Invesco Ltd. lifted its stake in shares of Carlyle Group Inc. (NASDAQ:CG - Free Report) by 14.2% in the first quarter, according to the company in its most recent filing with the SEC. The fund owned 742,934 shares of the financial services provider's stock after buying an additional 92,199 shares during the quarter. Invesco Ltd. owned about 0.21% of Carlyle Group worth $32,384,000 as of its most recent SEC filing.

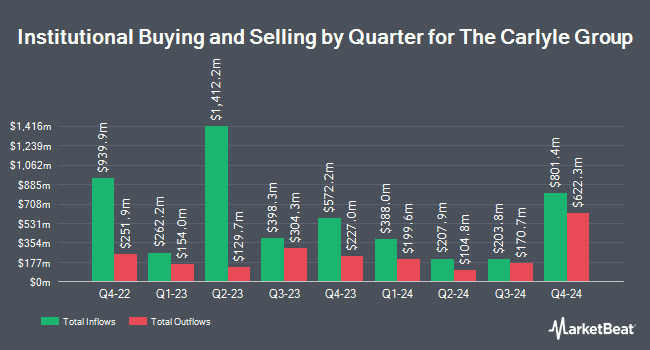

Other hedge funds also recently modified their holdings of the company. Tidal Investments LLC raised its stake in Carlyle Group by 6.2% in the 4th quarter. Tidal Investments LLC now owns 5,219 shares of the financial services provider's stock worth $264,000 after purchasing an additional 306 shares in the last quarter. Dynamic Advisor Solutions LLC raised its stake in Carlyle Group by 6.5% in the 1st quarter. Dynamic Advisor Solutions LLC now owns 5,147 shares of the financial services provider's stock worth $224,000 after purchasing an additional 314 shares in the last quarter. Private Trust Co. NA increased its holdings in Carlyle Group by 101.9% in the 1st quarter. Private Trust Co. NA now owns 636 shares of the financial services provider's stock valued at $28,000 after buying an additional 321 shares during the period. American Trust increased its holdings in Carlyle Group by 6.8% in the 4th quarter. American Trust now owns 5,320 shares of the financial services provider's stock valued at $269,000 after buying an additional 340 shares during the period. Finally, Wellington Management Group LLP increased its holdings in Carlyle Group by 4.1% in the 4th quarter. Wellington Management Group LLP now owns 8,664 shares of the financial services provider's stock valued at $437,000 after buying an additional 344 shares during the period. Institutional investors and hedge funds own 55.88% of the company's stock.

Analysts Set New Price Targets

Several research firms have commented on CG. Cowen raised shares of Carlyle Group from a "hold" rating to a "buy" rating in a report on Wednesday, May 14th. TD Cowen raised shares of Carlyle Group from a "hold" rating to a "buy" rating and set a $56.00 target price on the stock in a report on Wednesday, May 14th. Citigroup reissued an "outperform" rating on shares of Carlyle Group in a report on Thursday. Keefe, Bruyette & Woods lifted their price target on shares of Carlyle Group from $43.00 to $45.00 and gave the company a "market perform" rating in a report on Monday, May 12th. Finally, Wells Fargo & Company lifted their price target on shares of Carlyle Group from $49.00 to $61.00 and gave the company an "equal weight" rating in a report on Friday, July 11th. Two investment analysts have rated the stock with a sell rating, eight have assigned a hold rating and seven have issued a buy rating to the company. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus target price of $59.60.

View Our Latest Stock Report on Carlyle Group

Insiders Place Their Bets

In other news, General Counsel Jeffrey W. Ferguson sold 202,606 shares of the business's stock in a transaction that occurred on Tuesday, August 12th. The shares were sold at an average price of $64.23, for a total value of $13,013,383.38. Following the transaction, the general counsel owned 753,255 shares in the company, valued at approximately $48,381,568.65. The trade was a 21.20% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. 26.30% of the stock is owned by insiders.

Carlyle Group Trading Down 0.6%

CG opened at $63.45 on Tuesday. Carlyle Group Inc. has a fifty-two week low of $33.02 and a fifty-two week high of $65.97. The company has a debt-to-equity ratio of 1.52, a current ratio of 2.24 and a quick ratio of 2.24. The firm has a market capitalization of $22.95 billion, a price-to-earnings ratio of 18.55, a PEG ratio of 1.17 and a beta of 1.90. The company's 50 day moving average price is $56.49 and its two-hundred day moving average price is $48.39.

Carlyle Group Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Thursday, August 28th. Shareholders of record on Monday, August 18th will be issued a dividend of $0.35 per share. This represents a $1.40 dividend on an annualized basis and a yield of 2.2%. The ex-dividend date of this dividend is Monday, August 18th. Carlyle Group's payout ratio is presently 40.94%.

Carlyle Group Profile

(

Free Report)

The Carlyle Group Inc is an investment firm specializing in direct and fund of fund investments. Within direct investments, it specializes in management-led/ Leveraged buyouts, privatizations, divestitures, strategic minority equity investments, structured credit, global distressed and corporate opportunities, small and middle market, equity private placements, consolidations and buildups, senior debt, mezzanine and leveraged finance, and venture and growth capital financings, seed/startup, early venture, emerging growth, turnaround, mid venture, late venture, PIPES.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Carlyle Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carlyle Group wasn't on the list.

While Carlyle Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.