Intech Investment Management LLC increased its position in Interface, Inc. (NASDAQ:TILE - Free Report) by 104.4% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 216,520 shares of the textile maker's stock after buying an additional 110,597 shares during the period. Intech Investment Management LLC owned 0.37% of Interface worth $4,296,000 at the end of the most recent reporting period.

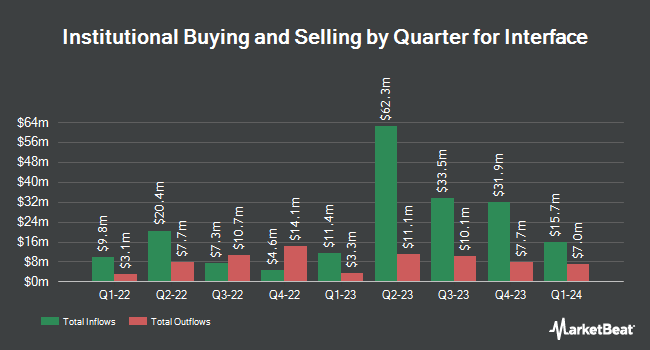

Several other large investors also recently made changes to their positions in TILE. Vanguard Group Inc. grew its position in Interface by 0.7% in the 1st quarter. Vanguard Group Inc. now owns 6,159,773 shares of the textile maker's stock valued at $122,210,000 after purchasing an additional 43,309 shares during the period. Congress Asset Management Co. acquired a new position in Interface during the 1st quarter valued at about $44,969,000. American Century Companies Inc. boosted its position in shares of Interface by 11.1% during the first quarter. American Century Companies Inc. now owns 2,214,325 shares of the textile maker's stock valued at $43,932,000 after buying an additional 222,029 shares during the last quarter. GW&K Investment Management LLC boosted its holdings in Interface by 15.0% during the 1st quarter. GW&K Investment Management LLC now owns 1,183,961 shares of the textile maker's stock worth $23,490,000 after acquiring an additional 154,872 shares during the last quarter. Finally, Nuveen LLC purchased a new position in Interface during the 1st quarter worth $15,505,000. 98.34% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

A number of equities analysts have recently weighed in on the company. Wall Street Zen upgraded Interface from a "buy" rating to a "strong-buy" rating in a research note on Saturday, August 9th. Barrington Research reissued an "outperform" rating and issued a $32.00 price target on shares of Interface in a report on Friday, August 29th. One investment analyst has rated the stock with a Buy rating, Based on data from MarketBeat, the stock currently has a consensus rating of "Buy" and a consensus target price of $32.00.

Read Our Latest Stock Report on Interface

Insider Buying and Selling at Interface

In other news, CFO Bruce Andrew Hausmann sold 25,000 shares of the firm's stock in a transaction on Wednesday, August 27th. The shares were sold at an average price of $26.95, for a total transaction of $673,750.00. Following the sale, the chief financial officer owned 145,403 shares in the company, valued at approximately $3,918,610.85. This trade represents a 14.67% decrease in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Also, VP Stansfield Nigel sold 79,497 shares of the firm's stock in a transaction dated Wednesday, August 6th. The shares were sold at an average price of $25.60, for a total value of $2,035,123.20. Following the sale, the vice president owned 65,125 shares in the company, valued at $1,667,200. The trade was a 54.97% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 109,497 shares of company stock valued at $2,839,573 in the last 90 days. Corporate insiders own 2.30% of the company's stock.

Interface Price Performance

TILE traded up $0.70 during trading on Thursday, reaching $29.88. 140,946 shares of the company were exchanged, compared to its average volume of 449,399. The company's 50-day moving average is $24.98 and its two-hundred day moving average is $21.60. The company has a market cap of $1.74 billion, a price-to-earnings ratio of 18.42, a P/E/G ratio of 1.14 and a beta of 2.11. The company has a quick ratio of 1.59, a current ratio of 2.88 and a debt-to-equity ratio of 0.53. Interface, Inc. has a 12-month low of $17.24 and a 12-month high of $30.19.

Interface (NASDAQ:TILE - Get Free Report) last announced its quarterly earnings results on Friday, August 1st. The textile maker reported $0.60 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.47 by $0.13. Interface had a net margin of 7.08% and a return on equity of 18.97%. The firm had revenue of $375.52 million for the quarter, compared to the consensus estimate of $360.57 million. During the same period in the prior year, the firm posted $0.40 earnings per share. The company's revenue for the quarter was up 8.3% on a year-over-year basis. Interface has set its FY 2025 guidance at EPS. Q3 2025 guidance at EPS. Research analysts forecast that Interface, Inc. will post 1.37 earnings per share for the current fiscal year.

Interface Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Friday, September 12th. Shareholders of record on Friday, August 29th were issued a $0.02 dividend. The ex-dividend date of this dividend was Friday, August 29th. This represents a $0.08 annualized dividend and a dividend yield of 0.3%. Interface's dividend payout ratio (DPR) is presently 4.94%.

Interface Company Profile

(

Free Report)

Interface, Inc designs, produces, and sells modular carpet products primarily worldwide. The company operates in two segments, Americas (AMS), and Europe, Africa, Asia and Australia (EAAA). The company offers modular carpets under the Interface and FLOR brand names; luxury vinyl tiles; carpet tiles under the CQuestGB name for use in commercial interiors, include offices, healthcare facilities, airports, educational and other institutions, hospitality spaces, and retail facilities, as well as residential interiors; and modular resilient flooring products.

Featured Stories

Before you consider Interface, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Interface wasn't on the list.

While Interface currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report