Inspire Investing LLC lessened its holdings in shares of Compass Minerals International, Inc. (NYSE:CMP - Free Report) by 48.0% during the second quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 19,364 shares of the basic materials company's stock after selling 17,842 shares during the period. Inspire Investing LLC's holdings in Compass Minerals International were worth $389,000 as of its most recent filing with the SEC.

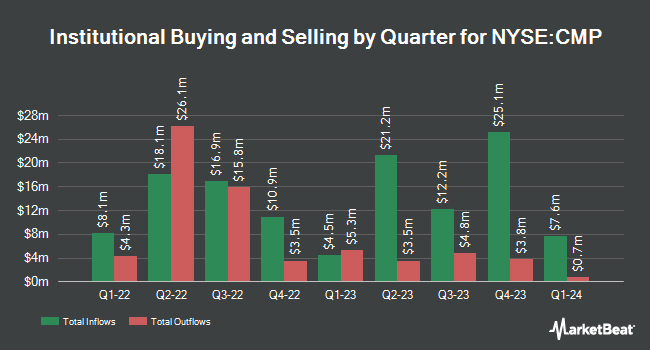

A number of other hedge funds also recently modified their holdings of CMP. Nuveen LLC acquired a new position in shares of Compass Minerals International during the first quarter worth $4,279,000. American Century Companies Inc. lifted its holdings in shares of Compass Minerals International by 275.5% during the first quarter. American Century Companies Inc. now owns 581,231 shares of the basic materials company's stock worth $5,400,000 after purchasing an additional 426,458 shares during the period. Ewing Morris & Co. Investment Partners Ltd. acquired a new position in shares of Compass Minerals International during the first quarter worth $3,944,000. O Keefe Stevens Advisory Inc. lifted its holdings in shares of Compass Minerals International by 85.8% during the second quarter. O Keefe Stevens Advisory Inc. now owns 545,828 shares of the basic materials company's stock worth $10,966,000 after purchasing an additional 252,036 shares during the period. Finally, Lightrock Netherlands B.V. raised its stake in Compass Minerals International by 33.6% during the first quarter. Lightrock Netherlands B.V. now owns 755,373 shares of the basic materials company's stock worth $7,029,000 after buying an additional 189,786 shares during the last quarter. Institutional investors and hedge funds own 99.78% of the company's stock.

Compass Minerals International Trading Down 1.8%

CMP opened at $19.55 on Thursday. Compass Minerals International, Inc. has a 1-year low of $8.60 and a 1-year high of $22.69. The company has a current ratio of 2.15, a quick ratio of 1.15 and a debt-to-equity ratio of 3.30. The company has a market cap of $814.96 million, a P/E ratio of -6.69 and a beta of 1.11. The company has a fifty day moving average price of $19.08 and a two-hundred day moving average price of $17.97.

Compass Minerals International (NYSE:CMP - Get Free Report) last posted its quarterly earnings results on Monday, August 11th. The basic materials company reported ($0.39) earnings per share for the quarter, missing the consensus estimate of ($0.13) by ($0.26). Compass Minerals International had a negative net margin of 9.87% and a negative return on equity of 16.70%. The company had revenue of $214.60 million during the quarter, compared to the consensus estimate of $208.60 million. During the same period last year, the firm posted ($1.05) earnings per share. The company's revenue for the quarter was up 5.8% on a year-over-year basis. Compass Minerals International has set its FY 2025 guidance at EPS. Analysts predict that Compass Minerals International, Inc. will post -0.53 EPS for the current fiscal year.

Analyst Ratings Changes

A number of brokerages recently weighed in on CMP. Weiss Ratings reissued a "sell (d-)" rating on shares of Compass Minerals International in a research note on Wednesday, October 8th. JPMorgan Chase & Co. reissued an "underweight" rating and set a $18.00 target price (up previously from $15.00) on shares of Compass Minerals International in a research note on Wednesday, August 13th. Deutsche Bank Aktiengesellschaft reissued a "buy" rating and set a $22.00 target price (up previously from $14.00) on shares of Compass Minerals International in a research note on Monday, June 23rd. Zacks Research downgraded shares of Compass Minerals International from a "hold" rating to a "strong sell" rating in a research note on Monday. Finally, Wall Street Zen downgraded shares of Compass Minerals International from a "buy" rating to a "hold" rating in a research note on Saturday, August 16th. One investment analyst has rated the stock with a Buy rating, one has given a Hold rating and three have given a Sell rating to the company. Based on data from MarketBeat.com, the stock has a consensus rating of "Reduce" and an average price target of $20.00.

View Our Latest Research Report on Compass Minerals International

Compass Minerals International Company Profile

(

Free Report)

Compass Minerals International, Inc, provides essential minerals in the United States, Canada, the United Kingdom, and internationally. It operates through two segments, Salt and Plant Nutrition. The Salt segment produces, markets, and sells sodium chloride and magnesium chloride, including rock salt, mechanically and solar evaporated salt, and brine and flake magnesium chloride products; and purchases potassium chloride and calcium chloride to sell as finished products or to blend with sodium chloride to produce specialty products.

Further Reading

Want to see what other hedge funds are holding CMP? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Compass Minerals International, Inc. (NYSE:CMP - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Compass Minerals International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Compass Minerals International wasn't on the list.

While Compass Minerals International currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.