Intech Investment Management LLC boosted its stake in Qualys, Inc. (NASDAQ:QLYS - Free Report) by 35.6% during the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 23,988 shares of the software maker's stock after purchasing an additional 6,292 shares during the period. Intech Investment Management LLC owned about 0.07% of Qualys worth $3,021,000 at the end of the most recent reporting period.

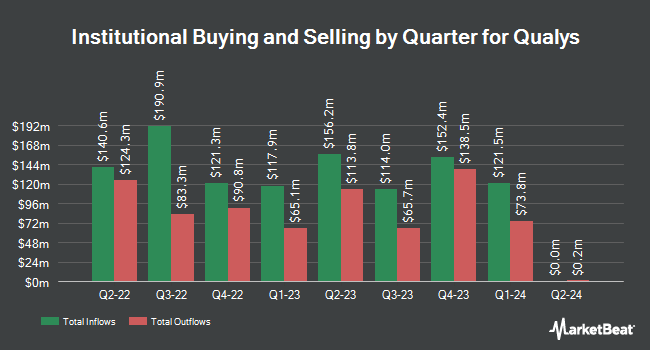

Other large investors have also bought and sold shares of the company. AQR Capital Management LLC raised its holdings in Qualys by 96.8% during the 1st quarter. AQR Capital Management LLC now owns 688,776 shares of the software maker's stock valued at $85,394,000 after buying an additional 338,702 shares during the last quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC increased its position in shares of Qualys by 92.2% in the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 643,238 shares of the software maker's stock valued at $81,003,000 after acquiring an additional 308,635 shares during the period. Penserra Capital Management LLC increased its position in shares of Qualys by 53.3% in the first quarter. Penserra Capital Management LLC now owns 499,084 shares of the software maker's stock valued at $62,849,000 after acquiring an additional 173,512 shares during the period. GAMMA Investing LLC increased its position in shares of Qualys by 43,505.0% in the first quarter. GAMMA Investing LLC now owns 122,530 shares of the software maker's stock valued at $15,430,000 after acquiring an additional 122,249 shares during the period. Finally, Nuveen LLC purchased a new position in shares of Qualys in the first quarter valued at about $13,291,000. 99.31% of the stock is owned by hedge funds and other institutional investors.

Insider Transactions at Qualys

In other news, CFO Joo Mi Kim sold 844 shares of the stock in a transaction that occurred on Friday, September 5th. The shares were sold at an average price of $134.80, for a total value of $113,771.20. Following the transaction, the chief financial officer owned 93,651 shares in the company, valued at $12,624,154.80. This represents a 0.89% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Director John A. Zangardi sold 3,103 shares of the stock in a transaction that occurred on Wednesday, August 27th. The stock was sold at an average price of $134.94, for a total transaction of $418,718.82. Following the completion of the transaction, the director owned 4,071 shares in the company, valued at $549,340.74. This trade represents a 43.25% decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 51,040 shares of company stock worth $7,030,879. 0.88% of the stock is owned by insiders.

Qualys Trading Down 0.2%

NASDAQ QLYS traded down $0.22 during trading on Friday, hitting $135.56. The company had a trading volume of 931,562 shares, compared to its average volume of 288,165. Qualys, Inc. has a one year low of $112.61 and a one year high of $170.00. The company has a market cap of $4.89 billion, a price-to-earnings ratio of 27.06 and a beta of 0.65. The company's fifty day moving average is $134.18 and its 200-day moving average is $133.02.

Qualys (NASDAQ:QLYS - Get Free Report) last released its earnings results on Tuesday, August 5th. The software maker reported $1.68 earnings per share for the quarter, topping analysts' consensus estimates of $1.47 by $0.21. The firm had revenue of $164.06 million for the quarter, compared to the consensus estimate of $161.25 million. Qualys had a net margin of 29.04% and a return on equity of 37.19%. The company's revenue was up 10.3% compared to the same quarter last year. During the same period in the prior year, the firm earned $1.52 EPS. Qualys has set its FY 2025 guidance at 6.200-6.5 EPS. Q3 2025 guidance at 1.500-1.6 EPS. As a group, equities analysts anticipate that Qualys, Inc. will post 3.85 EPS for the current year.

Analysts Set New Price Targets

QLYS has been the topic of a number of analyst reports. Wedbush boosted their price objective on shares of Qualys from $145.00 to $155.00 and gave the company an "outperform" rating in a research report on Wednesday, August 6th. Morgan Stanley boosted their price objective on shares of Qualys from $90.00 to $97.00 and gave the company an "underweight" rating in a research report on Wednesday, August 6th. Wall Street Zen cut shares of Qualys from a "buy" rating to a "hold" rating in a research report on Saturday, August 30th. Zacks Research upgraded shares of Qualys to a "strong-buy" rating in a report on Monday, August 11th. Finally, DA Davidson upped their price objective on shares of Qualys from $130.00 to $135.00 and gave the stock a "neutral" rating in a report on Wednesday, August 6th. One analyst has rated the stock with a Strong Buy rating, two have issued a Buy rating, twelve have assigned a Hold rating and two have given a Sell rating to the stock. According to MarketBeat, Qualys has a consensus rating of "Hold" and an average target price of $141.00.

Get Our Latest Stock Report on Qualys

Qualys Company Profile

(

Free Report)

Qualys, Inc, together with its subsidiaries, provides cloud-based platform delivering information technology (IT), security, and compliance solutions in the United States and internationally. It offers Qualys Cloud Apps, which include Cybersecurity Asset Management and External Attack Surface Management; Vulnerability Management, Detection and Response; Web Application Scanning; Patch Management; Custom Assessment and Remediation; Multi-Vector Endpoint Detection and Response; Context Extended Detection and Response; Policy Compliance; File Integrity Monitoring; and Qualys TotalCloud, as well as Cloud Workload Protection, Cloud Detection and Response, Cloud Security Posture Management, Infrastructure as Code, and Container Security.

Featured Stories

Before you consider Qualys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Qualys wasn't on the list.

While Qualys currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.