Invesco Ltd. lifted its holdings in Cavco Industries, Inc. (NASDAQ:CVCO - Free Report) by 7.5% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 196,210 shares of the construction company's stock after purchasing an additional 13,753 shares during the period. Invesco Ltd. owned 2.42% of Cavco Industries worth $101,957,000 at the end of the most recent reporting period.

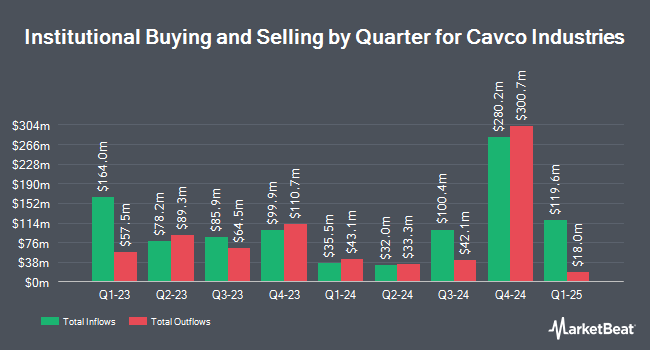

Several other institutional investors and hedge funds have also modified their holdings of the business. Vanguard Group Inc. lifted its stake in shares of Cavco Industries by 5.1% in the 1st quarter. Vanguard Group Inc. now owns 774,842 shares of the construction company's stock valued at $402,631,000 after purchasing an additional 37,249 shares during the last quarter. GAMMA Investing LLC raised its holdings in Cavco Industries by 71,961.9% in the 1st quarter. GAMMA Investing LLC now owns 229,157 shares of the construction company's stock worth $119,077,000 after acquiring an additional 228,839 shares during the period. GW&K Investment Management LLC lifted its position in Cavco Industries by 0.8% during the 1st quarter. GW&K Investment Management LLC now owns 190,227 shares of the construction company's stock worth $98,848,000 after acquiring an additional 1,512 shares during the last quarter. Northern Trust Corp boosted its holdings in Cavco Industries by 9.5% during the fourth quarter. Northern Trust Corp now owns 91,732 shares of the construction company's stock valued at $40,934,000 after acquiring an additional 7,986 shares during the period. Finally, Janus Henderson Group PLC boosted its holdings in Cavco Industries by 1,030.9% during the fourth quarter. Janus Henderson Group PLC now owns 72,534 shares of the construction company's stock valued at $32,371,000 after acquiring an additional 66,120 shares during the period. Institutional investors and hedge funds own 95.56% of the company's stock.

Analyst Upgrades and Downgrades

CVCO has been the subject of a number of recent analyst reports. Wall Street Zen cut shares of Cavco Industries from a "buy" rating to a "hold" rating in a report on Saturday, July 5th. Wedbush restated a "neutral" rating and set a $550.00 price target on shares of Cavco Industries in a report on Monday, August 4th. One investment analyst has rated the stock with a Buy rating and one has given a Hold rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $522.50.

Get Our Latest Analysis on CVCO

Cavco Industries Stock Performance

Shares of CVCO traded up $2.18 during trading hours on Thursday, reaching $487.29. 190,571 shares of the company traded hands, compared to its average volume of 114,357. The stock's fifty day moving average is $437.86 and its 200 day moving average is $477.33. The stock has a market cap of $3.86 billion, a P/E ratio of 21.12 and a beta of 1.15. Cavco Industries, Inc. has a 1-year low of $388.68 and a 1-year high of $549.99.

Cavco Industries (NASDAQ:CVCO - Get Free Report) last announced its quarterly earnings data on Thursday, July 31st. The construction company reported $6.42 EPS for the quarter, beating analysts' consensus estimates of $5.81 by $0.61. The business had revenue of $556.86 million during the quarter, compared to analyst estimates of $524.97 million. Cavco Industries had a net margin of 8.99% and a return on equity of 18.52%. On average, equities research analysts predict that Cavco Industries, Inc. will post 21.93 EPS for the current year.

Insider Activity at Cavco Industries

In other news, Director Susan L. Blount sold 2,000 shares of the company's stock in a transaction dated Thursday, August 14th. The shares were sold at an average price of $483.21, for a total transaction of $966,420.00. Following the completion of the transaction, the director owned 3,126 shares of the company's stock, valued at approximately $1,510,514.46. This represents a 39.02% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Corporate insiders own 1.60% of the company's stock.

About Cavco Industries

(

Free Report)

Cavco Industries, Inc designs, produces, and retails factory-built homes primarily in the United States. It operates in two segments, Factory-Built Housing and Financial Services. The company markets its factory-built homes under the Cavco, Fleetwood, Palm Harbor, Nationwide, Fairmont, Friendship, Chariot Eagle, Destiny, Commodore, Colony, Pennwest, R-Anell, Manorwood, MidCountry, and Solitaire brands.

Featured Stories

Before you consider Cavco Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cavco Industries wasn't on the list.

While Cavco Industries currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.