Inspire Investing LLC lessened its position in shares of Canadian National Railway Company (NYSE:CNI - Free Report) TSE: CNR by 25.5% in the first quarter, according to its most recent filing with the SEC. The firm owned 18,971 shares of the transportation company's stock after selling 6,499 shares during the quarter. Inspire Investing LLC's holdings in Canadian National Railway were worth $1,846,000 at the end of the most recent quarter.

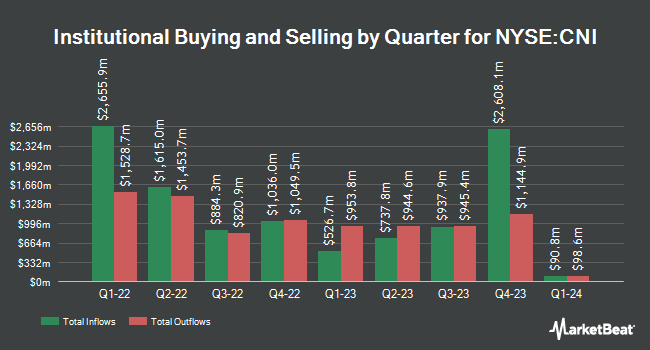

A number of other institutional investors and hedge funds have also added to or reduced their stakes in CNI. Dagco Inc. acquired a new stake in shares of Canadian National Railway during the first quarter worth $32,000. Bruce G. Allen Investments LLC grew its holdings in Canadian National Railway by 44.2% during the 1st quarter. Bruce G. Allen Investments LLC now owns 346 shares of the transportation company's stock worth $34,000 after acquiring an additional 106 shares during the period. CX Institutional acquired a new stake in Canadian National Railway during the 1st quarter worth about $39,000. Brooklyn Investment Group grew its holdings in Canadian National Railway by 354.3% during the 1st quarter. Brooklyn Investment Group now owns 427 shares of the transportation company's stock worth $42,000 after acquiring an additional 333 shares during the period. Finally, GAMMA Investing LLC grew its holdings in Canadian National Railway by 31.3% during the 1st quarter. GAMMA Investing LLC now owns 718 shares of the transportation company's stock worth $70,000 after acquiring an additional 171 shares during the period. Institutional investors and hedge funds own 80.74% of the company's stock.

Analysts Set New Price Targets

CNI has been the subject of several recent analyst reports. Wells Fargo & Company decreased their target price on Canadian National Railway from $120.00 to $117.00 and set an "overweight" rating for the company in a research note on Wednesday, July 23rd. Citigroup reduced their price objective on shares of Canadian National Railway from $124.00 to $123.00 and set a "buy" rating for the company in a research report on Wednesday, July 9th. Barclays reduced their price target on shares of Canadian National Railway from $106.00 to $99.00 and set an "equal weight" rating for the company in a report on Wednesday, July 23rd. Raymond James Financial upgraded shares of Canadian National Railway from a "market perform" rating to an "outperform" rating in a report on Thursday, July 17th. Finally, Argus upgraded Canadian National Railway to a "hold" rating in a research note on Friday, June 27th. Two equities research analysts have rated the stock with a Strong Buy rating, seven have issued a Buy rating, nine have issued a Hold rating and two have given a Sell rating to the company's stock. According to data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average price target of $118.36.

Get Our Latest Stock Analysis on CNI

Canadian National Railway Stock Down 1.0%

Shares of NYSE:CNI traded down $0.99 during mid-day trading on Thursday, hitting $93.67. 783,548 shares of the company traded hands, compared to its average volume of 1,528,702. The stock has a market cap of $58.15 billion, a P/E ratio of 18.01, a P/E/G ratio of 2.20 and a beta of 0.94. The company has a current ratio of 0.82, a quick ratio of 0.58 and a debt-to-equity ratio of 0.90. Canadian National Railway Company has a 12-month low of $91.07 and a 12-month high of $119.61. The stock has a 50-day moving average price of $96.12 and a two-hundred day moving average price of $99.41.

Canadian National Railway (NYSE:CNI - Get Free Report) TSE: CNR last announced its earnings results on Tuesday, July 22nd. The transportation company reported $1.35 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.37 by ($0.02). The company had revenue of $3.14 billion for the quarter, compared to analysts' expectations of $4.34 billion. Canadian National Railway had a net margin of 26.63% and a return on equity of 21.71%. The firm's quarterly revenue was down 1.3% on a year-over-year basis. During the same period in the previous year, the firm earned $1.84 EPS. On average, equities research analysts forecast that Canadian National Railway Company will post 5.52 earnings per share for the current year.

Canadian National Railway Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Monday, September 29th. Investors of record on Monday, September 8th will be issued a dividend of $0.6507 per share. This represents a $2.60 annualized dividend and a yield of 2.8%. This is a boost from Canadian National Railway's previous quarterly dividend of $0.62. The ex-dividend date is Monday, September 8th. Canadian National Railway's dividend payout ratio is presently 50.19%.

About Canadian National Railway

(

Free Report)

Canadian National Railway Company, together with its subsidiaries, engages in the rail, intermodal, trucking, and marine transportation and logistics business in Canada and the United States. The company provides rail services, which include equipment, custom brokerage services, transloading and distribution, business development and real estate, and private car storage services; and intermodal services, such as temperature controlled cargo, port partnerships, and logistics parks.

Recommended Stories

Before you consider Canadian National Railway, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian National Railway wasn't on the list.

While Canadian National Railway currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.