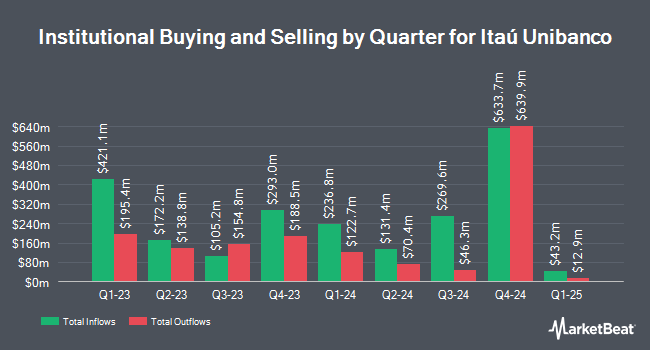

Public Employees Retirement System of Ohio raised its position in Itau Unibanco Holding S.A. (NYSE:ITUB - Free Report) by 18.3% in the 2nd quarter, according to its most recent filing with the SEC. The firm owned 7,355,262 shares of the bank's stock after acquiring an additional 1,136,134 shares during the period. Public Employees Retirement System of Ohio owned approximately 0.07% of Itau Unibanco worth $49,942,000 at the end of the most recent reporting period.

Several other hedge funds also recently made changes to their positions in the company. Allspring Global Investments Holdings LLC increased its holdings in shares of Itau Unibanco by 29.0% in the 1st quarter. Allspring Global Investments Holdings LLC now owns 25,562 shares of the bank's stock valued at $141,000 after purchasing an additional 5,743 shares in the last quarter. TT International Asset Management LTD purchased a new position in shares of Itau Unibanco in the 1st quarter valued at about $17,826,000. INCA Investments LLC increased its holdings in shares of Itau Unibanco by 10.0% in the 1st quarter. INCA Investments LLC now owns 1,247,501 shares of the bank's stock valued at $6,861,000 after purchasing an additional 113,409 shares in the last quarter. Banco Santander S.A. increased its holdings in shares of Itau Unibanco by 222.8% in the 1st quarter. Banco Santander S.A. now owns 155,795 shares of the bank's stock valued at $857,000 after purchasing an additional 107,527 shares in the last quarter. Finally, Vanguard Group Inc. increased its holdings in shares of Itau Unibanco by 6.7% in the 1st quarter. Vanguard Group Inc. now owns 24,592,740 shares of the bank's stock valued at $135,260,000 after purchasing an additional 1,549,003 shares in the last quarter.

Wall Street Analyst Weigh In

Separately, UBS Group reiterated a "neutral" rating on shares of Itau Unibanco in a report on Thursday, July 10th. One analyst has rated the stock with a Strong Buy rating, two have assigned a Buy rating and one has assigned a Hold rating to the company. According to data from MarketBeat.com, the stock currently has an average rating of "Buy" and an average price target of $6.27.

View Our Latest Stock Analysis on ITUB

Itau Unibanco Price Performance

ITUB opened at $7.42 on Wednesday. The stock has a market capitalization of $79.94 billion, a PE ratio of 10.51, a P/E/G ratio of 1.07 and a beta of 0.86. The company has a debt-to-equity ratio of 2.39, a quick ratio of 1.59 and a current ratio of 1.59. Itau Unibanco Holding S.A. has a 1 year low of $4.42 and a 1 year high of $7.44. The company's 50 day simple moving average is $6.80 and its 200 day simple moving average is $6.39.

Itau Unibanco (NYSE:ITUB - Get Free Report) last posted its earnings results on Tuesday, August 5th. The bank reported $0.18 EPS for the quarter, hitting analysts' consensus estimates of $0.18. Itau Unibanco had a net margin of 14.05% and a return on equity of 19.48%. The business had revenue of $7.14 billion for the quarter, compared to analysts' expectations of $44.75 billion. As a group, sell-side analysts expect that Itau Unibanco Holding S.A. will post 0.8 EPS for the current year.

Itau Unibanco Increases Dividend

The firm also recently announced a monthly dividend, which was paid on Monday, September 8th. Shareholders of record on Wednesday, August 20th were paid a dividend of $0.0454 per share. The ex-dividend date was Wednesday, August 20th. This is a positive change from Itau Unibanco's previous monthly dividend of $0.00. This represents a c) annualized dividend and a yield of 7.3%. Itau Unibanco's payout ratio is presently 4.23%.

Itau Unibanco Company Profile

(

Free Report)

Itaú Unibanco Holding SA offers a range of financial products and services to individuals and corporate customers in Brazil and internationally. The company operates through three segments: Retail Banking, Wholesale Banking, and Activities with the Market + Corporation. It offers current account; loans; credit and debit cards; investment and commercial banking services; real estate lending services; financing and investment services; economic, financial and brokerage advisory; and leasing and foreign exchange services.

Featured Stories

Want to see what other hedge funds are holding ITUB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Itau Unibanco Holding S.A. (NYSE:ITUB - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Itau Unibanco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Itau Unibanco wasn't on the list.

While Itau Unibanco currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.