Intech Investment Management LLC trimmed its stake in Tennant Company (NYSE:TNC - Free Report) by 20.5% during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 33,016 shares of the industrial products company's stock after selling 8,513 shares during the period. Intech Investment Management LLC owned about 0.18% of Tennant worth $2,633,000 as of its most recent SEC filing.

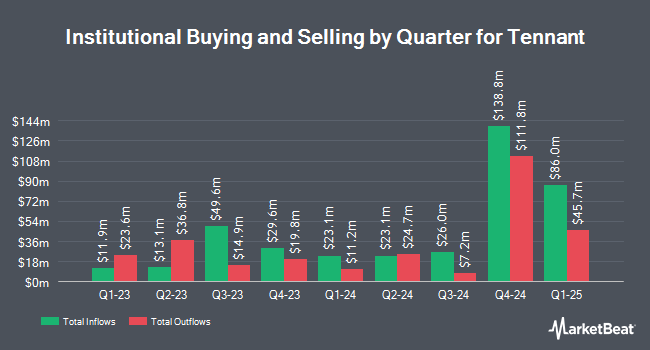

Other institutional investors have also made changes to their positions in the company. GAMMA Investing LLC boosted its position in shares of Tennant by 429.0% during the 1st quarter. GAMMA Investing LLC now owns 492 shares of the industrial products company's stock valued at $39,000 after acquiring an additional 399 shares in the last quarter. Farther Finance Advisors LLC boosted its position in shares of Tennant by 194.8% during the 1st quarter. Farther Finance Advisors LLC now owns 619 shares of the industrial products company's stock valued at $50,000 after acquiring an additional 409 shares in the last quarter. Banque Transatlantique SA acquired a new stake in shares of Tennant during the 1st quarter valued at about $59,000. Alta Fox Capital Management LLC acquired a new stake in shares of Tennant during the 1st quarter valued at about $73,000. Finally, CWM LLC boosted its position in shares of Tennant by 137.0% during the 1st quarter. CWM LLC now owns 1,519 shares of the industrial products company's stock valued at $121,000 after acquiring an additional 878 shares in the last quarter. 93.33% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Separately, Zacks Research upgraded shares of Tennant to a "hold" rating in a research report on Tuesday, August 12th. One research analyst has rated the stock with a Buy rating and one has assigned a Hold rating to the company. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $125.00.

Check Out Our Latest Report on Tennant

Tennant Price Performance

NYSE:TNC traded down $1.98 on Friday, reaching $80.46. The stock had a trading volume of 380,068 shares, compared to its average volume of 93,029. The company has a market capitalization of $1.49 billion, a P/E ratio of 25.07, a price-to-earnings-growth ratio of 1.79 and a beta of 1.09. Tennant Company has a 1-year low of $67.32 and a 1-year high of $98.52. The company has a quick ratio of 1.38, a current ratio of 2.09 and a debt-to-equity ratio of 0.33. The stock has a fifty day moving average price of $81.92 and a 200-day moving average price of $78.31.

Tennant (NYSE:TNC - Get Free Report) last released its quarterly earnings results on Wednesday, August 6th. The industrial products company reported $1.49 EPS for the quarter, missing analysts' consensus estimates of $1.63 by ($0.14). The firm had revenue of $318.60 million during the quarter, compared to analyst estimates of $327.20 million. Tennant had a net margin of 4.84% and a return on equity of 16.41%. Tennant's quarterly revenue was down 3.7% on a year-over-year basis. During the same quarter last year, the firm earned $1.83 earnings per share. Research analysts forecast that Tennant Company will post 5.89 EPS for the current year.

Tennant Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Monday, September 15th. Shareholders of record on Friday, August 29th were paid a $0.295 dividend. The ex-dividend date of this dividend was Friday, August 29th. This represents a $1.18 dividend on an annualized basis and a dividend yield of 1.5%. Tennant's payout ratio is currently 36.76%.

About Tennant

(

Free Report)

Tennant Company, together with its subsidiaries, designs, manufactures, and markets floor cleaning equipment in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company offers a suite of products, including floor maintenance and cleaning equipment, detergent-free and other sustainable cleaning technologies, aftermarket parts and consumables, equipment maintenance and repair services, and asset management solutions.

Featured Articles

Before you consider Tennant, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tennant wasn't on the list.

While Tennant currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.