Invesco Ltd. reduced its holdings in Uranium Energy Corp. (NYSEAMERICAN:UEC - Free Report) by 52.7% during the first quarter, according to the company in its most recent filing with the SEC. The fund owned 446,098 shares of the basic materials company's stock after selling 496,753 shares during the quarter. Invesco Ltd. owned approximately 0.11% of Uranium Energy worth $2,132,000 as of its most recent filing with the SEC.

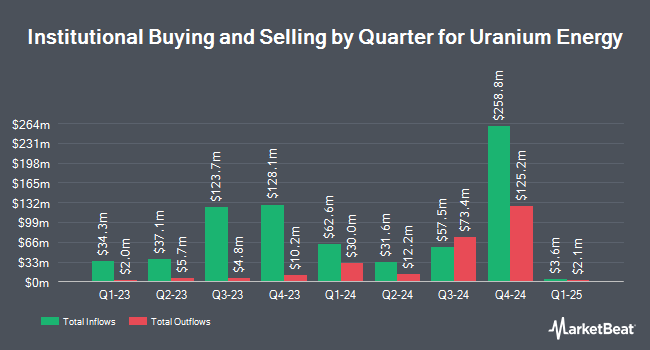

Other hedge funds and other institutional investors have also modified their holdings of the company. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its stake in Uranium Energy by 1.5% during the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 29,230,344 shares of the basic materials company's stock worth $195,551,000 after acquiring an additional 423,233 shares during the period. Driehaus Capital Management LLC grew its holdings in shares of Uranium Energy by 52.2% during the fourth quarter. Driehaus Capital Management LLC now owns 9,499,842 shares of the basic materials company's stock valued at $63,554,000 after purchasing an additional 3,259,704 shares during the last quarter. Ameriprise Financial Inc. raised its position in shares of Uranium Energy by 239.4% during the 4th quarter. Ameriprise Financial Inc. now owns 6,731,148 shares of the basic materials company's stock worth $45,036,000 after purchasing an additional 4,748,138 shares during the period. Dimensional Fund Advisors LP raised its position in shares of Uranium Energy by 11.1% during the 4th quarter. Dimensional Fund Advisors LP now owns 6,091,390 shares of the basic materials company's stock worth $40,756,000 after purchasing an additional 610,392 shares during the period. Finally, Victory Capital Management Inc. lifted its holdings in shares of Uranium Energy by 120.0% in the 1st quarter. Victory Capital Management Inc. now owns 5,930,920 shares of the basic materials company's stock worth $28,350,000 after purchasing an additional 3,235,394 shares during the last quarter. 62.28% of the stock is owned by institutional investors and hedge funds.

Uranium Energy Stock Performance

Shares of NYSEAMERICAN:UEC traded up $0.54 on Wednesday, hitting $11.52. The stock had a trading volume of 9,253,601 shares, compared to its average volume of 11,064,420. The firm's 50 day moving average price is $8.66 and its 200-day moving average price is $6.64. Uranium Energy Corp. has a twelve month low of $3.85 and a twelve month high of $11.50. The company has a market capitalization of $5.12 billion, a price-to-earnings ratio of -68.26 and a beta of 1.42.

Wall Street Analysts Forecast Growth

UEC has been the subject of a number of recent research reports. The Goldman Sachs Group upgraded Uranium Energy to a "strong-buy" rating in a research note on Tuesday, August 12th. HC Wainwright upped their price target on shares of Uranium Energy from $12.25 to $12.75 and gave the stock a "buy" rating in a research report on Wednesday, August 6th. Roth Capital reaffirmed a "buy" rating and issued a $11.50 price objective (up previously from $10.50) on shares of Uranium Energy in a report on Wednesday. TD Securities upped their target price on shares of Uranium Energy from $8.00 to $13.00 and gave the stock a "buy" rating in a research report on Friday, August 15th. Finally, BMO Capital Markets started coverage on shares of Uranium Energy in a research note on Tuesday, June 3rd. They issued an "outperform" rating and a $7.75 price target on the stock. Three research analysts have rated the stock with a Strong Buy rating and seven have assigned a Buy rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Buy" and an average price target of $10.97.

View Our Latest Report on UEC

Insider Buying and Selling

In other Uranium Energy news, Director David Kong sold 50,800 shares of the company's stock in a transaction dated Wednesday, August 6th. The shares were sold at an average price of $9.62, for a total transaction of $488,696.00. Following the sale, the director directly owned 182,237 shares of the company's stock, valued at approximately $1,753,119.94. This represents a 21.80% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. 2.00% of the stock is currently owned by company insiders.

Uranium Energy Company Profile

(

Free Report)

Uranium Energy Corp., together with its subsidiaries, engages in exploration, pre-extraction, extraction, and processing uranium and titanium concentrates in the United States, Canada, and Paraguay. It owns interests in the Palangana mine, Goliad, Burke Hollow, Longhorn, and Salvo projects located in Texas; Anderson, Workman Creek, and Los Cuatros projects situated in Arizona; Dalton Pass and C de Baca project located in New Mexico; Roughrider, Shea Creek, Christie Lake, Horseshoe-Raven, Hidden Bay, Diabase, West Bear, JCU, and other project located in Canada; and Yuty, Oviedo, and Alto Paraná titanium projects in Paraguay.

See Also

Before you consider Uranium Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Uranium Energy wasn't on the list.

While Uranium Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.