Invesco Ltd. boosted its position in shares of Eldorado Gold Corporation (NYSE:EGO - Free Report) TSE: ELD by 17.9% in the first quarter, according to the company in its most recent filing with the SEC. The firm owned 2,347,487 shares of the basic materials company's stock after acquiring an additional 355,962 shares during the quarter. Invesco Ltd. owned about 1.14% of Eldorado Gold worth $39,485,000 at the end of the most recent reporting period.

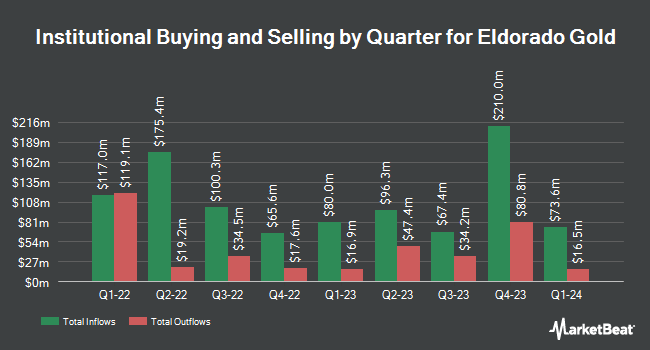

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in EGO. ANTIPODES PARTNERS Ltd lifted its position in Eldorado Gold by 43.5% during the 1st quarter. ANTIPODES PARTNERS Ltd now owns 3,802,895 shares of the basic materials company's stock worth $63,970,000 after acquiring an additional 1,152,909 shares during the period. Ruffer LLP acquired a new stake in Eldorado Gold during the 1st quarter worth about $16,687,000. Carrhae Capital LLP lifted its position in Eldorado Gold by 10.7% during the 1st quarter. Carrhae Capital LLP now owns 6,689,304 shares of the basic materials company's stock worth $112,514,000 after acquiring an additional 648,574 shares during the period. Wellington Management Group LLP acquired a new stake in Eldorado Gold during the 4th quarter worth about $6,973,000. Finally, Deutsche Bank AG lifted its position in Eldorado Gold by 85.2% during the 1st quarter. Deutsche Bank AG now owns 870,357 shares of the basic materials company's stock worth $14,639,000 after acquiring an additional 400,477 shares during the period. Institutional investors and hedge funds own 69.58% of the company's stock.

Eldorado Gold Stock Performance

Shares of NYSE EGO traded up $0.4160 during trading on Friday, reaching $23.4960. 1,190,186 shares of the company traded hands, compared to its average volume of 1,697,315. The firm's fifty day simple moving average is $21.20 and its 200 day simple moving average is $18.72. The stock has a market cap of $4.77 billion, a P/E ratio of 11.81, a PEG ratio of 0.37 and a beta of 0.37. Eldorado Gold Corporation has a 12-month low of $13.29 and a 12-month high of $23.74. The company has a current ratio of 3.23, a quick ratio of 2.65 and a debt-to-equity ratio of 0.28.

Eldorado Gold (NYSE:EGO - Get Free Report) TSE: ELD last announced its quarterly earnings results on Thursday, July 31st. The basic materials company reported $0.44 earnings per share for the quarter, missing the consensus estimate of $0.51 by ($0.07). Eldorado Gold had a net margin of 26.07% and a return on equity of 8.79%. The business had revenue of $459.53 million during the quarter, compared to analysts' expectations of $401.85 million. As a group, research analysts anticipate that Eldorado Gold Corporation will post 1.5 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

EGO has been the subject of a number of research reports. Canaccord Genuity Group lowered their price target on Eldorado Gold from $29.00 to $27.00 and set a "hold" rating for the company in a research report on Monday, May 5th. Wall Street Zen lowered Eldorado Gold from a "buy" rating to a "hold" rating in a research note on Saturday, August 9th. National Bankshares reiterated an "outperform" rating on shares of Eldorado Gold in a research note on Wednesday, July 16th. Scotiabank reiterated a "sector perform" rating on shares of Eldorado Gold in a research note on Monday, August 11th. Finally, CIBC reiterated an "outperform" rating on shares of Eldorado Gold in a research note on Tuesday, July 15th. One investment analyst has rated the stock with a Strong Buy rating, three have given a Buy rating and three have assigned a Hold rating to the stock. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $23.60.

Check Out Our Latest Stock Report on EGO

About Eldorado Gold

(

Free Report)

Eldorado Gold Corporation, together with its subsidiaries, engages in the mining, exploration, development, and sale of mineral products primarily in Turkey, Canada, Greece, and Romania. The company primarily produces gold, as well as silver, lead, and zinc. It holds a 100% interest in the Kisladag and Efemçukuru mines located in Turkey; Lamaque complex located in Canada; and Olympias, Stratoni, Skouries, Perama Hill, and Sapes gold mines located in Greece, as well as the 80.5% interest in Certej development projects located in Romania.

Featured Stories

Before you consider Eldorado Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eldorado Gold wasn't on the list.

While Eldorado Gold currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.