ING Groep NV lessened its holdings in shares of Thermo Fisher Scientific Inc. (NYSE:TMO - Free Report) by 31.5% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 108,841 shares of the medical research company's stock after selling 50,012 shares during the quarter. ING Groep NV's holdings in Thermo Fisher Scientific were worth $54,159,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

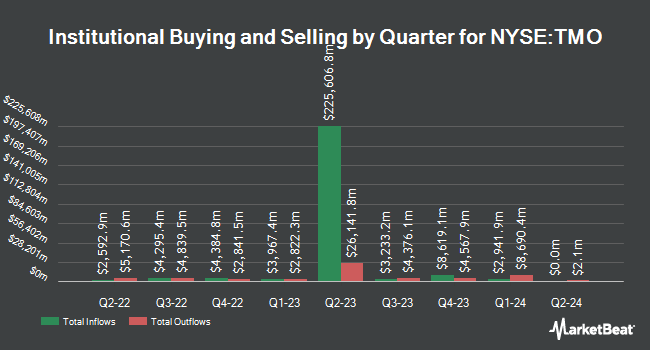

Several other institutional investors and hedge funds have also modified their holdings of the business. Earned Wealth Advisors LLC purchased a new position in shares of Thermo Fisher Scientific during the 1st quarter worth $265,000. Allianz SE boosted its stake in shares of Thermo Fisher Scientific by 5.1% during the 1st quarter. Allianz SE now owns 15,822 shares of the medical research company's stock worth $7,873,000 after acquiring an additional 762 shares during the last quarter. Commonwealth Equity Services LLC boosted its stake in shares of Thermo Fisher Scientific by 3.8% during the 1st quarter. Commonwealth Equity Services LLC now owns 113,948 shares of the medical research company's stock worth $56,701,000 after acquiring an additional 4,199 shares during the last quarter. Raiffeisen Bank International AG boosted its stake in shares of Thermo Fisher Scientific by 0.6% during the 1st quarter. Raiffeisen Bank International AG now owns 98,818 shares of the medical research company's stock worth $49,425,000 after acquiring an additional 598 shares during the last quarter. Finally, Avalon Trust Co boosted its stake in shares of Thermo Fisher Scientific by 1.1% during the 1st quarter. Avalon Trust Co now owns 37,206 shares of the medical research company's stock worth $18,513,000 after acquiring an additional 422 shares during the last quarter. Hedge funds and other institutional investors own 89.23% of the company's stock.

Insider Activity at Thermo Fisher Scientific

In related news, EVP Gianluca Pettiti sold 400 shares of Thermo Fisher Scientific stock in a transaction dated Friday, July 25th. The shares were sold at an average price of $479.98, for a total transaction of $191,992.00. Following the completion of the transaction, the executive vice president directly owned 22,367 shares of the company's stock, valued at approximately $10,735,712.66. The trade was a 1.76% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Corporate insiders own 0.33% of the company's stock.

Thermo Fisher Scientific Price Performance

Shares of Thermo Fisher Scientific stock traded up $0.04 during trading hours on Tuesday, reaching $466.61. The company's stock had a trading volume of 1,978,967 shares, compared to its average volume of 3,341,029. The firm has a 50 day moving average price of $422.36 and a 200-day moving average price of $465.77. Thermo Fisher Scientific Inc. has a one year low of $385.46 and a one year high of $627.88. The company has a debt-to-equity ratio of 0.65, a current ratio of 1.93 and a quick ratio of 1.50. The stock has a market cap of $176.20 billion, a P/E ratio of 26.99, a P/E/G ratio of 2.49 and a beta of 0.74.

Thermo Fisher Scientific (NYSE:TMO - Get Free Report) last posted its earnings results on Wednesday, July 23rd. The medical research company reported $5.36 earnings per share for the quarter, topping analysts' consensus estimates of $5.22 by $0.14. Thermo Fisher Scientific had a net margin of 15.24% and a return on equity of 16.82%. The firm had revenue of $10.86 billion for the quarter, compared to the consensus estimate of $10.68 billion. During the same period in the previous year, the firm posted $5.37 EPS. The business's quarterly revenue was up 2.9% on a year-over-year basis. On average, analysts predict that Thermo Fisher Scientific Inc. will post 23.28 EPS for the current year.

Thermo Fisher Scientific Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, October 15th. Investors of record on Monday, September 15th will be paid a dividend of $0.43 per share. The ex-dividend date of this dividend is Monday, September 15th. This represents a $1.72 dividend on an annualized basis and a dividend yield of 0.4%. Thermo Fisher Scientific's payout ratio is currently 9.95%.

Wall Street Analyst Weigh In

Several analysts have recently commented on TMO shares. Wall Street Zen upgraded shares of Thermo Fisher Scientific from a "hold" rating to a "buy" rating in a research report on Saturday. Raymond James Financial restated an "outperform" rating and set a $535.00 price objective (up from $525.00) on shares of Thermo Fisher Scientific in a research report on Thursday, July 24th. Evercore ISI decreased their price objective on shares of Thermo Fisher Scientific from $500.00 to $480.00 and set an "outperform" rating on the stock in a research report on Tuesday, July 8th. Hsbc Global Res downgraded shares of Thermo Fisher Scientific from a "strong-buy" rating to a "hold" rating in a research report on Thursday, July 24th. Finally, UBS Group raised their price objective on shares of Thermo Fisher Scientific from $460.00 to $500.00 and gave the company a "neutral" rating in a research report on Thursday, July 24th. Six analysts have rated the stock with a hold rating and sixteen have given a buy rating to the stock. According to MarketBeat.com, Thermo Fisher Scientific presently has an average rating of "Moderate Buy" and an average price target of $593.00.

Read Our Latest Analysis on TMO

Thermo Fisher Scientific Profile

(

Free Report)

Thermo Fisher Scientific Inc provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally. The company's Life Sciences Solutions segment offers reagents, instruments, and consumables for biological and medical research, discovery, and production of drugs and vaccines, as well as diagnosis of infections and diseases; and solutions include biosciences, genetic sciences, and bio production to pharmaceutical, biotechnology, agricultural, clinical, healthcare, academic, and government markets.

Featured Stories

Before you consider Thermo Fisher Scientific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Thermo Fisher Scientific wasn't on the list.

While Thermo Fisher Scientific currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.