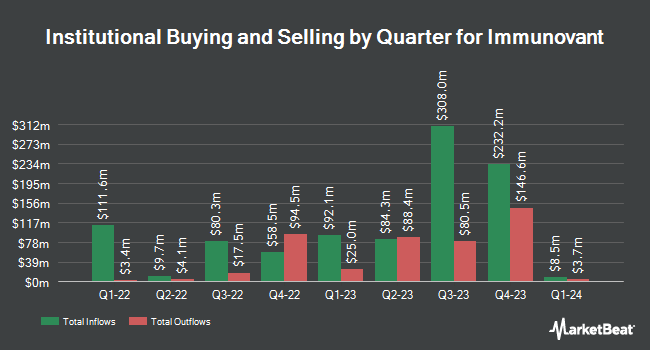

Granahan Investment Management LLC lifted its stake in Immunovant, Inc. (NASDAQ:IMVT - Free Report) by 15.3% during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 172,316 shares of the company's stock after buying an additional 22,920 shares during the period. Granahan Investment Management LLC owned approximately 0.10% of Immunovant worth $2,945,000 as of its most recent SEC filing.

Other large investors also recently modified their holdings of the company. FNY Investment Advisers LLC bought a new stake in Immunovant during the 1st quarter valued at approximately $34,000. BI Asset Management Fondsmaeglerselskab A S bought a new stake in Immunovant during the 1st quarter valued at approximately $37,000. Headlands Technologies LLC bought a new stake in Immunovant during the 1st quarter valued at approximately $51,000. GF Fund Management CO. LTD. bought a new stake in Immunovant during the 4th quarter valued at approximately $76,000. Finally, Covestor Ltd boosted its position in Immunovant by 187.5% during the 1st quarter. Covestor Ltd now owns 3,764 shares of the company's stock valued at $64,000 after acquiring an additional 2,455 shares in the last quarter. 47.08% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

Several analysts have weighed in on the company. Citigroup reaffirmed a "buy" rating on shares of Immunovant in a research report on Monday, August 11th. UBS Group lifted their price objective on Immunovant from $17.00 to $18.00 and gave the company a "neutral" rating in a research report on Monday, July 28th. The Goldman Sachs Group raised Immunovant to a "hold" rating and set a $18.00 price objective on the stock in a research report on Thursday, July 10th. JPMorgan Chase & Co. dropped their price target on Immunovant from $40.00 to $37.00 and set an "overweight" rating on the stock in a research report on Tuesday, August 12th. Finally, Bank of America dropped their price target on Immunovant from $33.00 to $30.00 and set a "buy" rating on the stock in a research report on Tuesday, August 12th. One equities research analyst has rated the stock with a Strong Buy rating, eight have issued a Buy rating and three have issued a Hold rating to the company. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average price target of $33.60.

Check Out Our Latest Stock Analysis on Immunovant

Immunovant Price Performance

NASDAQ IMVT traded up $0.56 during mid-day trading on Thursday, reaching $16.76. The stock had a trading volume of 390,445 shares, compared to its average volume of 1,468,196. Immunovant, Inc. has a 1 year low of $12.72 and a 1 year high of $32.10. The stock has a market cap of $2.92 billion, a PE ratio of -5.87 and a beta of 0.45. The company has a fifty day moving average price of $16.31 and a 200 day moving average price of $16.28.

Immunovant (NASDAQ:IMVT - Get Free Report) last announced its quarterly earnings data on Monday, August 11th. The company reported ($0.60) earnings per share for the quarter, topping analysts' consensus estimates of ($0.69) by $0.09. During the same quarter in the previous year, the business earned ($0.60) earnings per share. As a group, equities research analysts expect that Immunovant, Inc. will post -2.69 earnings per share for the current year.

Insider Buying and Selling

In related news, CTO Jay S. Stout sold 2,805 shares of the business's stock in a transaction that occurred on Wednesday, July 23rd. The shares were sold at an average price of $18.15, for a total value of $50,910.75. Following the completion of the transaction, the chief technology officer directly owned 204,919 shares in the company, valued at $3,719,279.85. The trade was a 1.35% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Michael Geffner sold 2,385 shares of the business's stock in a transaction that occurred on Wednesday, July 23rd. The stock was sold at an average price of $18.15, for a total transaction of $43,287.75. Following the completion of the transaction, the insider owned 221,825 shares of the company's stock, valued at approximately $4,026,123.75. The trade was a 1.06% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 7,869 shares of company stock valued at $140,384. 1.80% of the stock is owned by company insiders.

Immunovant Profile

(

Free Report)

Immunovant, Inc, a clinical-stage biopharmaceutical company, develops monoclonal antibodies for the treatment of autoimmune diseases. It develops batoclimab, a novel fully human monoclonal antibody that target the neonatal fragment crystallizable receptor for the treatment of myasthenia gravis, thyroid eye disease, chronic inflammatory demyelinating polyneuropathy, and Graves diseases, as well as warm autoimmune hemolytic anemia.

See Also

Before you consider Immunovant, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Immunovant wasn't on the list.

While Immunovant currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.