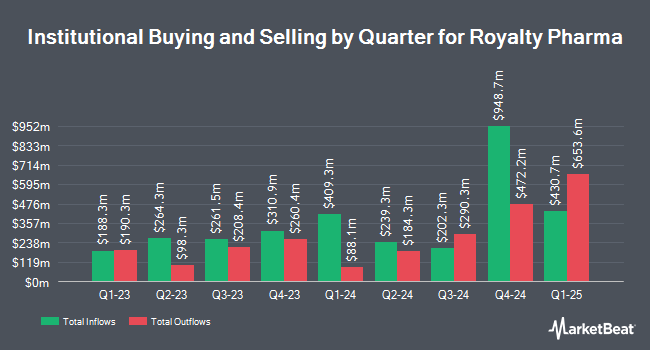

Invesco Ltd. increased its position in Royalty Pharma PLC (NASDAQ:RPRX - Free Report) by 34.1% in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 1,284,418 shares of the biopharmaceutical company's stock after acquiring an additional 326,525 shares during the period. Invesco Ltd. owned about 0.22% of Royalty Pharma worth $39,984,000 at the end of the most recent reporting period.

Several other large investors also recently modified their holdings of RPRX. Louisbourg Investments Inc. bought a new stake in shares of Royalty Pharma in the first quarter worth $28,000. MassMutual Private Wealth & Trust FSB grew its holdings in shares of Royalty Pharma by 76.4% in the first quarter. MassMutual Private Wealth & Trust FSB now owns 956 shares of the biopharmaceutical company's stock worth $30,000 after acquiring an additional 414 shares during the period. Allworth Financial LP grew its holdings in shares of Royalty Pharma by 41.6% in the first quarter. Allworth Financial LP now owns 1,539 shares of the biopharmaceutical company's stock worth $49,000 after acquiring an additional 452 shares during the period. Transce3nd LLC bought a new stake in shares of Royalty Pharma in the fourth quarter worth $61,000. Finally, Friedenthal Financial bought a new stake in shares of Royalty Pharma in the first quarter worth $77,000. Institutional investors own 54.35% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts recently commented on RPRX shares. Morgan Stanley lifted their price objective on Royalty Pharma from $51.00 to $54.00 and gave the stock an "overweight" rating in a report on Thursday, July 10th. Citigroup boosted their price target on Royalty Pharma from $40.00 to $42.00 and gave the company a "buy" rating in a report on Tuesday, July 22nd. Finally, Wall Street Zen raised Royalty Pharma from a "hold" rating to a "buy" rating in a report on Saturday, August 9th.

Read Our Latest Stock Analysis on Royalty Pharma

Royalty Pharma Stock Performance

NASDAQ:RPRX opened at $35.92 on Tuesday. The stock has a 50-day simple moving average of $36.02 and a two-hundred day simple moving average of $33.80. Royalty Pharma PLC has a 52-week low of $24.05 and a 52-week high of $38.00. The company has a debt-to-equity ratio of 0.74, a quick ratio of 1.26 and a current ratio of 1.26. The firm has a market capitalization of $20.95 billion, a PE ratio of 20.76, a P/E/G ratio of 2.37 and a beta of 0.55.

Royalty Pharma (NASDAQ:RPRX - Get Free Report) last released its quarterly earnings results on Wednesday, August 6th. The biopharmaceutical company reported $1.14 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.10 by $0.04. Royalty Pharma had a return on equity of 25.54% and a net margin of 44.23%. The business had revenue of $578.67 million during the quarter, compared to analyst estimates of $750.06 million. Analysts forecast that Royalty Pharma PLC will post 4.49 EPS for the current year.

Royalty Pharma Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, September 10th. Stockholders of record on Friday, August 15th will be given a $0.22 dividend. This represents a $0.88 annualized dividend and a dividend yield of 2.4%. The ex-dividend date is Friday, August 15th. Royalty Pharma's payout ratio is presently 50.87%.

Royalty Pharma Profile

(

Free Report)

Royalty Pharma plc operates as a buyer of biopharmaceutical royalties and a funder of innovations in the biopharmaceutical industry in the United States. It is also involved in the identification, evaluation, and acquisition of royalties on various biopharmaceutical therapies. In addition, the company collaborates with innovators from academic institutions, research hospitals and not-for-profits, small and mid-cap biotechnology companies, and pharmaceutical companies.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Royalty Pharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Royalty Pharma wasn't on the list.

While Royalty Pharma currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.