First Light Asset Management LLC cut its stake in shares of Insmed, Inc. (NASDAQ:INSM - Free Report) by 85.5% in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 68,153 shares of the biopharmaceutical company's stock after selling 402,039 shares during the quarter. First Light Asset Management LLC's holdings in Insmed were worth $5,199,000 at the end of the most recent reporting period.

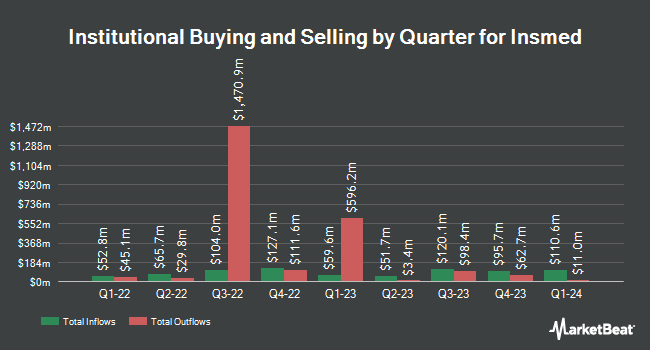

A number of other hedge funds also recently made changes to their positions in INSM. Nuveen LLC purchased a new position in Insmed in the 1st quarter worth approximately $88,351,000. Brown Advisory Inc. purchased a new position in Insmed in the 4th quarter worth approximately $45,773,000. Duquesne Family Office LLC lifted its holdings in Insmed by 2,867.4% in the 4th quarter. Duquesne Family Office LLC now owns 593,470 shares of the biopharmaceutical company's stock worth $40,973,000 after purchasing an additional 573,470 shares in the last quarter. 1832 Asset Management L.P. purchased a new position in Insmed in the 1st quarter worth approximately $37,214,000. Finally, Wellington Management Group LLP lifted its holdings in Insmed by 62.5% in the 1st quarter. Wellington Management Group LLP now owns 1,222,627 shares of the biopharmaceutical company's stock worth $93,274,000 after purchasing an additional 470,401 shares in the last quarter.

Analyst Upgrades and Downgrades

INSM has been the topic of a number of research analyst reports. Royal Bank Of Canada boosted their price target on Insmed from $108.00 to $120.00 and gave the stock an "outperform" rating in a report on Friday, August 8th. Stifel Nicolaus boosted their price target on Insmed from $121.00 to $145.00 and gave the stock a "buy" rating in a report on Thursday, August 14th. Bank of America boosted their price target on Insmed from $94.00 to $109.00 and gave the stock a "buy" rating in a report on Wednesday, June 11th. Jefferies Financial Group upped their price objective on Insmed from $129.00 to $148.00 and gave the stock a "buy" rating in a report on Wednesday, August 13th. Finally, Citigroup raised Insmed to a "buy" rating in a report on Tuesday, June 10th. Sixteen research analysts have rated the stock with a Buy rating and one has issued a Hold rating to the company's stock. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $134.79.

Read Our Latest Research Report on Insmed

Insmed Trading Up 1.8%

NASDAQ:INSM traded up $2.57 during midday trading on Friday, hitting $145.10. 2,532,328 shares of the company traded hands, compared to its average volume of 2,914,153. The firm's fifty day moving average is $114.64 and its 200-day moving average is $89.66. Insmed, Inc. has a 12-month low of $60.40 and a 12-month high of $146.84. The firm has a market capitalization of $30.67 billion, a P/E ratio of -25.41 and a beta of 0.97. The company has a current ratio of 6.68, a quick ratio of 6.33 and a debt-to-equity ratio of 0.45.

Insmed (NASDAQ:INSM - Get Free Report) last released its quarterly earnings results on Thursday, August 7th. The biopharmaceutical company reported ($1.70) earnings per share for the quarter, missing the consensus estimate of ($1.30) by ($0.40). Insmed had a negative net margin of 259.82% and a negative return on equity of 195.37%. The company had revenue of $107.42 million for the quarter, compared to analysts' expectations of $104.06 million. During the same quarter in the previous year, the company posted ($1.94) EPS. The business's quarterly revenue was up 18.9% on a year-over-year basis. Insmed has set its FY 2025 guidance at EPS. On average, sell-side analysts predict that Insmed, Inc. will post -4.56 EPS for the current year.

Insider Buying and Selling

In other Insmed news, CFO Sara Bonstein sold 58,400 shares of the company's stock in a transaction on Monday, July 21st. The stock was sold at an average price of $102.67, for a total value of $5,995,928.00. Following the transaction, the chief financial officer owned 73,505 shares of the company's stock, valued at $7,546,758.35. This represents a 44.27% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, COO Roger Adsett sold 25,000 shares of the company's stock in a transaction on Tuesday, August 19th. The shares were sold at an average price of $127.58, for a total value of $3,189,500.00. Following the completion of the transaction, the chief operating officer directly owned 105,637 shares in the company, valued at $13,477,168.46. This trade represents a 19.14% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 535,320 shares of company stock worth $54,581,793 over the last ninety days. Corporate insiders own 3.00% of the company's stock.

Insmed Company Profile

(

Free Report)

Insmed Incorporated is a global biopharmaceutical company on a mission to transform the lives of patients with serious and rare diseases. Insmed's first commercial product is ARIKAYCE® (amikacin liposome inhalation suspension), which is approved in the United States for the treatment of Mycobacterium avium complex (MAC) lung disease as part of a combination antibacterial drug regimen for adult patients with limited or no alternative treatment options.

Featured Articles

Before you consider Insmed, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Insmed wasn't on the list.

While Insmed currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.