ING Groep NV acquired a new stake in AutoNation, Inc. (NYSE:AN - Free Report) in the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund acquired 31,699 shares of the company's stock, valued at approximately $5,133,000. ING Groep NV owned approximately 0.08% of AutoNation at the end of the most recent reporting period.

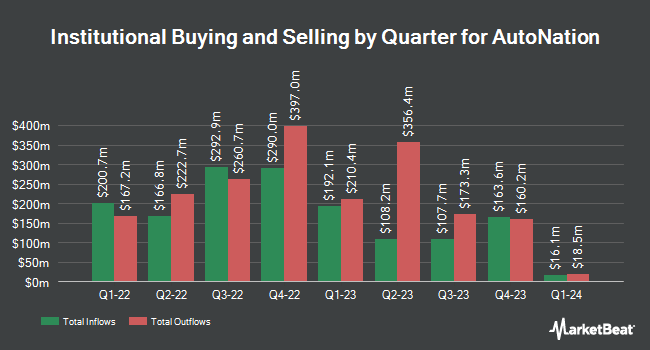

A number of other hedge funds also recently added to or reduced their stakes in the business. NewEdge Advisors LLC grew its position in shares of AutoNation by 25.5% in the 4th quarter. NewEdge Advisors LLC now owns 315 shares of the company's stock worth $54,000 after buying an additional 64 shares during the last quarter. Wealth Enhancement Advisory Services LLC boosted its stake in AutoNation by 104.2% in the first quarter. Wealth Enhancement Advisory Services LLC now owns 5,882 shares of the company's stock valued at $952,000 after acquiring an additional 3,001 shares in the last quarter. Cerity Partners LLC grew its holdings in AutoNation by 95.3% in the first quarter. Cerity Partners LLC now owns 5,247 shares of the company's stock worth $850,000 after purchasing an additional 2,561 shares during the last quarter. Focus Partners Wealth acquired a new position in shares of AutoNation during the fourth quarter worth $503,000. Finally, Bessemer Group Inc. increased its position in shares of AutoNation by 9.7% during the first quarter. Bessemer Group Inc. now owns 987 shares of the company's stock worth $160,000 after purchasing an additional 87 shares in the last quarter. 94.62% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of research firms recently commented on AN. Guggenheim decreased their target price on AutoNation from $212.00 to $183.00 and set a "buy" rating for the company in a report on Tuesday, April 22nd. Bank of America lifted their price objective on shares of AutoNation from $225.00 to $255.00 and gave the company a "buy" rating in a research note on Monday, June 16th. Citigroup upgraded shares of AutoNation to a "strong-buy" rating in a research note on Thursday, April 24th. JPMorgan Chase & Co. boosted their target price on shares of AutoNation from $185.00 to $205.00 and gave the company a "neutral" rating in a research report on Tuesday. Finally, Cfra Research raised AutoNation to a "strong-buy" rating in a research report on Friday, April 25th. Three investment analysts have rated the stock with a hold rating, five have given a buy rating and two have given a strong buy rating to the company's stock. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus price target of $215.13.

Get Our Latest Stock Analysis on AN

AutoNation Stock Down 0.6%

Shares of NYSE AN traded down $1.11 during mid-day trading on Thursday, reaching $194.40. The company had a trading volume of 458,657 shares, compared to its average volume of 588,782. The firm has a 50 day simple moving average of $197.92 and a two-hundred day simple moving average of $184.11. The stock has a market cap of $7.33 billion, a P/E ratio of 12.18, a PEG ratio of 0.98 and a beta of 0.89. AutoNation, Inc. has a 52-week low of $148.33 and a 52-week high of $217.40. The company has a current ratio of 0.81, a quick ratio of 0.21 and a debt-to-equity ratio of 1.84.

AutoNation (NYSE:AN - Get Free Report) last announced its quarterly earnings data on Friday, July 25th. The company reported $5.46 earnings per share (EPS) for the quarter, beating the consensus estimate of $4.70 by $0.76. AutoNation had a net margin of 2.31% and a return on equity of 31.12%. The company had revenue of $6.97 billion for the quarter, compared to analysts' expectations of $6.77 billion. During the same period in the previous year, the company posted $3.99 EPS. AutoNation's revenue was up 7.6% compared to the same quarter last year. Sell-side analysts predict that AutoNation, Inc. will post 18.15 earnings per share for the current year.

AutoNation Profile

(

Free Report)

AutoNation, Inc, through its subsidiaries, operates as an automotive retailer in the United States. The company operates through three segments: Domestic, Import, and Premium Luxury. It offers a range of automotive products and services, including new and used vehicles; and parts and services, such as automotive repair and maintenance, and wholesale parts and collision services.

Featured Stories

Before you consider AutoNation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AutoNation wasn't on the list.

While AutoNation currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.