Invesco LLC increased its position in shares of Palo Alto Networks, Inc. (NASDAQ:PANW - Free Report) by 93.4% in the 2nd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 9,176 shares of the network technology company's stock after purchasing an additional 4,432 shares during the period. Invesco LLC's holdings in Palo Alto Networks were worth $1,878,000 as of its most recent SEC filing.

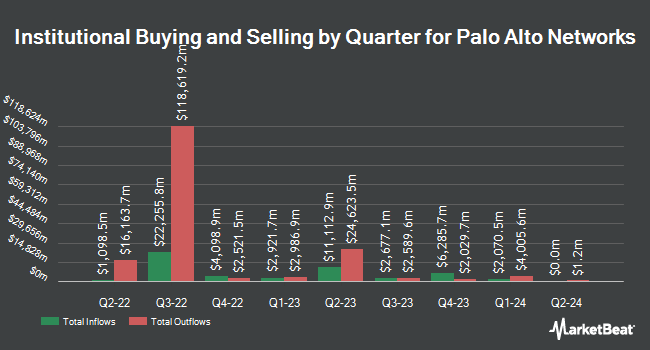

Other institutional investors also recently added to or reduced their stakes in the company. Nuveen LLC purchased a new position in Palo Alto Networks in the first quarter worth $810,047,000. Kingstone Capital Partners Texas LLC purchased a new position in shares of Palo Alto Networks in the 2nd quarter valued at about $633,068,000. Goldman Sachs Group Inc. lifted its stake in shares of Palo Alto Networks by 41.9% in the first quarter. Goldman Sachs Group Inc. now owns 7,235,406 shares of the network technology company's stock valued at $1,234,650,000 after purchasing an additional 2,134,735 shares during the period. Price T Rowe Associates Inc. MD boosted its holdings in Palo Alto Networks by 77.1% during the first quarter. Price T Rowe Associates Inc. MD now owns 3,879,506 shares of the network technology company's stock worth $662,000,000 after buying an additional 1,688,432 shares in the last quarter. Finally, Vanguard Group Inc. grew its position in Palo Alto Networks by 2.5% during the first quarter. Vanguard Group Inc. now owns 62,775,544 shares of the network technology company's stock worth $10,712,019,000 after buying an additional 1,541,637 shares during the period. Hedge funds and other institutional investors own 79.82% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research firms have recently issued reports on PANW. Morgan Stanley lifted their price target on shares of Palo Alto Networks from $210.00 to $216.00 and gave the company an "overweight" rating in a research report on Tuesday, September 2nd. UBS Group set a $245.00 target price on Palo Alto Networks in a research report on Friday. Rosenblatt Securities lowered their target price on Palo Alto Networks from $235.00 to $215.00 and set a "buy" rating on the stock in a report on Thursday, August 14th. Jefferies Financial Group set a $235.00 price target on Palo Alto Networks in a research report on Tuesday, July 29th. Finally, Stephens reiterated an "equal weight" rating and issued a $205.00 price objective on shares of Palo Alto Networks in a research report on Tuesday, August 19th. Thirty analysts have rated the stock with a Buy rating, eleven have issued a Hold rating and two have issued a Sell rating to the stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus price target of $214.64.

View Our Latest Research Report on PANW

Insider Activity at Palo Alto Networks

In related news, CAO Josh D. Paul sold 700 shares of the stock in a transaction on Thursday, August 21st. The stock was sold at an average price of $184.20, for a total value of $128,940.00. Following the transaction, the chief accounting officer directly owned 37,723 shares of the company's stock, valued at approximately $6,948,576.60. This trade represents a 1.82% decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, EVP Lee Klarich sold 120,774 shares of the business's stock in a transaction dated Wednesday, September 3rd. The shares were sold at an average price of $191.11, for a total value of $23,081,119.14. Following the sale, the executive vice president directly owned 177,954 shares of the company's stock, valued at approximately $34,008,788.94. This trade represents a 40.43% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 1,415,030 shares of company stock valued at $279,198,494 over the last 90 days. 2.50% of the stock is currently owned by insiders.

Palo Alto Networks Stock Up 0.1%

Shares of NASDAQ:PANW opened at $202.37 on Monday. The company has a market cap of $135.37 billion, a P/E ratio of 126.09, a P/E/G ratio of 4.82 and a beta of 0.98. The business has a fifty day simple moving average of $189.58 and a 200-day simple moving average of $187.47. Palo Alto Networks, Inc. has a 52 week low of $144.15 and a 52 week high of $210.39.

Palo Alto Networks (NASDAQ:PANW - Get Free Report) last issued its quarterly earnings results on Monday, August 18th. The network technology company reported $0.95 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.89 by $0.06. Palo Alto Networks had a return on equity of 17.66% and a net margin of 12.30%.The firm had revenue of $2.54 billion for the quarter, compared to analyst estimates of $2.50 billion. During the same period last year, the company earned $0.75 EPS. The firm's quarterly revenue was up 15.8% on a year-over-year basis. Palo Alto Networks has set its FY 2026 guidance at 3.750-3.850 EPS. Q1 2026 guidance at 0.880-0.900 EPS. Sell-side analysts expect that Palo Alto Networks, Inc. will post 1.76 earnings per share for the current fiscal year.

About Palo Alto Networks

(

Free Report)

Palo Alto Networks, Inc provides cybersecurity solutions worldwide. The company offers firewall appliances and software; and Panorama, a security management solution for the global control of network security platform as a virtual or a physical appliance. It also provides subscription services covering the areas of threat prevention, malware and persistent threat, URL filtering, laptop and mobile device protection, DNS security, Internet of Things security, SaaS security API, and SaaS security inline, as well as threat intelligence, and data loss prevention.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Palo Alto Networks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Palo Alto Networks wasn't on the list.

While Palo Alto Networks currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report