Natixis Advisors LLC raised its holdings in Installed Building Products, Inc. (NYSE:IBP - Free Report) by 19.8% in the first quarter, according to the company in its most recent disclosure with the SEC. The fund owned 103,949 shares of the construction company's stock after buying an additional 17,146 shares during the quarter. Natixis Advisors LLC owned about 0.38% of Installed Building Products worth $17,823,000 at the end of the most recent reporting period.

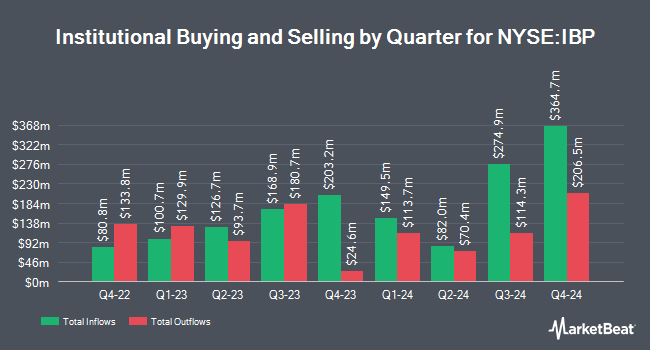

Other hedge funds have also recently made changes to their positions in the company. JPMorgan Chase & Co. boosted its stake in shares of Installed Building Products by 112.6% during the 4th quarter. JPMorgan Chase & Co. now owns 153,772 shares of the construction company's stock worth $26,949,000 after acquiring an additional 81,455 shares in the last quarter. Norges Bank purchased a new stake in Installed Building Products in the 4th quarter valued at $28,509,000. Pictet Asset Management Holding SA boosted its holdings in Installed Building Products by 8.2% in the 4th quarter. Pictet Asset Management Holding SA now owns 3,397 shares of the construction company's stock valued at $595,000 after purchasing an additional 257 shares during the last quarter. Orion Portfolio Solutions LLC raised its position in Installed Building Products by 3.8% in the fourth quarter. Orion Portfolio Solutions LLC now owns 3,992 shares of the construction company's stock valued at $700,000 after purchasing an additional 146 shares during the period. Finally, Wellington Management Group LLP lifted its holdings in shares of Installed Building Products by 2.1% in the 4th quarter. Wellington Management Group LLP now owns 143,579 shares of the construction company's stock worth $25,162,000 after acquiring an additional 2,939 shares during the last quarter. 99.61% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several research analysts have recently issued reports on IBP shares. Benchmark lowered their price objective on Installed Building Products from $210.00 to $185.00 and set a "buy" rating for the company in a research report on Friday, May 9th. Loop Capital lowered their price target on Installed Building Products from $210.00 to $200.00 and set a "buy" rating on the stock in a report on Monday, May 12th. Two investment analysts have rated the stock with a sell rating, six have issued a hold rating and four have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average price target of $209.70.

View Our Latest Stock Report on IBP

Installed Building Products Stock Up 20.7%

Shares of NYSE:IBP traded up $43.75 during trading on Thursday, reaching $255.57. 1,676,259 shares of the stock traded hands, compared to its average volume of 423,044. The company has a debt-to-equity ratio of 1.28, a quick ratio of 2.31 and a current ratio of 2.89. Installed Building Products, Inc. has a 52-week low of $150.83 and a 52-week high of $263.20. The stock has a market cap of $7.06 billion, a P/E ratio of 29.14 and a beta of 1.73. The stock has a 50-day moving average of $185.70 and a two-hundred day moving average of $177.42.

Installed Building Products (NYSE:IBP - Get Free Report) last posted its quarterly earnings data on Thursday, May 8th. The construction company reported $2.08 earnings per share for the quarter, missing analysts' consensus estimates of $2.23 by ($0.15). The firm had revenue of $684.80 million for the quarter, compared to the consensus estimate of $681.34 million. Installed Building Products had a net margin of 8.39% and a return on equity of 60.73%. The company's revenue was down 1.2% on a year-over-year basis. During the same quarter last year, the firm earned $2.47 EPS. As a group, sell-side analysts expect that Installed Building Products, Inc. will post 10.66 earnings per share for the current fiscal year.

Installed Building Products Profile

(

Free Report)

Installed Building Products, Inc, together with its subsidiaries, engages in the installation of insulation, waterproofing, fire-stopping, fireproofing, garage doors, rain gutters, window blinds, shower doors, closet shelving and mirrors, and other products in the United States. It operates through Installation, Distribution, and Manufacturing operation segments.

See Also

Before you consider Installed Building Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Installed Building Products wasn't on the list.

While Installed Building Products currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.