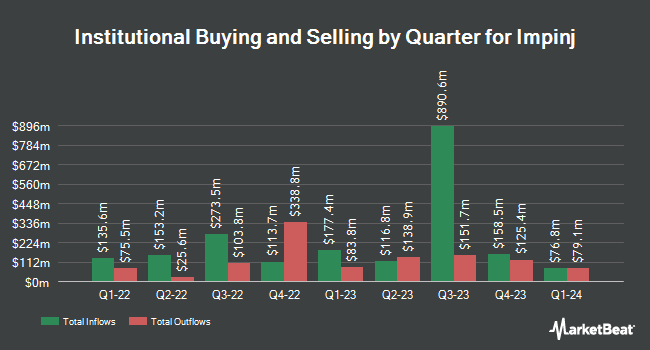

Shufro Rose & Co. LLC increased its holdings in Impinj, Inc. (NASDAQ:PI - Free Report) by 235.3% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 5,700 shares of the company's stock after acquiring an additional 4,000 shares during the quarter. Shufro Rose & Co. LLC's holdings in Impinj were worth $517,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other institutional investors have also recently modified their holdings of the company. Bayforest Capital Ltd purchased a new stake in Impinj during the first quarter valued at approximately $118,000. XTX Topco Ltd purchased a new stake in shares of Impinj during the 1st quarter worth approximately $1,033,000. LPL Financial LLC raised its position in shares of Impinj by 29.3% during the 1st quarter. LPL Financial LLC now owns 15,200 shares of the company's stock valued at $1,379,000 after buying an additional 3,442 shares in the last quarter. Zurcher Kantonalbank Zurich Cantonalbank increased its position in shares of Impinj by 10.4% during the 1st quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 6,989 shares of the company's stock valued at $634,000 after purchasing an additional 660 shares during the last quarter. Finally, Cetera Investment Advisers lifted its stake in Impinj by 254.3% in the first quarter. Cetera Investment Advisers now owns 5,761 shares of the company's stock worth $523,000 after purchasing an additional 4,135 shares during the last quarter.

Impinj Price Performance

Shares of PI stock traded down $2.99 during mid-day trading on Wednesday, reaching $159.97. The stock had a trading volume of 559,820 shares, compared to its average volume of 649,766. The business has a 50-day simple moving average of $117.49 and a 200 day simple moving average of $105.34. The company has a market cap of $4.65 billion, a P/E ratio of 16,013.01 and a beta of 1.74. Impinj, Inc. has a 12-month low of $60.85 and a 12-month high of $239.88. The company has a current ratio of 11.64, a quick ratio of 8.44 and a debt-to-equity ratio of 1.51.

Impinj (NASDAQ:PI - Get Free Report) last posted its quarterly earnings results on Wednesday, July 30th. The company reported $0.80 earnings per share for the quarter, topping analysts' consensus estimates of $0.72 by $0.08. Impinj had a net margin of 0.18% and a return on equity of 8.14%. The company had revenue of $97.89 million for the quarter, compared to the consensus estimate of $93.78 million. During the same quarter last year, the firm posted $0.83 earnings per share. Impinj's revenue was down 4.5% on a year-over-year basis. On average, sell-side analysts anticipate that Impinj, Inc. will post -0.47 earnings per share for the current year.

Wall Street Analyst Weigh In

A number of analysts have recently commented on the company. Needham & Company LLC boosted their price objective on Impinj from $115.00 to $165.00 and gave the company a "buy" rating in a research report on Thursday, July 31st. Cantor Fitzgerald increased their price objective on shares of Impinj from $133.00 to $158.00 and gave the company an "overweight" rating in a report on Thursday, July 31st. Susquehanna upped their price target on Impinj from $130.00 to $140.00 and gave the company a "positive" rating in a research report on Tuesday, July 22nd. Piper Sandler raised their target price on Impinj from $140.00 to $180.00 and gave the stock an "overweight" rating in a research note on Thursday, July 31st. Finally, Evercore ISI upped their price objective on shares of Impinj from $99.00 to $117.00 and gave the company an "outperform" rating in a report on Thursday, April 24th. One research analyst has rated the stock with a sell rating, one has given a hold rating and six have assigned a buy rating to the stock. Based on data from MarketBeat.com, Impinj presently has an average rating of "Moderate Buy" and an average target price of $163.29.

Get Our Latest Stock Analysis on PI

Impinj Profile

(

Free Report)

Impinj, Inc operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. Its platform wirelessly connects items and delivers data about the connected items to business and consumer applications. The company's platform comprises endpoint ICs, a miniature radios-on-a-chip that attaches to a host item and includes a number to identify the item.

Featured Stories

Before you consider Impinj, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Impinj wasn't on the list.

While Impinj currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.