Invesco Ltd. grew its holdings in iQIYI, Inc. Sponsored ADR (NASDAQ:IQ - Free Report) by 50.0% during the 1st quarter, according to the company in its most recent disclosure with the SEC. The fund owned 674,349 shares of the company's stock after purchasing an additional 224,694 shares during the quarter. Invesco Ltd. owned about 0.07% of iQIYI worth $1,524,000 as of its most recent filing with the SEC.

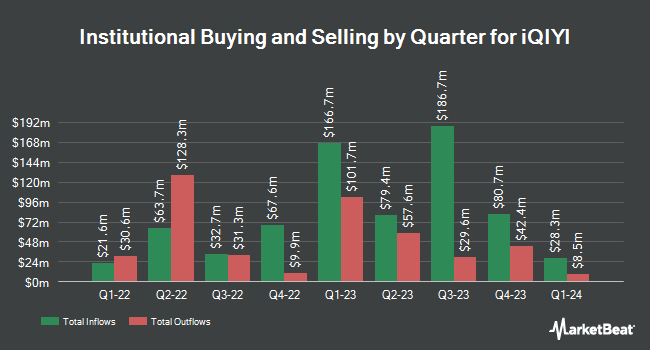

Several other hedge funds and other institutional investors also recently made changes to their positions in IQ. Private Advisor Group LLC acquired a new stake in shares of iQIYI in the first quarter valued at about $30,000. Vident Advisory LLC acquired a new stake in shares of iQIYI in the fourth quarter valued at about $33,000. Ping Capital Management Inc. acquired a new stake in shares of iQIYI in the first quarter valued at about $90,000. LMR Partners LLP acquired a new stake in shares of iQIYI in the fourth quarter valued at about $237,000. Finally, Jefferies Financial Group Inc. grew its position in shares of iQIYI by 171.5% in the first quarter. Jefferies Financial Group Inc. now owns 181,752 shares of the company's stock valued at $411,000 after purchasing an additional 435,800 shares during the last quarter. 52.69% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several equities research analysts have recently issued reports on IQ shares. UBS Group raised iQIYI from a "neutral" rating to a "buy" rating and set a $3.32 price target on the stock in a research report on Thursday, August 21st. CLSA raised iQIYI from a "hold" rating to a "moderate buy" rating in a research report on Tuesday, August 19th. Cfra Research downgraded iQIYI from a "hold" rating to a "moderate sell" rating in a research report on Thursday, August 28th. Wall Street Zen downgraded iQIYI from a "hold" rating to a "sell" rating in a research report on Saturday, July 26th. Finally, Jefferies Financial Group lifted their target price on iQIYI from $2.10 to $2.50 and gave the stock a "buy" rating in a research report on Wednesday, August 20th. Three equities research analysts have rated the stock with a Buy rating, four have given a Hold rating and one has given a Sell rating to the company. According to MarketBeat.com, the company currently has a consensus rating of "Hold" and an average target price of $2.51.

Check Out Our Latest Report on iQIYI

iQIYI Stock Up 0.2%

NASDAQ IQ traded up $0.01 on Thursday, reaching $2.72. The company had a trading volume of 7,240,785 shares, compared to its average volume of 28,533,846. The firm has a market capitalization of $2.61 billion, a price-to-earnings ratio of 271.77 and a beta of -0.14. The company has a debt-to-equity ratio of 0.67, a quick ratio of 0.42 and a current ratio of 0.42. iQIYI, Inc. Sponsored ADR has a 1-year low of $1.50 and a 1-year high of $3.35. The company's fifty day moving average is $2.02 and its 200-day moving average is $1.97.

About iQIYI

(

Free Report)

iQIYI, Inc, together with its subsidiaries, provides online entertainment video services in the People's Republic of China. It offers various products and services, including online video, online games, online literature, animations, and other products. The company operates a platform that provides a collection of internet video content, such as professionally produced content licensed from professional content providers and self-produced content.

Recommended Stories

Before you consider iQIYI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and iQIYI wasn't on the list.

While iQIYI currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.