Intech Investment Management LLC raised its stake in shares of Five Below, Inc. (NASDAQ:FIVE - Free Report) by 35.1% in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 37,133 shares of the specialty retailer's stock after buying an additional 9,652 shares during the period. Intech Investment Management LLC owned about 0.07% of Five Below worth $2,782,000 as of its most recent SEC filing.

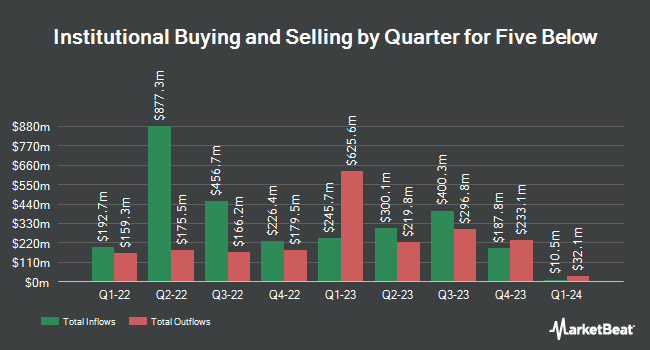

Several other hedge funds and other institutional investors have also recently modified their holdings of FIVE. Byrne Asset Management LLC purchased a new stake in shares of Five Below in the 1st quarter worth $29,000. Caitong International Asset Management Co. Ltd increased its position in shares of Five Below by 1,097.4% during the first quarter. Caitong International Asset Management Co. Ltd now owns 455 shares of the specialty retailer's stock worth $34,000 after acquiring an additional 417 shares during the period. Bessemer Group Inc. increased its position in shares of Five Below by 246.9% during the first quarter. Bessemer Group Inc. now owns 496 shares of the specialty retailer's stock worth $37,000 after acquiring an additional 353 shares during the period. UMB Bank n.a. increased its holdings in Five Below by 61.7% during the first quarter. UMB Bank n.a. now owns 540 shares of the specialty retailer's stock valued at $40,000 after buying an additional 206 shares during the period. Finally, NewEdge Advisors LLC increased its holdings in Five Below by 143.0% during the first quarter. NewEdge Advisors LLC now owns 1,096 shares of the specialty retailer's stock valued at $82,000 after buying an additional 645 shares during the period.

Five Below Trading Up 1.4%

FIVE traded up $2.10 during trading hours on Tuesday, hitting $149.06. 1,356,446 shares of the company's stock were exchanged, compared to its average volume of 1,484,906. Five Below, Inc. has a 12-month low of $52.38 and a 12-month high of $155.34. The firm has a 50 day moving average of $140.20 and a 200 day moving average of $110.30. The firm has a market cap of $8.22 billion, a P/E ratio of 30.17, a price-to-earnings-growth ratio of 2.15 and a beta of 1.09.

Five Below (NASDAQ:FIVE - Get Free Report) last announced its earnings results on Wednesday, August 27th. The specialty retailer reported $0.81 earnings per share for the quarter, topping the consensus estimate of $0.61 by $0.20. Five Below had a net margin of 6.45% and a return on equity of 17.13%. The firm had revenue of $1.03 billion for the quarter, compared to the consensus estimate of $988.91 million. During the same period in the prior year, the firm earned $0.54 EPS. The firm's revenue for the quarter was up 23.7% on a year-over-year basis. Five Below has set its FY 2025 guidance at 4.760-5.160 EPS. Q3 2025 guidance at 0.120-0.240 EPS. As a group, research analysts expect that Five Below, Inc. will post 4.93 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

FIVE has been the subject of several research reports. Truist Financial lifted their price objective on shares of Five Below from $141.00 to $148.00 and gave the stock a "hold" rating in a research note on Thursday, August 28th. Craig Hallum lifted their price objective on shares of Five Below from $164.00 to $180.00 and gave the company a "buy" rating in a report on Thursday, August 28th. UBS Group lifted their price objective on shares of Five Below from $160.00 to $184.00 and gave the company a "buy" rating in a report on Thursday, August 28th. Guggenheim boosted their target price on shares of Five Below from $155.00 to $165.00 and gave the stock a "buy" rating in a research note on Friday, August 29th. Finally, JPMorgan Chase & Co. upped their price objective on shares of Five Below from $105.00 to $154.00 and gave the company a "neutral" rating in a research note on Monday, July 21st. Eight research analysts have rated the stock with a Buy rating, eleven have assigned a Hold rating and one has issued a Sell rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Hold" and an average price target of $143.56.

View Our Latest Analysis on Five Below

Insider Activity

In other news, CAO Eric M. Specter sold 5,500 shares of the firm's stock in a transaction on Thursday, June 26th. The shares were sold at an average price of $130.77, for a total value of $719,235.00. Following the sale, the chief accounting officer directly owned 55,854 shares in the company, valued at approximately $7,304,027.58. This trade represents a 8.96% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, EVP Ronald James Masciantonio sold 818 shares of the firm's stock in a transaction on Friday, August 29th. The shares were sold at an average price of $146.41, for a total transaction of $119,763.38. Following the completion of the sale, the executive vice president owned 9,858 shares in the company, valued at $1,443,309.78. The trade was a 7.66% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 7,818 shares of company stock worth $1,048,998. 1.90% of the stock is currently owned by corporate insiders.

About Five Below

(

Free Report)

Five Below, Inc operates as a specialty value retailer in the United States. The company offers range of accessories, which includes novelty socks, sunglasses, jewelry, scarves, gloves, hair accessories, athletic tops and bottoms, and t-shirts, as well as nail polish, lip gloss, fragrance, and branded cosmetics; and personalized living space products, such as lamps, posters, frames, fleece blankets, plush items, pillows, candles, incense, lighting, novelty décor, accent furniture, and related items, as well as provides storage options.

See Also

Before you consider Five Below, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Five Below wasn't on the list.

While Five Below currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report