Immersion Corp acquired a new position in shares of Nano Dimension Ltd. (NASDAQ:NNDM - Free Report) in the 1st quarter, according to its most recent 13F filing with the SEC. The fund acquired 1,358,052 shares of the technology company's stock, valued at approximately $2,159,000. Nano Dimension comprises about 1.3% of Immersion Corp's investment portfolio, making the stock its 7th largest holding. Immersion Corp owned 0.64% of Nano Dimension as of its most recent SEC filing.

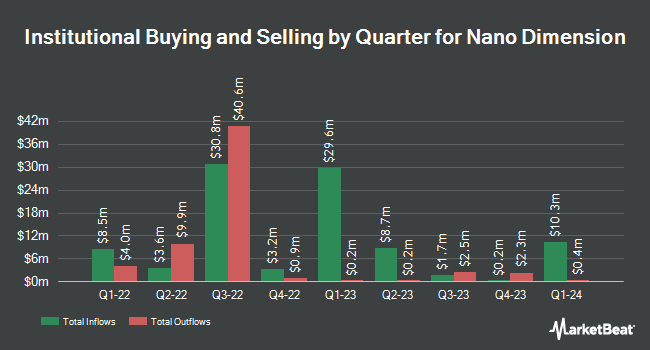

Other institutional investors and hedge funds also recently modified their holdings of the company. Anson Funds Management LP raised its stake in shares of Nano Dimension by 3.1% in the 4th quarter. Anson Funds Management LP now owns 19,662,867 shares of the technology company's stock worth $48,764,000 after buying an additional 598,957 shares in the last quarter. Ameriprise Financial Inc. boosted its position in shares of Nano Dimension by 0.7% during the fourth quarter. Ameriprise Financial Inc. now owns 2,560,820 shares of the technology company's stock worth $6,351,000 after purchasing an additional 17,700 shares in the last quarter. Alpine Global Management LLC acquired a new stake in shares of Nano Dimension during the fourth quarter worth $2,128,000. Y Intercept Hong Kong Ltd acquired a new stake in Nano Dimension during the 1st quarter valued at $842,000. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC grew its holdings in Nano Dimension by 21.6% in the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 465,856 shares of the technology company's stock valued at $1,155,000 after buying an additional 82,667 shares in the last quarter. Institutional investors and hedge funds own 33.89% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen upgraded Nano Dimension from a "sell" rating to a "hold" rating in a research note on Saturday, June 21st.

Read Our Latest Analysis on Nano Dimension

Nano Dimension Stock Performance

NASDAQ:NNDM traded down $0.01 during trading hours on Friday, reaching $1.36. The stock had a trading volume of 1,615,348 shares, compared to its average volume of 1,995,850. The company has a 50 day moving average price of $1.46 and a two-hundred day moving average price of $1.62. Nano Dimension Ltd. has a 52 week low of $1.31 and a 52 week high of $2.74. The stock has a market capitalization of $294.41 million, a PE ratio of -3.39 and a beta of 1.29.

Nano Dimension (NASDAQ:NNDM - Get Free Report) last posted its quarterly earnings results on Thursday, June 12th. The technology company reported ($0.11) EPS for the quarter. Nano Dimension had a negative net margin of 144.35% and a negative return on equity of 9.90%. The business had revenue of $14.40 million during the quarter.

Nano Dimension Profile

(

Free Report)

Nano Dimension Ltd., together with its subsidiaries, engages in additive manufacturing solutions in Israel and internationally. The company offers 3D printers, comprising AME systems, which are inkjet printers, that produces Hi-PEDs by depositing proprietary conductive and dielectric substances, as well as integrates in-situ capacitors, antennas, coils, transformers, and electromechanical components; micro additive manufacturing systems, a digital light processing printers (DLP) that achieves production-grade polymer and composite parts; and industrial additive manufacturing systems, that utilizes a patented foil system that fabricates ceramic and metal parts.

See Also

Before you consider Nano Dimension, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nano Dimension wasn't on the list.

While Nano Dimension currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.