deutsche Zentral Genossenschafts Bank Frankfurt am Main raised its position in shares of Knight-Swift Transportation by 1.8% in the fourth quarter. DZ BANK AG Deutsche Zentral Genossenschafts Bank Frankfurt am Main now owns 3,556,405 shares of the transportation company's stock valued at $188,632,000 after buying an additional 63,241 shares in the last quarter. Finally, Interval Partners LP raised its position in shares of Knight-Swift Transportation by 320.7% in the fourth quarter. Interval Partners LP now owns 1,754,822 shares of the transportation company's stock valued at $93,076,000 after buying an additional 1,337,727 shares in the last quarter. Institutional investors own 88.77% of the company's stock.

Analyst Ratings Changes

Several equities research analysts have weighed in on the company. Baird R W upgraded Knight-Swift Transportation to a "strong-buy" rating in a research note on Tuesday, July 1st. Susquehanna upped their price target on shares of Knight-Swift Transportation from $45.00 to $52.00 and gave the stock a "positive" rating in a report on Tuesday, June 24th. Citigroup upped their price target on shares of Knight-Swift Transportation from $53.00 to $54.00 and gave the stock a "buy" rating in a report on Wednesday, July 9th. JPMorgan Chase & Co. upped their price target on shares of Knight-Swift Transportation from $45.00 to $52.00 and gave the stock a "neutral" rating in a report on Thursday, July 24th. Finally, Wells Fargo & Company upped their price target on shares of Knight-Swift Transportation from $46.00 to $50.00 and gave the stock an "overweight" rating in a report on Wednesday, May 28th. Two analysts have rated the stock with a Strong Buy rating, eleven have given a Buy rating and four have issued a Hold rating to the company's stock. According to MarketBeat.com, Knight-Swift Transportation presently has a consensus rating of "Moderate Buy" and a consensus price target of $53.88.

Read Our Latest Stock Report on KNX

Knight-Swift Transportation Trading Up 1.2%

Shares of Knight-Swift Transportation stock traded up $0.53 during trading on Thursday, hitting $44.12. The company's stock had a trading volume of 2,212,106 shares, compared to its average volume of 2,236,818. The company has a debt-to-equity ratio of 0.30, a current ratio of 0.89 and a quick ratio of 0.89. Knight-Swift Transportation Holdings Inc. has a 52 week low of $36.69 and a 52 week high of $61.51. The stock has a market cap of $7.16 billion, a price-to-earnings ratio of 43.25, a price-to-earnings-growth ratio of 0.65 and a beta of 1.19. The stock has a 50-day moving average price of $44.29 and a two-hundred day moving average price of $44.13.

Knight-Swift Transportation (NYSE:KNX - Get Free Report) last issued its quarterly earnings data on Wednesday, July 23rd. The transportation company reported $0.35 earnings per share for the quarter, topping the consensus estimate of $0.34 by $0.01. Knight-Swift Transportation had a net margin of 2.22% and a return on equity of 3.03%. The company had revenue of $1.86 billion for the quarter, compared to analysts' expectations of $1.87 billion. During the same quarter in the previous year, the firm posted $0.24 earnings per share. Knight-Swift Transportation's revenue for the quarter was up .8% on a year-over-year basis. Knight-Swift Transportation has set its Q3 2025 guidance at 0.360-0.420 EPS. Equities research analysts anticipate that Knight-Swift Transportation Holdings Inc. will post 2.13 EPS for the current fiscal year.

Knight-Swift Transportation Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Monday, September 22nd. Shareholders of record on Friday, September 5th will be given a dividend of $0.18 per share. The ex-dividend date of this dividend is Friday, September 5th. This represents a $0.72 dividend on an annualized basis and a yield of 1.6%. Knight-Swift Transportation's dividend payout ratio is 70.59%.

About Knight-Swift Transportation

(

Free Report)

Knight-Swift Transportation Holdings Inc, together with its subsidiaries, provides freight transportation services in the United States and Mexico. The company operates through four segments: Truckload, Less-than-truckload (LTL), Logistics, and Intermodal. The Truckload segment provides transportation services, which include irregular route and dedicated, refrigerated, expedited, flatbed, and cross-border operations.

Further Reading

Before you consider Knight-Swift Transportation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Knight-Swift Transportation wasn't on the list.

While Knight-Swift Transportation currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.