Inspire Trust Co. N.A. raised its position in The Madison Square Garden Company (NYSE:MSGS - Free Report) by 28.6% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 9,000 shares of the company's stock after acquiring an additional 2,000 shares during the quarter. Inspire Trust Co. N.A.'s holdings in Madison Square Garden were worth $1,752,000 at the end of the most recent quarter.

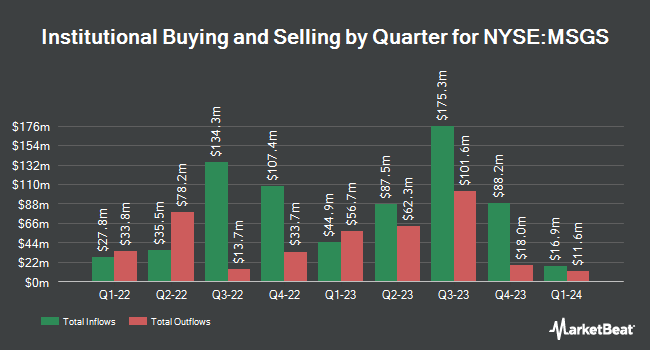

Several other hedge funds and other institutional investors also recently modified their holdings of MSGS. T. Rowe Price Investment Management Inc. boosted its stake in Madison Square Garden by 1,854.0% during the fourth quarter. T. Rowe Price Investment Management Inc. now owns 498,607 shares of the company's stock worth $112,526,000 after acquiring an additional 473,090 shares in the last quarter. Victory Capital Management Inc. lifted its stake in shares of Madison Square Garden by 523.2% in the first quarter. Victory Capital Management Inc. now owns 347,800 shares of the company's stock worth $67,724,000 after buying an additional 291,989 shares in the last quarter. The Manufacturers Life Insurance Company lifted its position in Madison Square Garden by 16.8% during the fourth quarter. The Manufacturers Life Insurance Company now owns 255,339 shares of the company's stock valued at $57,625,000 after purchasing an additional 36,799 shares during the period. Dimensional Fund Advisors LP lifted its position in Madison Square Garden by 4.7% during the fourth quarter. Dimensional Fund Advisors LP now owns 222,090 shares of the company's stock valued at $50,124,000 after purchasing an additional 9,979 shares during the period. Finally, GAMMA Investing LLC increased its holdings in Madison Square Garden by 14,886.7% during the first quarter. GAMMA Investing LLC now owns 137,278 shares of the company's stock valued at $26,731,000 after buying an additional 136,362 shares during the last quarter. Hedge funds and other institutional investors own 68.94% of the company's stock.

Madison Square Garden Stock Performance

MSGS stock traded down $1.2150 during trading on Tuesday, reaching $195.7050. The company had a trading volume of 35,580 shares, compared to its average volume of 155,934. The firm has a 50-day simple moving average of $201.58 and a 200-day simple moving average of $197.40. The company has a market cap of $4.70 billion, a price-to-earnings ratio of -212.56 and a beta of 0.79. The Madison Square Garden Company has a twelve month low of $173.26 and a twelve month high of $237.99.

Madison Square Garden (NYSE:MSGS - Get Free Report) last released its earnings results on Tuesday, August 12th. The company reported ($0.07) EPS for the quarter, topping analysts' consensus estimates of ($0.42) by $0.35. The company had revenue of $203.96 million during the quarter, compared to analysts' expectations of $151.00 million. Madison Square Garden had a negative net margin of 2.16% and a negative return on equity of 1.76%. Madison Square Garden's revenue for the quarter was down 10.3% on a year-over-year basis. During the same period last year, the business earned $1.06 EPS. Sell-side analysts expect that The Madison Square Garden Company will post 0.73 earnings per share for the current year.

Wall Street Analysts Forecast Growth

A number of analysts have commented on the stock. JPMorgan Chase & Co. reduced their target price on shares of Madison Square Garden from $240.00 to $230.00 and set an "overweight" rating for the company in a report on Monday, May 5th. Morgan Stanley raised their target price on shares of Madison Square Garden from $215.00 to $220.00 and gave the stock an "equal weight" rating in a report on Wednesday, August 13th. Guggenheim reaffirmed a "buy" rating and issued a $314.00 price target on shares of Madison Square Garden in a research note on Tuesday, May 6th. Finally, Susquehanna assumed coverage on shares of Madison Square Garden in a research note on Monday, April 28th. They issued a "positive" rating and a $254.00 price target on the stock. Four research analysts have rated the stock with a Buy rating and one has given a Hold rating to the stock. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $253.60.

Read Our Latest Stock Report on Madison Square Garden

Madison Square Garden Company Profile

(

Free Report)

Madison Square Garden Sports Corp. operates as a professional sports company in the United States. The company owns and operates a portfolio of assets that consists of the New York Knickerbockers of the National Basketball Association (NBA) and the New York Rangers of the National Hockey League. Its other professional franchises include development league teams, the Hartford Wolf Pack of the American Hockey League and the Westchester Knicks of the NBA G League.

See Also

Before you consider Madison Square Garden, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Madison Square Garden wasn't on the list.

While Madison Square Garden currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.