ING Groep NV trimmed its holdings in Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN - Free Report) by 26.7% during the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 21,331 shares of the biopharmaceutical company's stock after selling 7,754 shares during the period. ING Groep NV's holdings in Regeneron Pharmaceuticals were worth $13,529,000 as of its most recent filing with the Securities and Exchange Commission.

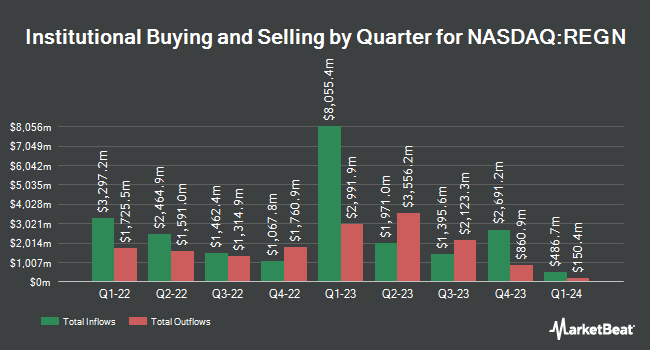

A number of other large investors have also recently added to or reduced their stakes in the business. Brighton Jones LLC boosted its stake in shares of Regeneron Pharmaceuticals by 261.8% during the 4th quarter. Brighton Jones LLC now owns 948 shares of the biopharmaceutical company's stock worth $675,000 after purchasing an additional 686 shares during the last quarter. American Assets Inc. acquired a new stake in shares of Regeneron Pharmaceuticals during the 4th quarter worth about $427,000. Thoroughbred Financial Services LLC boosted its stake in shares of Regeneron Pharmaceuticals by 20.8% during the 4th quarter. Thoroughbred Financial Services LLC now owns 592 shares of the biopharmaceutical company's stock worth $421,000 after purchasing an additional 102 shares during the last quarter. Envestnet Asset Management Inc. boosted its stake in shares of Regeneron Pharmaceuticals by 12.4% during the 4th quarter. Envestnet Asset Management Inc. now owns 91,138 shares of the biopharmaceutical company's stock worth $64,921,000 after purchasing an additional 10,060 shares during the last quarter. Finally, Wedbush Securities Inc. boosted its stake in shares of Regeneron Pharmaceuticals by 6.8% during the 4th quarter. Wedbush Securities Inc. now owns 843 shares of the biopharmaceutical company's stock worth $600,000 after purchasing an additional 54 shares during the last quarter. 83.31% of the stock is owned by institutional investors and hedge funds.

Regeneron Pharmaceuticals Stock Down 2.6%

Shares of NASDAQ:REGN traded down $14.77 during trading on Wednesday, hitting $555.13. 864,754 shares of the company were exchanged, compared to its average volume of 969,242. The stock has a market cap of $59.93 billion, a price-to-earnings ratio of 13.99, a P/E/G ratio of 2.08 and a beta of 0.33. Regeneron Pharmaceuticals, Inc. has a fifty-two week low of $476.49 and a fifty-two week high of $1,211.20. The firm has a fifty day moving average price of $537.05 and a two-hundred day moving average price of $601.77. The company has a current ratio of 4.60, a quick ratio of 4.73 and a debt-to-equity ratio of 0.09.

Regeneron Pharmaceuticals (NASDAQ:REGN - Get Free Report) last posted its earnings results on Friday, August 1st. The biopharmaceutical company reported $12.89 earnings per share for the quarter, topping analysts' consensus estimates of $8.43 by $4.46. The business had revenue of $3,675,600 billion for the quarter, compared to analyst estimates of $3.30 billion. Regeneron Pharmaceuticals had a return on equity of 15.06% and a net margin of 31.37%. The firm's revenue was up 3.6% compared to the same quarter last year. During the same period in the previous year, the firm earned $11.56 EPS. As a group, research analysts anticipate that Regeneron Pharmaceuticals, Inc. will post 35.92 earnings per share for the current fiscal year.

Regeneron Pharmaceuticals Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, September 3rd. Stockholders of record on Monday, August 18th will be given a dividend of $0.88 per share. This represents a $3.52 dividend on an annualized basis and a dividend yield of 0.6%. The ex-dividend date is Monday, August 18th. Regeneron Pharmaceuticals's dividend payout ratio is presently 8.87%.

Wall Street Analyst Weigh In

Several equities research analysts have issued reports on the stock. Wells Fargo & Company cut shares of Regeneron Pharmaceuticals from an "overweight" rating to an "equal weight" rating and set a $580.00 price target on the stock. in a research note on Friday, August 1st. Canaccord Genuity Group reaffirmed a "buy" rating and set a $850.00 price target on shares of Regeneron Pharmaceuticals in a research note on Wednesday, July 23rd. Cantor Fitzgerald assumed coverage on shares of Regeneron Pharmaceuticals in a report on Tuesday, April 22nd. They issued an "overweight" rating and a $695.00 target price for the company. Wall Street Zen lowered shares of Regeneron Pharmaceuticals from a "buy" rating to a "hold" rating in a research report on Thursday, May 1st. Finally, Morgan Stanley lifted their price target on shares of Regeneron Pharmaceuticals from $754.00 to $761.00 and gave the company an "overweight" rating in a report on Friday, August 1st. One analyst has rated the stock with a sell rating, seven have given a hold rating, sixteen have assigned a buy rating and two have given a strong buy rating to the stock. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $841.30.

Get Our Latest Stock Report on REGN

Regeneron Pharmaceuticals Profile

(

Free Report)

Regeneron Pharmaceuticals, Inc discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide. The company's products include EYLEA injection to treat wet age-related macular degeneration and diabetic macular edema; myopic choroidal neovascularization; diabetic retinopathy; neovascular glaucoma; and retinopathy of prematurity.

Read More

Before you consider Regeneron Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regeneron Pharmaceuticals wasn't on the list.

While Regeneron Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.